The Bengaluru-headquartered venture capital firm PointOne Capital would be looking to invest in pre-seed and seed rounds

The AIF is targetting an average ticket size of INR 1 Cr per investment till Series A rounds

Some of the companies in PointOne Capital’s portfolio are ConnectedH, Tamasha and Finin

Bengaluru-headquartered venture capital firm PointOne Capital has announced the first close of its maiden fund. The SEBI-registered alternative investment fund (AIF) targets early seed-stage startups. The fund plans a corpus of INR 50 Cr with a ticket size of INR 1 Cr per startup.

PointOne Capital focuses on pre-seed and seed-stage technology-enabled startups in emerging sectors. “Our aim is to plug the early stage liquidity gap in the pre-seed market and provide active sector-specific expertise until a Series A round,” the company says on its social media collateral.

The fund will see participation from entrepreneurs, private equity (PE) and VC firm partners, chief experience officers (CXOs) and seasoned senior corporate leaders.

The team at PointOne Capital includes Archana Priyadarshini, Mihir Jha and Ravish Ratnam. The VC firm claims that the three have collectively worked with more than 1,000 startups, closing over 60 investments in their tenure apart from collaborating with more than 100 VC funds and 1,000 angel investors.

“Having met over 500 startups in the last 5 years, I have seen that initial days are the most difficult in a founder’s journey. At such a stage, guidance along with capital becomes very important as founders need support in clearly articulating their vision, preparing a focused output-oriented pilot and defining the initial GTM (go-to-market strategy),” said Priyadarshini, managing partner at PointOne Capital.

Some of the companies in PointOne Capital’s portfolio are ConnectedH, Tamasha and Finin.

Seed Stage Funding Picks Up Pace As 2020 Ends

Although largely sector agnostic, PointOne Capital is primarily targeting large untapped opportunities in fintech, consumer internet, gaming, SMB SaaS, enterprise SaaS, healthcare and edtech. The fund plans at least one investment per month going forward.

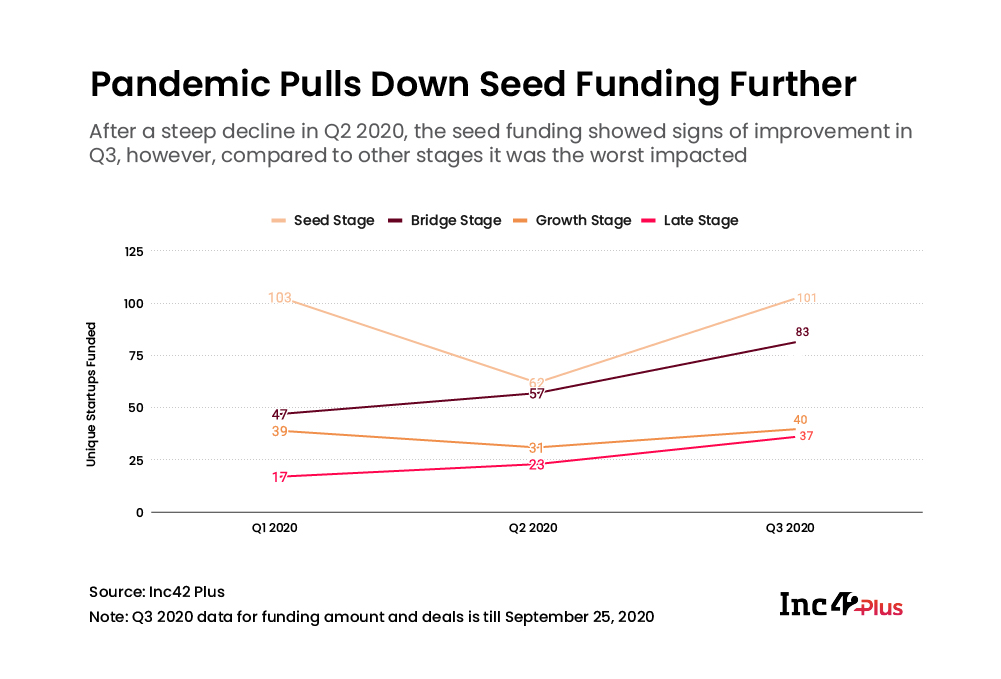

After witnessing a 40% quarter-on-quarter (QoQ) decline in the second quarter of 2020, seed-stage funding picked up pace in the third quarter, growing by 40%, with 101 unique startups being funded.

Given that seed-stage investments are riskier for VCs, and the inclement financial climate from March onwards this year, it was no surprise that seed funding plummeted massively in Q2 2020 when the lockdown was at its peak. And in Q3, seed funding made up the ground lost in the first two quarters.

Enterprise tech and media and entertainment were the top sectors in seed-stage funding in Q3, while ecommerce — driven by massive D2C adoption and investor activity — and enterprise tech topped the charts at the growth stage or Series A and B rounds.

Ad-lite browsing experience

Ad-lite browsing experience