Of the 14 newly listed tech startups under Inc42’s coverage, nine saw their shares gain this week in a range of 0.9% to a little over 7%

EaseMyTrip was the biggest loser this week, falling 3.9%. Nykaa, DroneAcharya, MapmyIndia, and IndiaMart InterMESH also ended in the red

Benchmark indices Sensex and Nifty 50 touched record highs at 64,718.56 and 19,189.05, respectively, on Friday

Indian new-age tech stocks saw moderate growth for the second straight week despite a bull run in the broader domestic equity market.

Of the 14 new-age tech startups under Inc42’s coverage, nine saw their shares gain this week in a range of 0.9% to a little over 7%. Among these, PB Fintech emerged as the biggest winner by surging 7.4% on the BSE.

Nazara Technologies gained 5.6% this week, while Paytm and RateGain rose over 3% each. Fino Payments Bank, Tracxn Technologies, and Zomato gained over 1% each, while Delhivery was up 2% and CarTrade Technologies up 0.9%.

On the other hand, EaseMyTrip continued to slump and was the biggest loser this week, falling 3.9%. Besides, Nykaa, DroneAcharya, MapmyIndia, and IndiaMart InterMESH also declined between 0.6% to 2.3% on the BSE.

Benchmark indices Sensex and Nifty 50 touched record highs at 64,718.56 and 19,189.05, respectively, on Friday. This week, Sensex gained 2.76% and Nifty gained 2.8%.

Higher inflow from foreign institutional investors (FIIs), revival of monsoon, and the positive impact of the merger of HDFC and HDFC Bank were among the reasons for the rally in the broader market this week, said Prashanth Tapse, senior VP (research), Mehta Equities.

Though new-age tech stocks had two back-to-back mixed weeks after three straight weeks of significant gains, the investor outlook seems to be positive on these companies now.

In fact, drone startup ideaForge saw its IPO getting subscribed 106X, with the issue witnessing high demand from across the board. ideaForge’s IPO opened on June 26 (Monday) and closed on June 30 (Friday).

Arvinder Singh Nanda, senior vice president of Master Capital Services, said, “The primary market is back in action after a period of lull, with a flurry of IPOs in the pipeline. Investors are kept busy as not just the mainboard but also many SME IPOs are hitting the market.”

“In the coming days, India’s manufacturing and services PMI data will be in focus, Globally, Europe, the UK and the US will also be sharing their manufacturing and services PMI numbers. US’ initial jobless claims, non-farm payrolls, India’s forex reserve data will be the key events that will drive the market next week,” Nanda added.

Now, let’s take a deeper look into the performance of some of the new-age tech stocks this week:

