India to have 150 Unicorns by 2025

Venture Capital and Private Equity constitute 20% of Indian Family investments

VC/PE investments contribute to 30% of overall returns of Indian Family investments

Ultra high net worth individuals (UHNI) are likely to invest up to $30 Bn+ in tech startups in India by 2025, reiterating the growing investment opportunity for home-grown tech ventures, according to a joint report released by 256 Network and Praxis Global Alliance India.

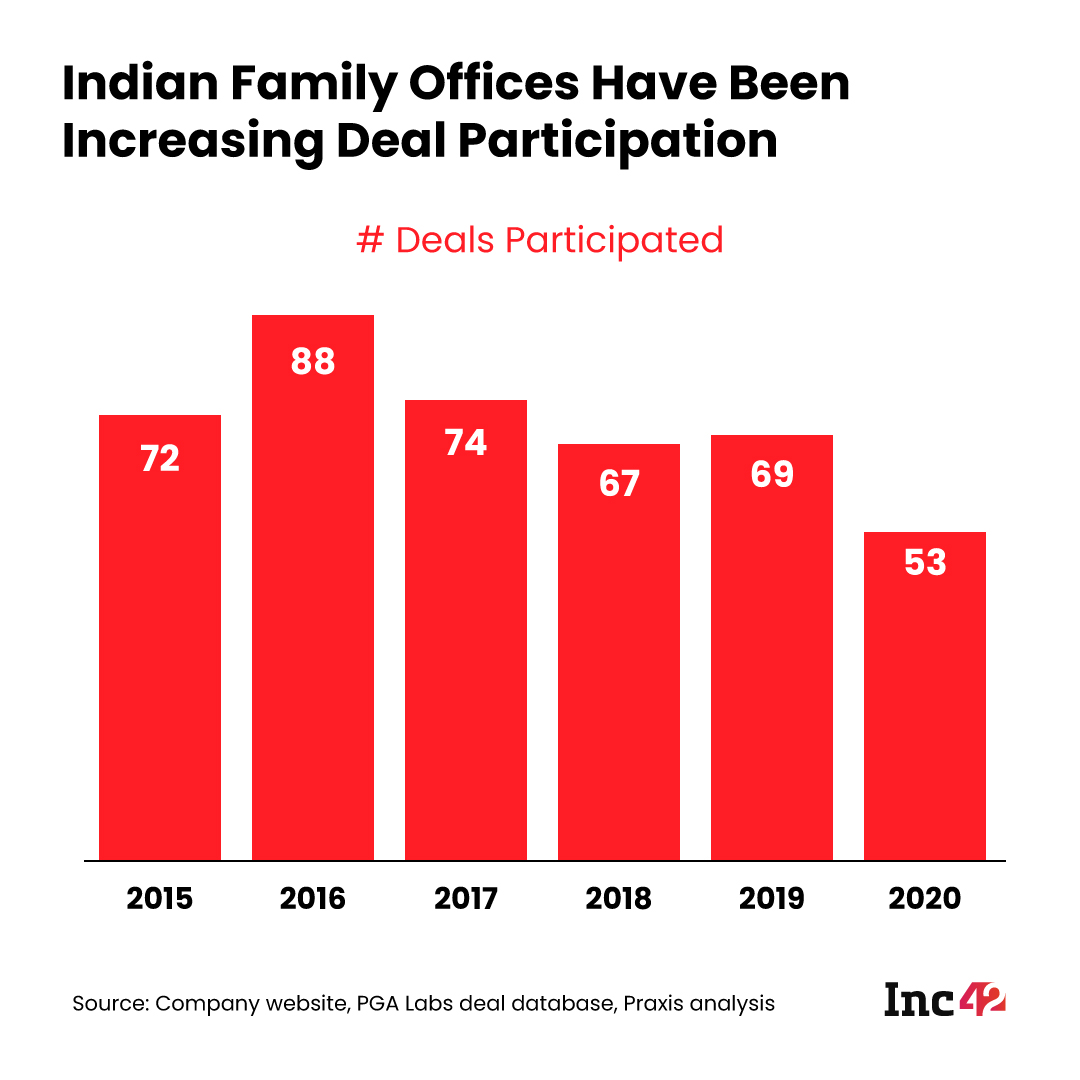

The report titled “Turning Ideas to Gold” expects that India will have approximately 10K UHNIs including business leaders, celebrities, NRIs, and digital entrepreneurs with a cumulative wealth of $700 Bn by 2024. Family offices are being set up as full-service private wealth management services to cater to one or a small clutch of these UHNIs. Currently, India has about 140+ family offices catering to Indian UHNIs. They invest heavily in the Indian startup space. They have been pro-actively involved in 50+ such deals every year since 2015, according to the report.

While these offices have already been investing in startups, in the coming years, the investment portfolio will be dominated by tech startups as it expects India to add 95 new tech unicorns by 2025.

“Technology investments have emerged as a lucrative alternate asset class to traditional investments like equity, debt, commodities, and real estate. However, it is difficult to get exposure to high growth portfolios which use technology to solve real challenges and build large companies in a relatively short period of time. Backing such companies requires deep expertise, strong networks, patience, and sufficient capital. Funds run by professionals provide that opportunity to Indian Family Offices and UHNIs,” said Kris Gopalakrishnan, cofounder of Infosys and promoter of Pratithi Family Office.

Gopalakrishnan has been actively urging India’s wealthy to look at startups as a serious investment opportunity and not just a trend for some time.

However, for such investments, the family offices have to be more open to investing in VCs, say experts. Currently, investments in VC and PE offerings comprise only 20% of the portfolio of these family offices. According to Dhruv Sehra, founder of 256 Network, over 2/3rd of this group of family offices still wait and watch when it comes to investing in VCs. “Preferring to keep their portfolios wedded to conventional asset classes like stocks, real estate, and gold, many Family Offices do not benefit from the healthy returns generated by VC investments,” said Sehra.

