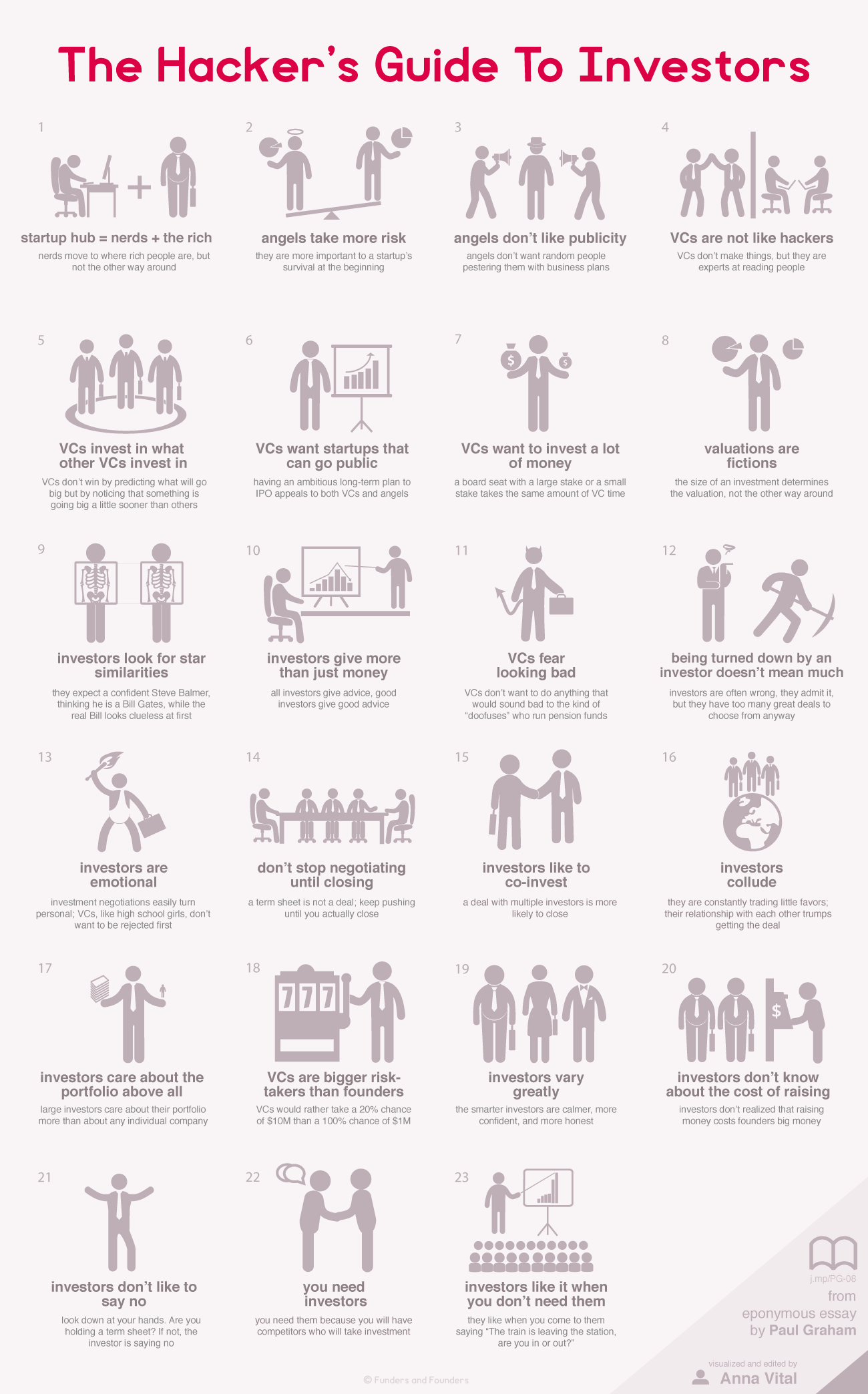

If there is any investor who successfully explained how investors think, it is Paul Graham. In this essay from 2009. The startup world changed a lot since then, but this essay is still valid.

Source: Funders and Founders

Investors think differently. Armed with an intuition about people, they make ultra risky decisions even by a founder’s standards. If you understand how investors think, though, you can negotiate with them.

Investors seem mysterious. They only approach you if you are already making it big. You can’t talk to them through their website. They don’t answer emails. To the average person, though, even their existence is somewhat of a mystery. Why do they put a lot of money into young companies when they could just be investing in the stock market?

Investors exist to make money. Venture capitalists and angel investors exist to make money orders of magnitude bigger than the money to be made elsewhere, legally. So why doesn’t everyone do it? Because venture capital and angel investing is extremely risky. As Graham mentioned in another one of his essays, only 50 from about a thousand VC firms in the U.S. actually make money.

How Investors Think

If you want to understand how VCs think, you need to figure out what they worry about. Their first worry is raising a fund. Without a fund they are not a VC. They raise a fund by persuading people at bigger funds, think pension funds, to give them money. For that you need to appear trustworthy and show that you have a track record of good returns.

The track record is the second thing a VC has to worry about. It’s their portfolio – all the companies they’ve invested in. A VC can’t point to an individual successful company to prove that they are a good VC. A single successful company doesn’t show that their good judgement is consistent. Instead they want a certain percentage of their portfolio to be doing really well.

Now that you know what a VC worries about, you can figure out what they think. They need to be a really good judge of people, especially when they don’t understand the technology or the business. They need to avoid the thousands of people who want to pitch their startups only to waste the VC’s time. At the same time they need to know when a startup is becoming hot, earlier than the other VCs so they can get the deal. Since most startups will fail, and therefore are a waste of time, they probably only take meetings with people who are recommended by other VCs they trust.

In the rare case that a quiet but a wildly successful startup like WhatsApp is not trying to raise VC money at all, they would pursue them and persuade them to take the money. They would go through people they know and eventually physically show up at their office. That is what Jim Goetz of Sequoia Capital did. His investment in WhatsApp returned 50-fold, by the way.

Lastly, a VC gets a board seat with almost every investment. A board seat means having some control over the startup. With the board seat comes the responsibility to attend board meetings. Whether you are a VC with a 10% stake or a 30% stake, you have got to sit through the same meetings every month. So VCs tend to want to invest more money per deal so that thay can get a larger return for the same amount of work.

If you want to negotiate with a VC, remember that their goal is to maximize the return. That is why they are ready to take the risk, and that is why you should show them that whether they invest or not, your company will grow exponentially. Big return. They need to feel that they should better invest now, or the opportunity will be gone.

Based on Paul Graham’s essay “The Hacker’s Guide to Investors”.

[Editor’s Note: This article was written by Anna Vital and originally published at Funders And Founders. Copyright 2015.]

Ad-lite browsing experience

Ad-lite browsing experience