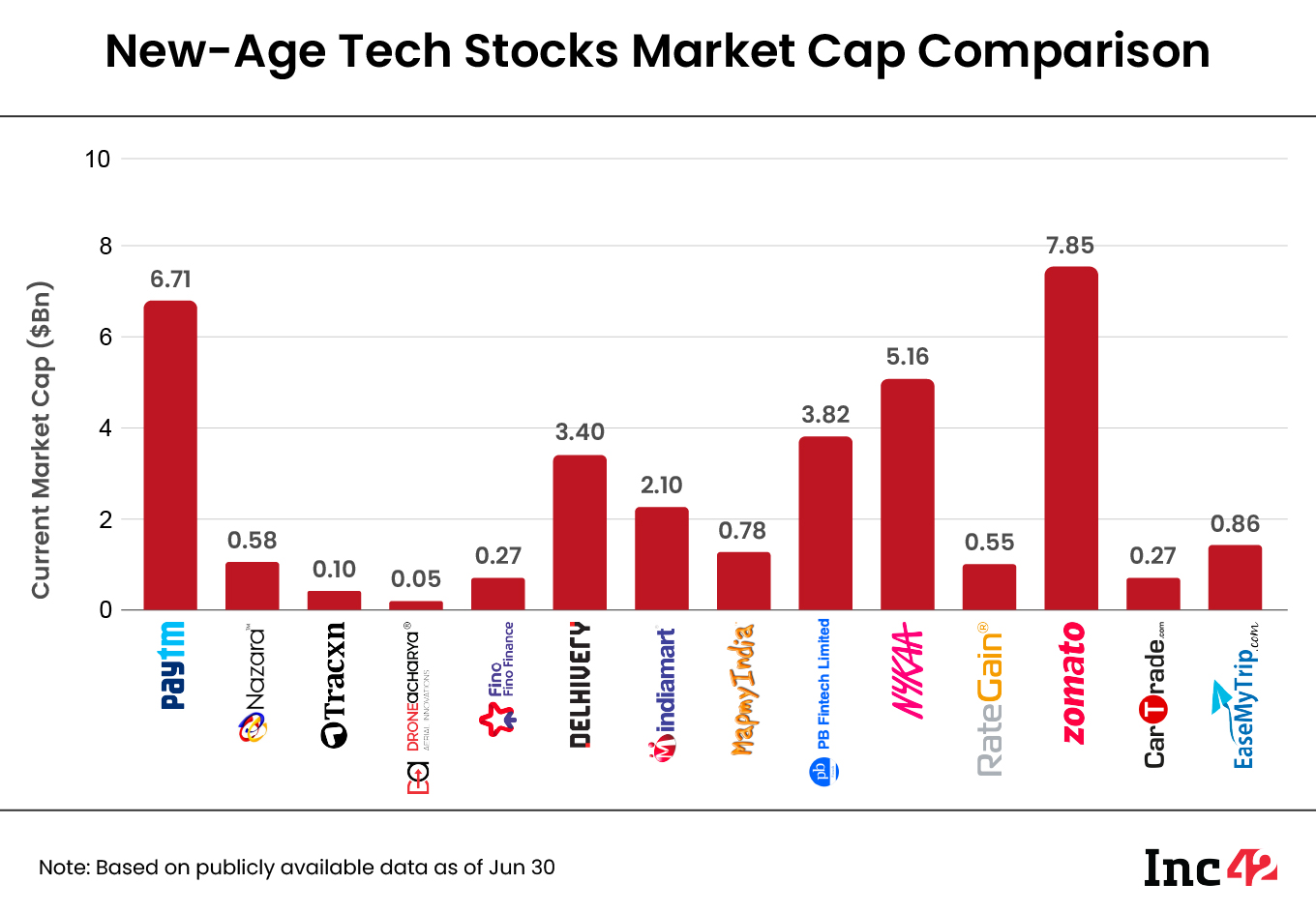

The 14 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $32.5 Bn as against $32.1 Bn last week.

