GlobalBees, incorporated in May last year, reported revenue of INR 121.6 Cr in FY22

The D2C rollup startup’s total expenditure stood at INR 157.1 Cr, with purchase of stock in trade having the highest share

GlobalBees turned unicorn last year after raising $111 Mn in its Series B round from FirstCry, SoftBank, and others

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

SoftBank-backed ecommerce rollup startup GlobalBees posted a consolidated loss of INR 40.9 Cr in the financial year 2021-22 (FY22).

The startup was founded by Nitin Agarwal and FirstCry founder Supam Maheswari in May 2021, and the financial numbers are only for the first 10 months of its operations.

The Thrasio-style unicorn’s total revenue stood at INR 121.6 Cr in FY22, while the operating revenue was at INR 103.9 Cr.

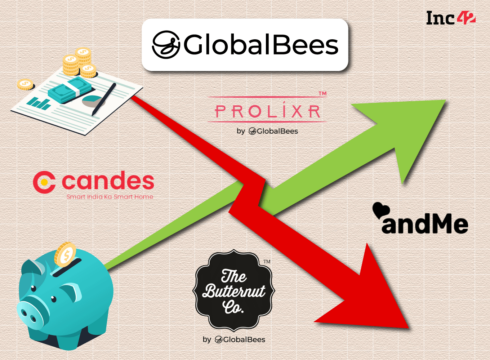

While GlobalBees has acquired over 12 brands since its inception, its financial results included performance of only four brands. Apart from parent entity GlobalBees Brands Private Limited, the startup included financials of andMe, The Butternut Company, Prolixr, and Candes in its consolidated financial statement.

The D2C rollup startup’s total expenses stood at INR 157.1 Cr during the first year of operations. The startup’s purchase of stock in trade, which stood at INR 83.1 Cr, contributed to over 50% of its total expenses.

Purchase of stock in trade refers to all the purchases of finished goods that the company makes to conduct its business.

GlobalBees spent INR 33.7 Cr on employee benefit expenses in the year under review. Employee benefit expenses usually comprise employee salaries, PF contributions, gratuity, and other employee welfare benefits.

GlobalBees spent INR 15.5 Cr and INR 10.7 Cr on legal and professional expenses and advertising expenses, respectively, in FY22.

GlobalBees, which is headed by Agarwal as the CEO, invests in and acquires seller businesses on Amazon India, Flipkart, and other ecommerce marketplaces. The startup usually invests $2 Mn–$3 Mn to acquire majority stakes in D2C brands.

After its Series A funding round last year, the startup said it intended to acquire over 40 brands over time.

GlobalBees entered the unicorn club in December last year, within seven months of its incorporation, after raising $111 Mn in its Series B round of funding led by FirstCry. Inc42 exclusively reported this development then. The round also saw participation from SoftBank, Premji Invest, Chiratae Ventures, and Trifecta Capital, among others.

The last valuation of $1.1 Bn of GlobalBees is 67X of its total revenue in FY22. In the rollup ecommerce space, Globalbees competes against the likes of Mensa Brands, GOAT Brand Labs, UpScalio, and Evenflo.

According to an Inc42 report, D2C is one of the fastest growing segments in the ecommerce sector. It is anticipated to touch the $100 Bn mark by 2025. The beauty and personal care sub-segment is expected to grow at a CAGR of 21% and the market opportunity is anticipated to be worth $8.2 Bn.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.