The Global Startup Ecosystem Report 2023 said Chinese startup hubs fell in its rankings while Indian startup nerve-centres have climbed up the ladder

As per the report, Bengaluru stood at the 20th position on the global startup ecosystem index, while Delhi and Mumbai took the 24th and 31st spot, respectively

The report said that India’s high percentage of working-age demographic and 1.4 Bn strong population has created the world’s largest talent pool

In 2014, Chua Kee Lock, the then and current group president of Vertex Venture, an arm of Singapore’s sovereign wealth fund Temasek, said that the Indian startup ecosystem was at least 10 years behind its Chinese counterpart.

Nine years on, the Indian startup ecosystem seems to be rapidly closing this gap. As per a report, The Global Startup Ecosystem Report 2023, by Startup Genome, Indian startup hubs have taken big strides forward and are competing not only with China but also other global startup hubs.

The report said that top Chinese startup hubs fell on its global startup ecosystem rankings while Indian startup nerve-centres climbed up the ladder, adding that the decline in China’s dominance coincided with the growth of India.

“The GSER 2022 outlined the decline of China’s dominance and the growth of India. This trend continues, with Beijing and Shanghai both declining in the rankings (down two places and one, respectively) and Bengaluru-Karnataka, Delhi, and Mumbai each moving up (up two places, two places, and five places, respectively),” the report said.

Rising two positions from last year, Bengaluru took the 20th position this year. Delhi and Mumbai took the 24th and 31st spot, respectively. The report attributed Bengaluru’s rise to a 57% increase in exits (above $50 Mn) and a significant growth in unicorns.

The report also said that relatively relaxed Covid-19 policies and initiatives such as ‘Startup India’ have helped catalyse the burgeoning startup ecosystem in India.

Around 35 Lakh companies across 290+ startup ecosystems across the globe were studied to prepare the rankings and the report. Data from three leading venture funds was also taken into account to formulate a combined framework for the report.

The India Story

The report squarely placed the blame for the slowing Chinese tech ecosystem on the ‘firmer’ antitrust and data protection regulations introduced by the country in 2021.

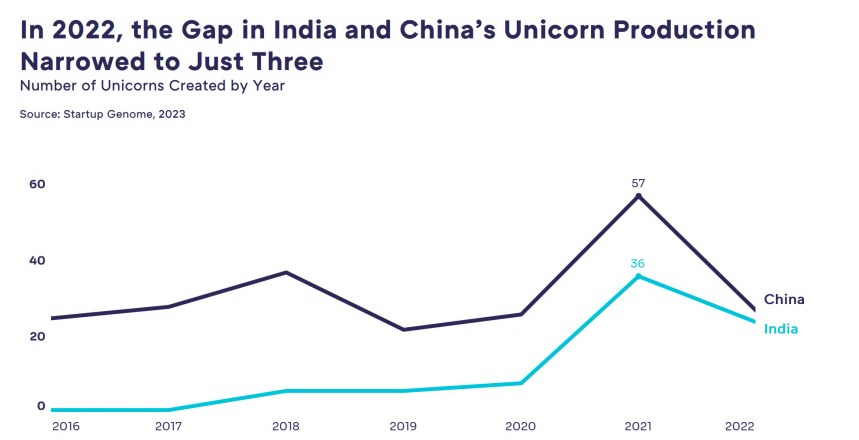

On the other hand, it was all praises for India. As per the report, India, on an average, minted seven unicorns against an average of 28 by China in 2020. However, by 2021, India upped the ante by producing 36 unicorns versus China’s 57.

Subsequently, last year, India ‘closed the gap’ as it saw the emergence of 24 unicorns against China’s 27, largely due to a combination of factors such as ‘China slowing and India’s growth’, as per the report.

It must be noted that India is currently home to 108 unicorns.

