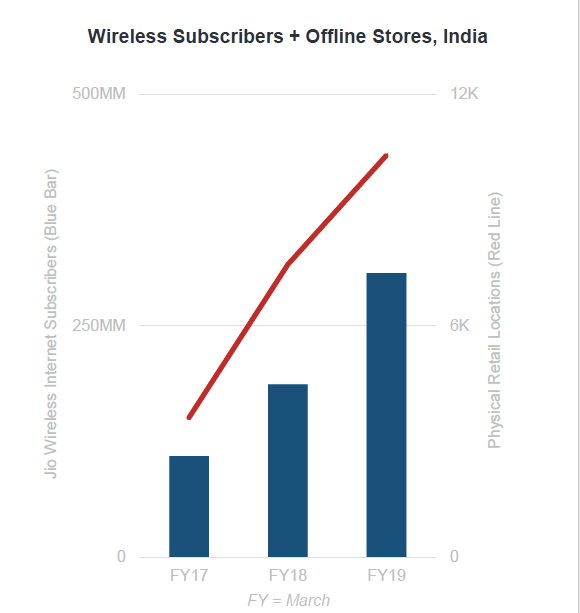

Reliance offline retail store count stood at about 10K in FY 2019

The company is working on a hybrid ecommerce model to reach 95% of India’s population

Jio wireless internet subscribers is reported to be around 307 Mn in FY 2019

The 2019 Mary Meeker report on Internet Trends has noted Reliance Jio as one of the most innovative internet companies based outside the US. The report has focussed on the company’s efforts in expanding offline or hybrid access to ecommerce.

Reliance announced its foray into the ecommerce segment with a hybrid online-offline model in 2018. “We are creating a hybrid, online-to-offline commerce platform by integrating Reliance Retail’s physical marketplace with Jio’s digital infrastructure and services.” Reliance’s chairman Mukesh Ambani had said at the time.

Ambani had claimed that Reliance’s ecommerce platform will bring together 350 Mn customer footfalls at Reliance Retail stores, 307 Mn Jio connectivity customers and 30 Mn small merchants all over India who provide the last-mile physical market connectivity.

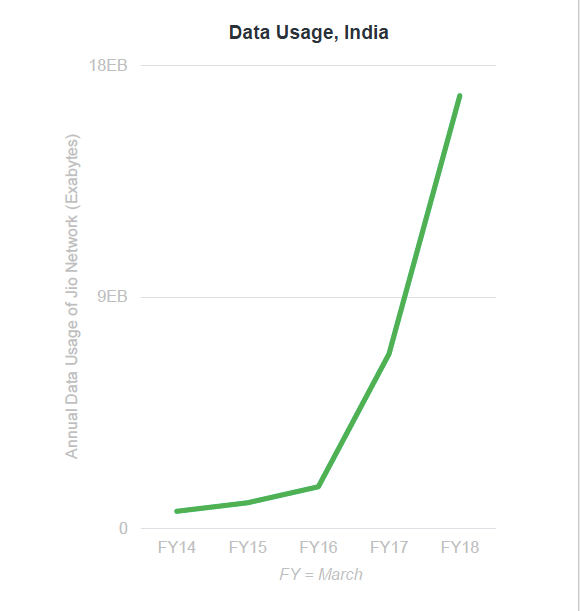

According to the report, annual data usage of Jio network was between 17-18 exabytes (17 Bn -18 Bn GB) in the financial year 2018, which is almost two times growth from 9 exabytes data usage in FY 2017. Further, the number of Reliance offline retail stores are reported to be somewhere between 10K – 11K in FY 2019.

Source: Internet Trends 2019 by Mary Meeker

Earlier in 2018, the company was reported to be planning on using its more than 5.1K Jio point stores located in 5K cities and towns as delivery and collection points for its ecommerce venture. With this, the company was expected to expand its direct reach to 95% of India’s population.

The report also noted the suite of consumer services offered by the Reliance in the category of music, movies, television, news, chat, finance, fashion, security, storage, and data transfer among others.

Reliance’s Ongoing Ecommerce Efforts

Since the announcement of its ecommerce venture, the conglomerate has acquired logistics and rural consumer-focused startups including logistics player Grab, software firm C-Square, vernacular language-as-a-service platform Reverie Language Technologies, Indian government schemes/services aggregator EasyGov, and a multiphysics simulation service SankhyaSutra Labs.

Recently in April, the company was reported to launch a ‘super app’ which will let its ecommerce customers order goods and services on the platform in addition to paying bills through in-app payment services. Under the super app model, Reliance is expected to partner with third-party applications in different verticals to offer over 100 services integrations.

Indian ecommerce market is largely dominated by global ecommerce major Amazon and Walmart-owned Flipkart. Also, Walmart owned-Flipkart has been looking to adopt the hybrid strategy and use convenience stores for expanding its business. It is planning to sell smartphones through 15K convenience stores, beauty salons, bakeries and pharmacies.

A Deloitte India and Retailers Association of India (RAI) report has predicted Indian ecommerce market to grow to $1.2 Tn by 2021.

Ad-lite browsing experience

Ad-lite browsing experience