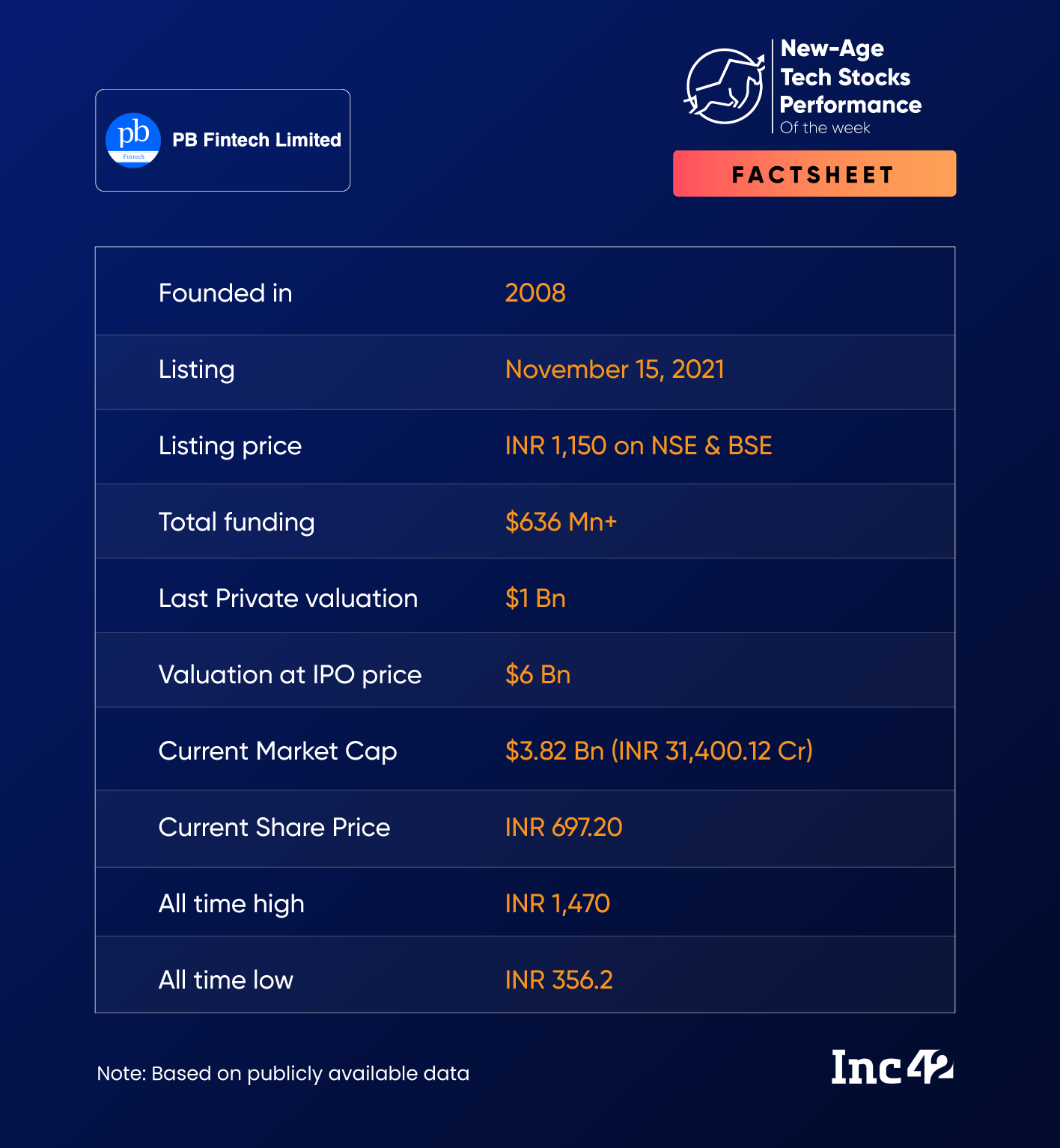

PB Fintech Touches 52-Week High This Week

On Monday, shares of fintech major PB Fintech gained 9% during intraday trading to touch its 52-week high of INR 708 on the BSE following a meeting of the company’s officials with analysts.

Gaining for the second straight session, the shares closed at INR 717.05 on Tuesday, the highest level since mid-April last year. However, the stock shed some of the gains in the next two sessions to end the week at INR 697.6. Overall, the shares gained 7.4% this week.

Several brokerages emphasised their confidence in the startup’s tech capabilities and data, which are expected to keep boosting its insurtech business Policybazaar.

In a research note, Kotak Institutional Equities said that the meeting reinforced the analysts’ conviction on PB Fintech’s domain capability, which is expected to keep it ahead of peers.

Speaking about the stock, Amol Athawale, deputy vice president, technical research at Kotak Securities, told Inc42 that it is currently looking positive on technical charts. For short-term traders, INR 660 level or 20-day simple moving average (SMA) is the immediate stop loss level.

Above that level, the stock is likely to continue its uptrend till INR 770-INR 775 in the near-to-medium term, he said.

It must be noted that shares of PB Fintech are trading almost 56% higher year to date.