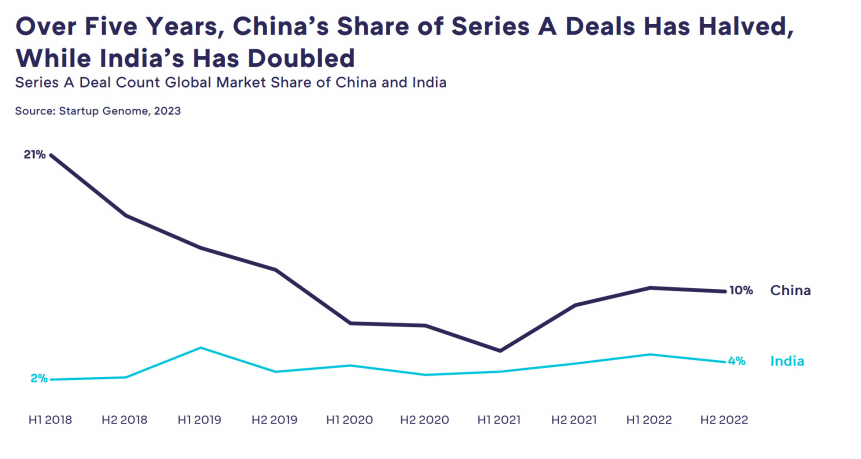

The report also found that China’s share in global Series A deals more than halved from 21% in 2018 to 10% in 2022. In contrast, India’s share in global Series A transaction count doubled to 4% during the same period.

“Further supporting the pattern of India growing and China declining, Pune has moved into the 31-40 range from 51-60 in 2022, experiencing both an increase in exits over $50 Mn and in the number of unicorns, while Guangzhou dropped seven positions from last year, to number 14,” the report added.

Elaborating further on the India story, the report claimed that India’s high percentage of working-age demographic and 1.4 Bn strong population has created the world’s largest talent pool. It also lauded the government’s push for investment-oriented policies and reforms, as well as investments in building infrastructure.

It also said that Budget 2023 focussed on boosting entrepreneurship in the country and sought to improve ease of doing business via simplification of the know your customer (KYC) process, introduction of a unified filing process, and tax sops for startups.

Bengaluru Takes The Spotlight

Bengaluru grabbed the lion’s share of attention in the report when it came to India. The IT and startup hub of the country took the fifth spot among Asia’s top startup ecosystems. It also secured the top spot in the continent in terms of per capita venture capital (VC) funding.

As per the report, Bengaluru was among the top 10 startup hubs globally in terms of funding and among top 20 across the world in terms of knowledge.

The study also pegged the value of Bengaluru’s startup ecosystem at an eye-popping $164 Bn. This included the economic impact created by the city and was calculated as the total value of exits and the valuations executed in the startup hub between the second half (H2) of 2020 and H2 2022.

The value of the startup ecosystem in Bengaluru grew 59% during the period (between H2 2018 to H2 2020 and H2 2020 to 2022) as against a global average of 47%.

Quoting Inc42’s data, ‘The Global Startup Ecosystem Report 2023’ said that Bengaluru-based startups raised $11 Bn in 2022. The report also said that Bengaluru-based startups took, on an average, 6.8 years for exits during the period between 2018 and 2022.

As per the report, startup exits refer to initial public offerings (IPOs), mergers and acquisitions (M&As), buyouts, and reverse mergers.

The research also lauded the vibrant ‘tech scene’ of the city, which is home to a large number of IT companies and tech talent. It said that the capital of Karnataka is home to a quarter of India’s digital talent (15 Lakh workers), offering skilled labour for the growing startup ecosystem.

It hosts the offices of some of the biggest tech conglomerates in the world, including Google, Amazon, Microsoft and Facebook. Besides, big ticket Indian startups such as BYJU’s, Flipkart, Zerodha, PhonePe and CRED also call the city their home.

The report comes at a time when the ongoing funding winter and global economic slowdown have pummelled Indian startups. The report also highlighted this, saying that despite the rise, the pace of and Series B+ deals declined in 2022 in the Indian startup ecosystem.

However, sprouts of hope continue to emerge as the funding raised by Indian startups saw a spike of 15% month-on-month (MoM) to $1 Bn in May 2023, as per Inc42 data. Number of deals also rose 31% to 80 in May 2023 from 61 in April 2023.

Besides, investors also seem bullish on the India story despite the recent slowdown in deals. VC and private equity (PE) firms have raised funds worth a total $3 Bn in 2023 so far, which could be deployed in the near future.

Recently, Lightspeed India Partner Bejul Somaia said that India is not for the ‘faint-hearted’ and sought a ‘patient, quality-oriented, disciplined, selective’ approach to invest in India.

The funding winter and adverse market conditions have indeed dried up capital and the path to recovery seems to be a long one for the Indian startup ecosystem. However, there is no denying that Indian startup hubs have created a huge resource base, which in turn, has benefited the country directly and indirectly.

Now, it remains to be seen if the Indian startup hubs are able to sustain the momentum of the last few years and compete with global leaders such as Silicon Valley in the US, London and Israel’s Tel Aviv.

Ad-lite browsing experience

Ad-lite browsing experience