The Covid-19 pandemic has helped to change some of these perceptions with investors seeking investments in tech-led India-specific solutions, thanks to the massive impact of internet-based businesses during the pandemic.

The report found that approximately 190 soonicorns are expected to become Unicorns by 2025. Currently, India has 56 Unicorns of which 14 have been added in the year 2021 already. Digital-first solutions providers are establishing India as a deeptech hub. The biggest gainers during Covid19 pandemic have been edtech, online gaming, egroceries and healthtech companies. India currently has over 950 AI startups, 480+ IOT startups, 80+ AR/VR startups and 30+ robotics startups. Indian tech-enabled businesses have beaten the traditional businesses during the pandemic.

Madhur Singhal, managing partner and CEO, Praxis Global Alliance, said, “Private wealth in India is burgeoning and UHNIs are increasingly turning to venture capital and private equity ecosystem as an asset class. Incumbents, digital entrepreneurs, celebrities, NRIs are setting up family offices and are investing in the Indian startup ecosystem which has generated 14 new unicorns in 2021 so far. These family offices are providing businesses with patient capital and we are closely following the role that these family offices play in the Indian startup ecosystem.”

India’s tech story can mirror the US with the right capital infusion to support tech disruption. More than 55K Indian startups raised over $70 Bn in funding between 2014-20. The total market capitalisation of public tech companies is 12.6% of India’s GDP while the valuation of private tech companies is 10.2% of India’s GDP. Over 250 private Indian tech companies have valuations above $100 Mn and the potential to go public in India. Typically an analysis of 7-year portfolio performance shows that 20% portfolio allocation towards alternative investment (incl. VC) yields 30% of total portfolio returns.

For the new Indian UHNIs, venture capital holds huge promise as an asset class generating superior financial returns even during crisis times. Family offices have just started realising this potential, as VC/PE as an asset class make around 20% of their portfolio allocation but contribute to 30% of their portfolio returns. Hence, the Indian family businesses have the potential to make India’s startup landscape blossom.

Ad-lite browsing experience

Ad-lite browsing experience