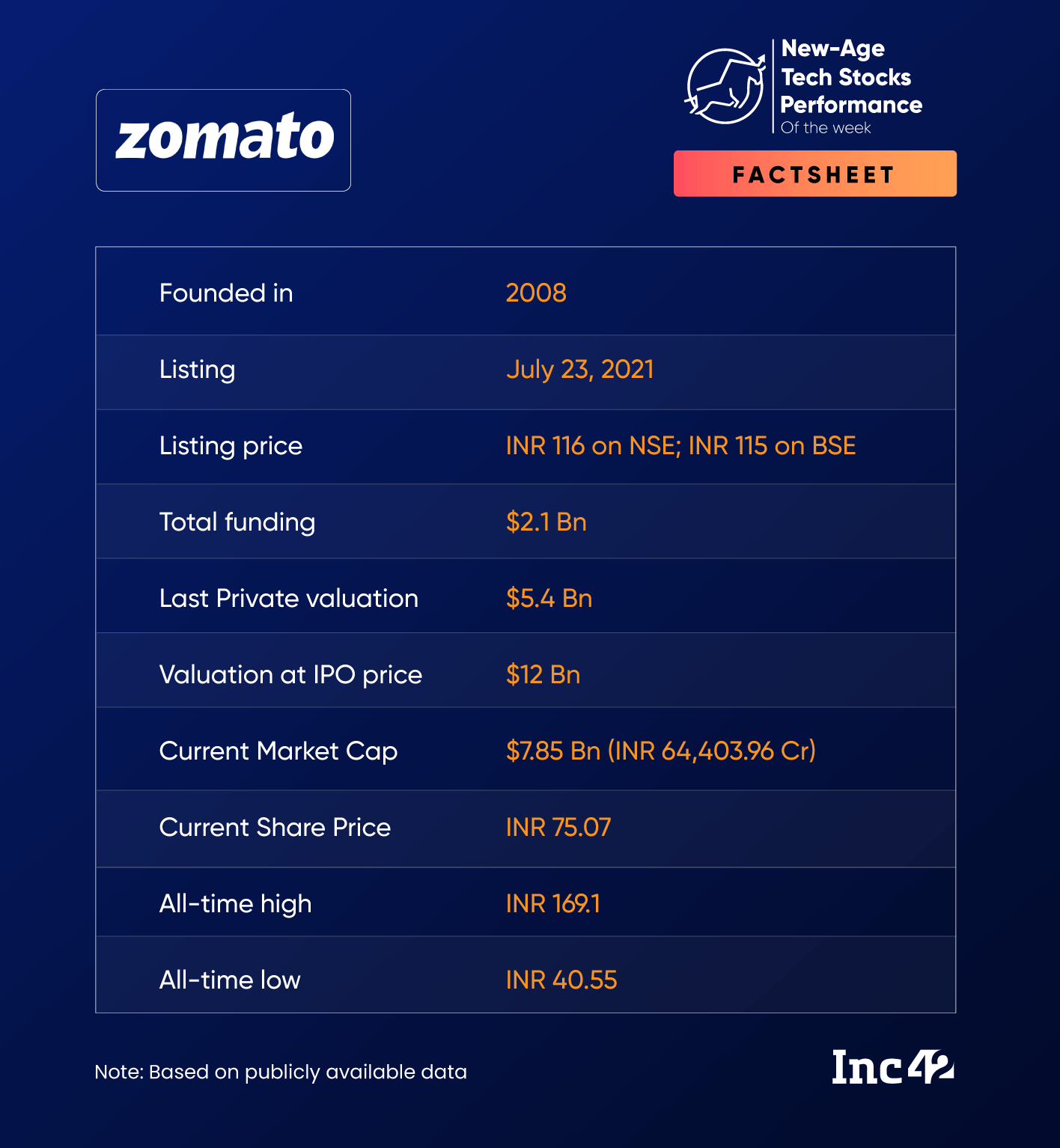

Zomato’s New Features

Zomato, which has seen its stock rally on the bourses since the start of April and positive commentary from analysts, introduced multiple new features this week.

In The News For:

- On Friday, the foodtech major introduced ‘Zomato Food Trends’, which would help restaurant partners make data-driven decisions based on insights such as demand and supply gaps, price distribution and demand trends. Zomato Food Trends is also free of cost and an open platform accessible to the general public.

- Besides, the food delivery startup has now started allowing its users to make multiple carts at the same time. Earlier, the app allowed a user to update the cart from a single restaurant only.

- Jefferies’ Christopher Wood is reportedly set to again increase his investment in Zomato by a percentage point.

Competition Watch:

- Amid Zomato’s announcement of new features, Swiggy also unveiled a new feature, WhatTo Eat, which would allow users to explore options based on their moods and cravings.

- The Open Network for Digital Commerce (ONDC) is bolstering its capabilities by onboarding new players on its platform. Meanwhile, Google Cloud announced the launch of an accelerator programme for the government-backed platform, which might gradually emerge as a key competitor for Zomato and Swiggy.

Shares of Zomato made modest gains this week, rising 1.3% to end Friday’s session at INR 75.07 on the BSE.

Commenting on the stock, Athawale said that while the stock looks positive, it is slightly in the overbought zone.

“We can expect a range-bound activity in the near future. The immediate support for the stock is 20-day SMA. On the higher side, INR 81-INR 82 would be the profit booking area for the short-term traders,” said Athawale, adding that buying on dips and selling on rallies would be the ideal strategy for trading Zomato.

