SUMMARY

The panellists agreed that there is huge scope for OTT right now, with considerable growth over the last two months

The discussions ensued about advertising and subscription-based video on demand

Indian consumers have knowingly or unknowingly already started getting accustomed to paying for content

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

India’s affinity to OTT video and music industry goes long back to the days of YouTube, which has been a primary choice both for video and audio content. Of late, due to the internet and smartphone penetration coupled with Gen-Z’s obsession towards on-the-go content, the on-demand-streaming segment attracted a number of new local and international players.

Covid-19 has accelerated this growth a step further. The growth that was potentially anticipated to happen somewhere in late 2021-2022, has been accelerated in 2020 itself. India saw a 55% hike in overall streaming traffic.

Although the overall OTT sector has gained its much-awaited spotlight, analysts have shown concerns around if it’s a temporary phase of growth for the industry. It is believed that the growth curve will get flattened once lockdown opens. However, the OTT industry leaders believe that the runway received during Covid-19 will be enough to continue their long term plans in India.

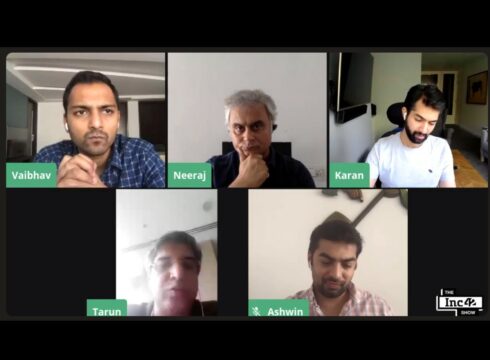

This week we saw Amazon Prime Video sign up seven films for release as producers look beyond movie theatres, and that is one-of-a-kind first experience we all may be witnessing. But are OTT platforms ready for this spotlight and how do they plan to tap the growth during the lockdown to make long-term customers? Will OTT and digital platforms take over from the traditional giants in the Indian media and entertainment industry? To discuss the same, we hosted the fourth edition of The Inc42 Show on “Will OTT Redefine India’s Media & Entertainment Landscape?”

The discussion involved Zee5 CEO Tarun Katial, MX Player CEO Karan Bedi, Hungama Digital Media Founder & CEO Neeraj Roy, and Pocket Aces Founder Ashwin Suresh in a session moderated by Vaibhav Vardhan, cofounder and CEO, Inc42 Media.

The panellists agreed that there is huge scope for OTT right now, and as Bedi from MX Player pointed out that these last two months have actually been a fair paradigm shift situation for OTT. While talking about the maturity, he said video streaming has moved from the bedroom to the living room.

“I think that while, of course, we are discussing these issues around, releasing directly on theatre vs OTT etc. You will notice that no one is talking about TV in the middle and it’s odd. So I think that there has been a huge shift. Of course, after the lockdown, some behaviour will start moving back, a lot of the shift will be permanent,” he added.

Finding A Market Beyond Short Videos

Suresh from Pocket Aces added from the short-video perspective saying that the format has been on the rise for the last few years thanks to the rise of Instagram and TikTok. He added that there isn’t much behavioural shift, but consumption numbers are going up. Genre-specific behaviours are taking hold among the user base, which could shape the future models.

“Broadly, anyone who has the ability to keep producing new content is doing really well. We’ve moved to a little bit of a shooting model, but also we’ve doubled down on animation because you don’t need physical activity to do that. And there we find a lot of uptake so I think every genre has a specific behaviour and time. And we’re seeing that play out but some of this will unwind and in a few months when things reversal,” he added.

Zee5’s Katial said that broadband has now become a reality, due to which WiFi usage has gone up leading to access of content on mobile as well as smart TVs. He noted that users have taken OTT as a personal consumption medium only and that impacts a lot of the content choices.

Advertising Or Subscription: What Brings Monetisation In Future?

Katial said that in terms of revenue, there is a significant difference between ad-based video on demand (AVOD) or freemium model that the likes of Hotstar use and the subscription-based video on demand (SVOD) that Netflix, Amazon Prime, Apple TV+ and others have backed.

“The amount of surge we’ve seen on people buying subscriptions has been huge. And also people seeking bundles from partners–telco partners, loyalty partners, credit card partners. And the reverse is also true that all partners see OTT as a means to driving retention and loyalty,” Katial added.

Hungama’s Roy added that in a market like India, advertising will continue to be a component, as the largest OTT player is YouTube, which is driven on advertisements. “But with what we are witnessing a dire collapse of a host of other forms of media, and in the foreseeable future, over the next six to 12 months of quantum of disruption that’s there with regard to lack of theatrical viewing, it couldn’t be a better time for OTT companies to cement their business and not make the mistake of earlier media businesses,” he added.

MX Player’s Bedi said that more than half the advertising spends in India is for TV, with digital slowly catching up to print. He added that this can be an INR 110K Cr market in five years. “Digital is very likely to be at least 40%- 50% of it by that point of time, I think we will see a major decline in a lot of the other media, and out of digital, probably half will be video. So you are looking at INR 25K cr- INR 30K Cr pie over there. I think that anybody who gets a reasonable share of that pie is going to be a very large business.”

Subscription Models To Grow

Bedi further added that in subscription there is definitely going to be an upswing, but the question is about the value proposition for the customer. He compared that earlier for TV, the cost for the customer was just DTH bill, which brought most of his demands at his home. But with OTT, there is the cost of data, cost of subscription etc and hence, customer needs to see value-proposition.

Katial of Zee5 added that subscription is untested waters but there is a clear latent need in the consumer to pay for premium and quality content.

On advertising, Katial agrees with Bedi that there is a huge opportunity, but he believes that “Indian players have to deal with the network effect of data, which allows you to do a huge amount of segmented advertising and performance, because a lot of the money lies there, and people like Google and Facebook have perfected the art.”

He added that Indian players are about 18 to 24 months behind any of them. “But over a period of time with all the investments that even Indian folks that are now making on ad tech, I think the ad model will grow over the next two to five years,” he adds.

Suresh from Pocket Aces said that it is too early to call what model works right with customers, as, in India, customers are paying for either convenience or value. Roy adds that at one level, Indian consumers have knowingly or unknowingly already started getting accustomed to paying for content.

What OTT Brings To The Table?

“We are now seeing a move towards making content which is OTT friendly. Structure of distribution in India has always been very odd— TV and theatres. OTT has taken all of those things and brought it in one box— on-demand, free or paid and at home. The sheer amount of customers and content variable have exploded.”

Addressing the concerns around the future of OTT originals, Roy said that for Indian OTTs and original contents, the moment will come 18-24 months in the future where there will be sufficient content. At the moment, it’s not there yet, which is why people are working with each other. Katial noted that even though there would be market consolidation, it would be about deep partnerships and will continue to evolve.

On the question of advice for startups to solve media and entertainment challenges, panellists said that this industry isn’t friendly to OTT startups. Suresh added, “New businesses should start from distribution and monetisation, then move to the product.”

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.