Shailendra Singh’s appointment will help Peak XV Partners drive global collaboration and foster innovation on the international stage

Singh joins the likes of WestBridge Capital MD Sumir Chadha and KKR India’s Gaurav Trehan on the USISPF’s board

The forum works to bridge gaps between businesses and the governments of India and the US, and also incubates cross-border startups via ‘Startup Connect’

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

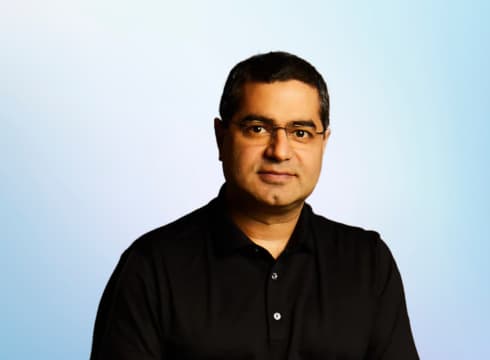

Peak XV Partners managing director Shailendra Singh has joined the board of directors of the US-India Strategic Partnership Forum (USISPF).

Singh joins the likes of WestBridge Capital managing director (MD) Sumir Chadha, KKR India country head Gaurav Trehan, WestRock chairman John Luke, Uniphore cofounder and CEO Umesh Sachdev at the USISPF board.

For the uninitiated, the forum works to bridge gaps between businesses and the governments of the two nations. Additionally, it also nurtures and incubates cross-border startups via its programme ‘Startup Connect’.

Singh’s appointment will help the VC firm drive global collaboration and help foster innovation and entrepreneurship on the international stage.

“I look forward to collaborating with fellow board members and leveraging our collective expertise to further strengthen the relationship between the US and India for founders and startups across both regions,” said Singh.

Commenting on the new appointment, USISPF president and CEO Mukesh Aghi added, “I am thrilled to welcome Shailendra to the USISPF Board of Directors… His deep industry knowledge and commitment to founders across India and Southeast Asia will be invaluable. We look forward to benefiting from his expertise. I am confident that with his inputs and expertise, we will explore newer avenues and deeper areas of collaboration between the US and India”.

The development comes three months after Peak XV launched a permanent capital vehicle ‘Peak XV Anchor Fund’ to enable the firm’s leadership to invest in future funds as well as partner with other fund managers.

In June last year, Sequoia Capital spun off Sequoia India & Southeast Asia and the latter was rebranded as Peak XV. Singh has helmed Peak XV since then.

At the time, the VC firm inherited over $9 Bn in over 400 companies stretching across 13 separate funds. Last year, it said that its portfolio companies achieved over $100 Mn in revenues.

Previously, Singh led Sequoia Capital’s investments in startups such as Pine Labs, CRED, Unacademy, Freecharge and Druva. He currently sits on the board of multiple Indian startups such as Scaler, Practo, Park+, Ola Cabs, and MobiKwik.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.