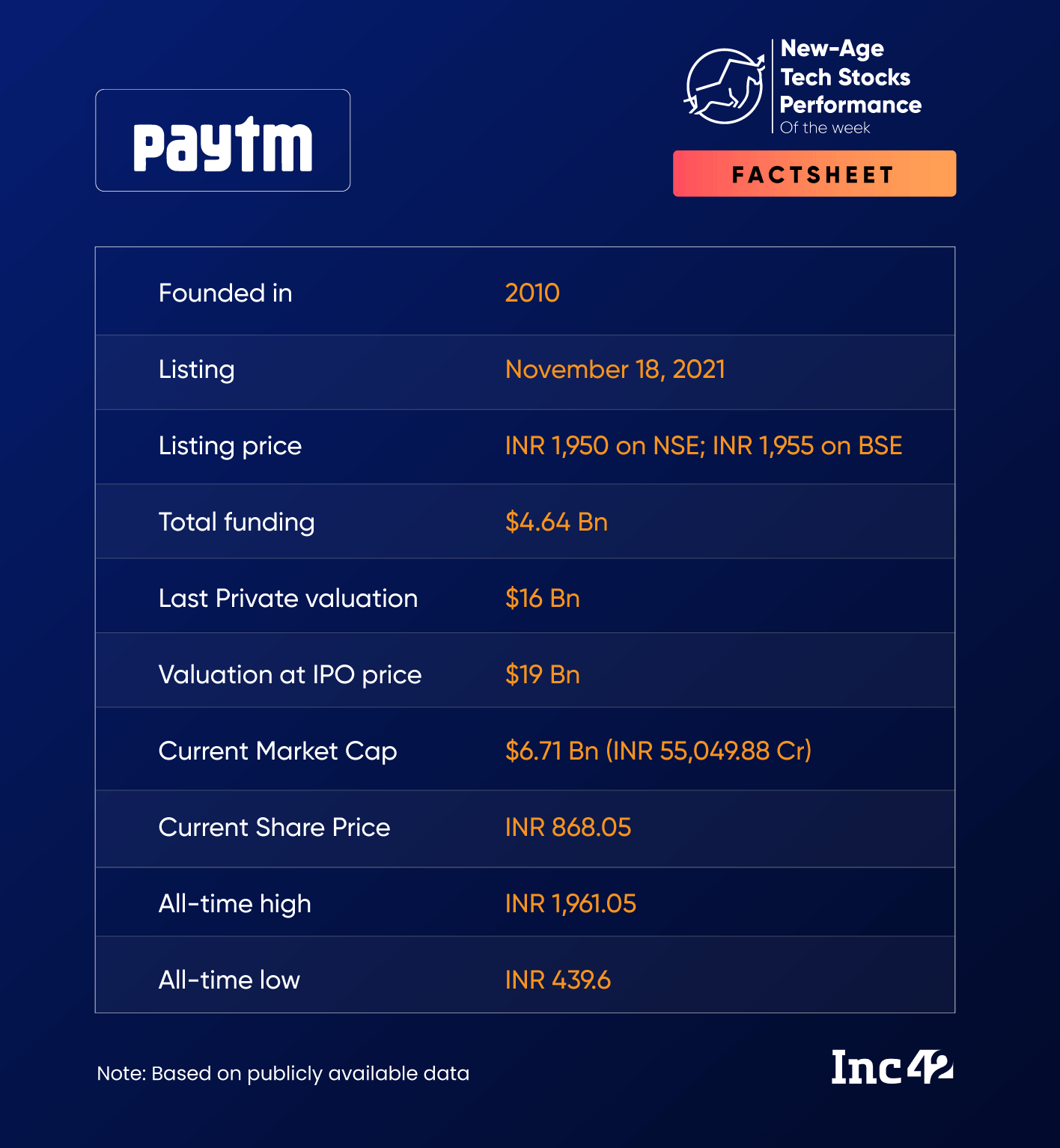

Paytm Gets A Downgrade From Macquarie

Brokerage Macquarie once again downgraded Paytm to ‘neutral’ rating from ‘outperform’, citing competitive and regulatory risks.

Despite the rating downgrade, shares of Paytm continued to rally and ended the week 3.2% higher.

Paytm gained 2.2% Friday alone, ending the week at INR 868.05 on the BSE. It is pertinent to note that the rally followed Paytm’s parent One97 Communications Limited’s announcement about a partnership with the largest retail NBFC in India, Shriram Finance Limited.

“Through this partnership, Shriram Finance’s products will be made available on Paytm’s platform digitally to further expand access to credit and drive financial inclusion in the country,” the fintech giant said.

Meanwhile, Paytm informed the stock exchanges on Saturday (July 1) that Vivek Kumar Mathur, COO of Elevation Capital, has resigned from its board, effective June 30.

Athawale said the stock looks bullish in the short-term. Its immediate support is at around INR 810-INR 820, while immediate resistance for the stock is around INR 910-INR 915.

Ad-lite browsing experience

Ad-lite browsing experience