The investment was conducted at a pre-money equity value of INR 4.285 Lakh Cr

Prior to this, Silver Lake had invested INR 7,500 Cr for 1.75% stake in Reliance Retail

Reliance Retail also raised INR 3,675 Cr from General Atlantic for 0.84% stake

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

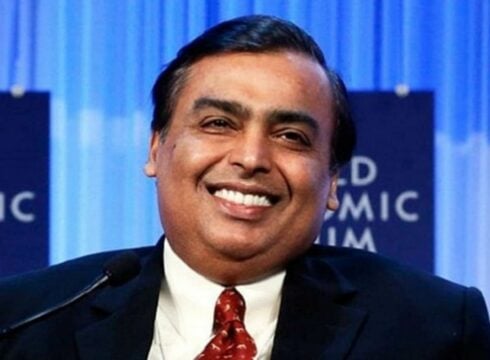

Mukesh Ambani-led Reliance Industries on Wednesday (September 30) said that co-investors of the private equity giant Silver Lake will invest an additional INR 1,875 Cr in its retail unit, Reliance Retail, at a pre-money equity value of INR 4.285 Lakh Cr.

Reliance Retail funding spree was flagged off by Silver Lake, who invested INR 7,500 Cr for a 1.75% stake at a pre-money equity value of INR 4.21 lakh Cr in September 2020. Overall, Silver Lake and its co-investors have pumped in INR 9,375 Cr in Reliance Retail, which translates into 2.13% equity shares.

Silver Lake had also previously invested in Reliance’s digital subsidiary Jio Platforms in the first half of 2020, acquiring a 2.08% equity stake in the company on a fully diluted basis. The deal was pegged at INR 10,202.55 Cr.

Silver Lake was established in 1999 by David Roux, Glenn Hutchins, Jim Davidson and Roger McNamee to focus on large-scale investments in leading technology companies. The company has made 68 investments so far, of which it has led 39 rounds.

Commenting on the latest investment, Chairperson and managing director of Reliance Industries, Mukesh Ambani said, “Silver Lake and its coinvestors are valued partners on our journey to transform Indian Retail for the benefit of all Indians… Silver Lake’s additional investment is a strong endorsement of the tremendous potential of Indian Retail and the capabilities of Reliance Retail.”

Silver Lake’s co-CEO and managing partner Egon Durban, said, “We are delighted to increase our exposure and bring more of our co-investors into this unmatched opportunity. The continued investment momentum over the last few weeks is proof of the compelling vision and business model of Reliance Retail – and underscores the tremendous potential of the transformative New Commerce initiative.”

The PE firm has approximately $40 Bn as combined assets under management and committed capital. Its portfolio includes Airbnb, Alibaba, ANT Financial, Alphabet’s Verily and Waymo units, Dell Technologies, Twitter and more. It has had 26 exits from companies Alibaba Group, Motorola Solutions, Groupon, Vantage Share, GoDaddy, and Expedia.

The additional investment from Silver Lake comes a day after Reliance Retail raised INR 3,675 Cr from General Atlantic in exchange for 0.84% equity stake on a fully diluted basis. The company has been valued at a pre money equity value of INR 4.285 Lakh Cr. Meanwhile, even KKR invested INR 5,550 Cr in the company for 1.38% equity stake.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.