SUMMARY

NPCI says the cap of 30% will be calculated basis the total volume of transactions processed in UPI during the preceding three months

The decision will impact PhonePe and Google Pay the most since both the UPI-based transactions app have a market share higher than 30%

UPI recorded over 2 Bn transactions in October, a milestone that highlights the faster adoption of digital payments in a pandemic-hit world

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

In a move that is likely to impact PhonePe and Google Pay which have market share higher than 30%, the National Payment Corporation of India (NPCI), which manages Unified Payment Interface (UPI), has decided to cap the share of the total number of transactions that a third party application can process at 30% of the total volume of transactions processed in UPI.

The decision will come into effect from January 1, 2021.

With UPI reaching 2 billion transactions a month and with potential for future growth, it has issued a cap of 30% of the total volume of transactions processed in UPI, applicable on all Third Party App Providers (TPAPs),” NPCI said in a statement.

NPCI has said, the cap of 30% will be calculated basis the total volume of transactions processed in UPI during the preceding three months (on a rolling basis). And, the existing TPAPs, which have exceeded the cap, will have a period of two years from January 2021, to comply with the same in a phased manner.

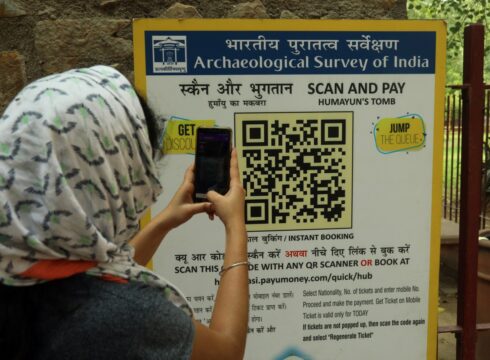

Currently, third party applications such as PhonePe, Google Pay, Paytm and Amazon Pay, dominate the UPI ecosystem, controlling a majority of the transactions. According to industry estimates, the biggest player is Google Pay with over a 40% market share, closely followed by PhonePe.

UPI recorded over 2 Bn transactions in October, a milestone that highlights the faster adoption of digital payments in a pandemic-hit world.

As businesses open up, there is a huge uptick in UPI payments as an increasing number of customers opt for digital payments, owing to convenience and safety. With the festive season in full bloom, October has seen a surge in UPI payments.

The cap will be calculated on the basis of the total volume of transactions processed in UPI during the preceding three months on a rolling basis.

Existing app providers with more market share of more than 30% market share will have two years from January 2021 to comply with the latest developments.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.