A total of 2,64,85,479 shares were on offer, and investors placed their bids for 2,16,59,47,080 shares

The company had raised over INR 2,395.84 Cr by allocating nearly 2.13 Cr shares to 174 anchor investors

The company aims to raise funds in the range of INR 4,554.03 Cr – INR 5,351.92 Cr

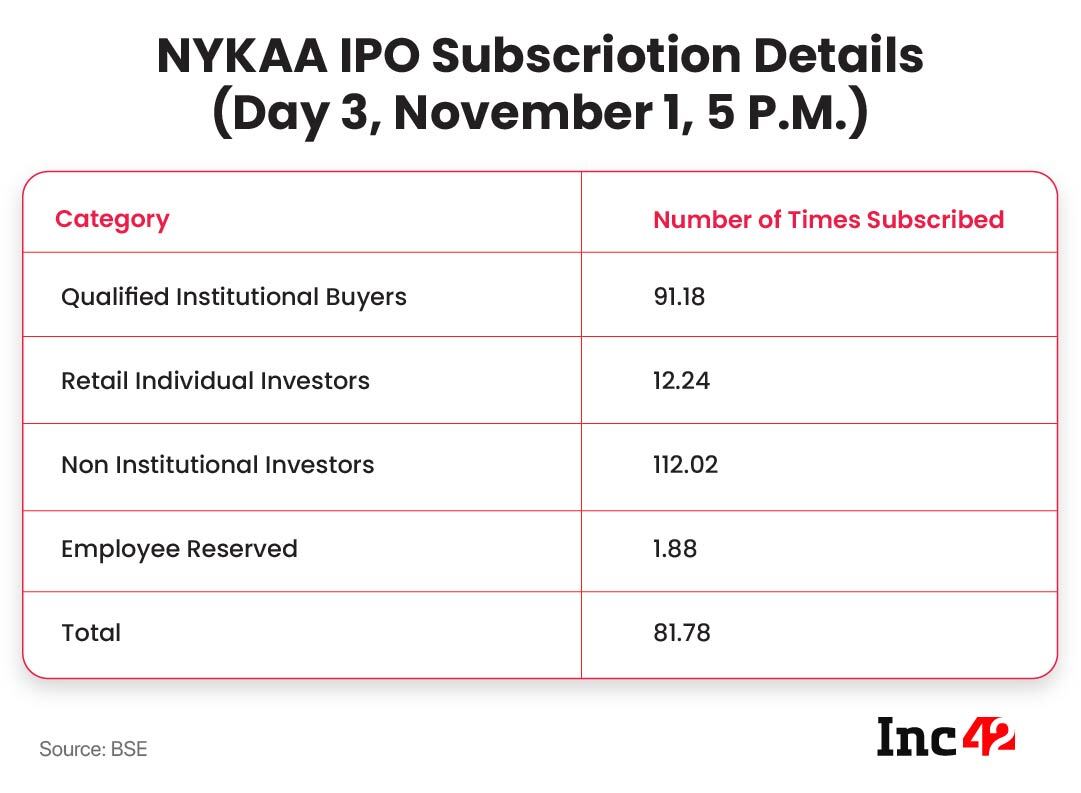

The initial public offering (IPO) of FSN E-Commerce, the parent of online lifestyle marketplace Nykaa witnessed emphatic interest among investors right from the opening of the offer. Overall, the IPO was subscribed 81.78 times at the time of closing.

At the upper limit of the IPO price band of INR 1,085 – INR 1,125, the offer has attracted bids worth a total of nearly $32.53 Bn.

A total of 2,64,85,479 shares were on offer, and investors placed their bids for 2,16,59,47,080 shares.

The robust demand was witnessed across categories of investors, right from retail investors to qualified institutional buyers (QIB).

- QIBs subscribed the earmarked portion of shares by a massive 91.18 times, as bids were received for 1,30,86,13,056 shares, against the 1,43,52,511 shares allocated for the institutional investors.

- During the three-day offer period, retail investors bid for 5,81,82,972 shares, while 47,53,187 were on offer for them.

- Non-institutional investors too showed robust interest with a subscription of the allocated portion by 112.02 times. A total of 71,29,781 were put aside for the corporates and individuals (other than retail investors), who form the NII category, while bids were placed for 79,86,81,132 shares.

- Employees also oversubscribed the allocated portion of shares. They bid for 4,69,920 shares (1.88 times), while 2,50,000 were on offer.

The shares of the online lifestyle and the beauty marketplace are expected to be listed on the domestic exchanges in the next 10 days. Grey market premiums suggest that its shares may get listed at a premium of INR 600 – 650 compared to the IPO price band, traders said.

Before the IPO, the beauty and lifestyle unicorn had raised over INR 2,395.84 Cr by allocating nearly 2.13 Cr shares to 174 anchor investors. The anchor investors subscribed to the shares at a value of INR 1,125 per share, an upper limit of the IPO price band (INR 1,085 – INR 1,125).

In a regulatory filing, FSN E-Commerce said, “Under Anchor Investors (AIs) portion in the public issue of FSN E–Commerce Ventures Limited, 21,296,397 equity shares have been subscribed today at Rs 1,125 per equity share.”

The anchor investors included — Blackrock, Fidelity International, the Government of Singapore and the Monetary Authority of Singapore.

As per the startup’s red herring prospectus (RHP), its IPO includes a fresh issue of INR 630 Cr and an offer for sale (OFS) of up to 41,972,660 shares. The company aims raise funds in the range of INR 4,554.03 Cr – INR 5,351.92 Cr.

Ad-lite browsing experience

Ad-lite browsing experience