Shares of Zomato, which have been on a downward trend for months now, ended the week as the biggest gainer, touching the INR 60-mark for the first time since June 28

Delhivery, which was doing quite well in the stock market so far, ended the week as the biggest loser among the new-age tech stocks

The benchmark indices NSE Nifty50 and BSE Sensex gained 1.7% and 1.8% during the week

It was a volatile week for most of the new-age tech stocks on the stock exchanges, with many of them seeing extreme ups and downs.

Delhivery, which was doing quite well in the stock market so far, ended the week as the biggest loser among the new-age tech stocks with its shares ending over 12% lower on a weekly basis at INR 555.35 on the BSE. The fall in the share prices was driven by its weak Q1 FY23 results.

On the other hand, shares of Zomato, which have been on a downward trend for months now, ended the week as the biggest winner, gaining over 13% to close at INR 61.75. On Friday, Zomato shares ended 6.65% higher than the previous close and touched the INR 60-mark for the first time since June 28. Analysts believe that the worst is over for Zomato, but selling off stakes by major investors can drive volatility in the near term.

Meanwhile, EaseMyTrip, one of the best-performing new-age tech stocks, also fell more than 6% this week, ending Friday’s session at INR 399.65.

For Paytm, it was a mixed week, and the stock ended marginally higher at INR 787.15.

Overall, the benchmark indices NSE Nifty50 and BSE Sensex gained 1.7% and 1.8% during the week to end at 17,698.15 and 59,462.78, respectively.

While the broader market trend has been driven by the first quarter results of the companies during the last few weeks, it might see some change in the following weeks.

“With Q1 FY23 result season coming towards close, market focus will shift towards macro factors that include inflation, central bank rate action, oil prices and recession concerns in key economies globally,” said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

Now, let’s take a look at the weekly performance of the listed new-age tech stocks from the Indian startup ecosystem and their key trends:

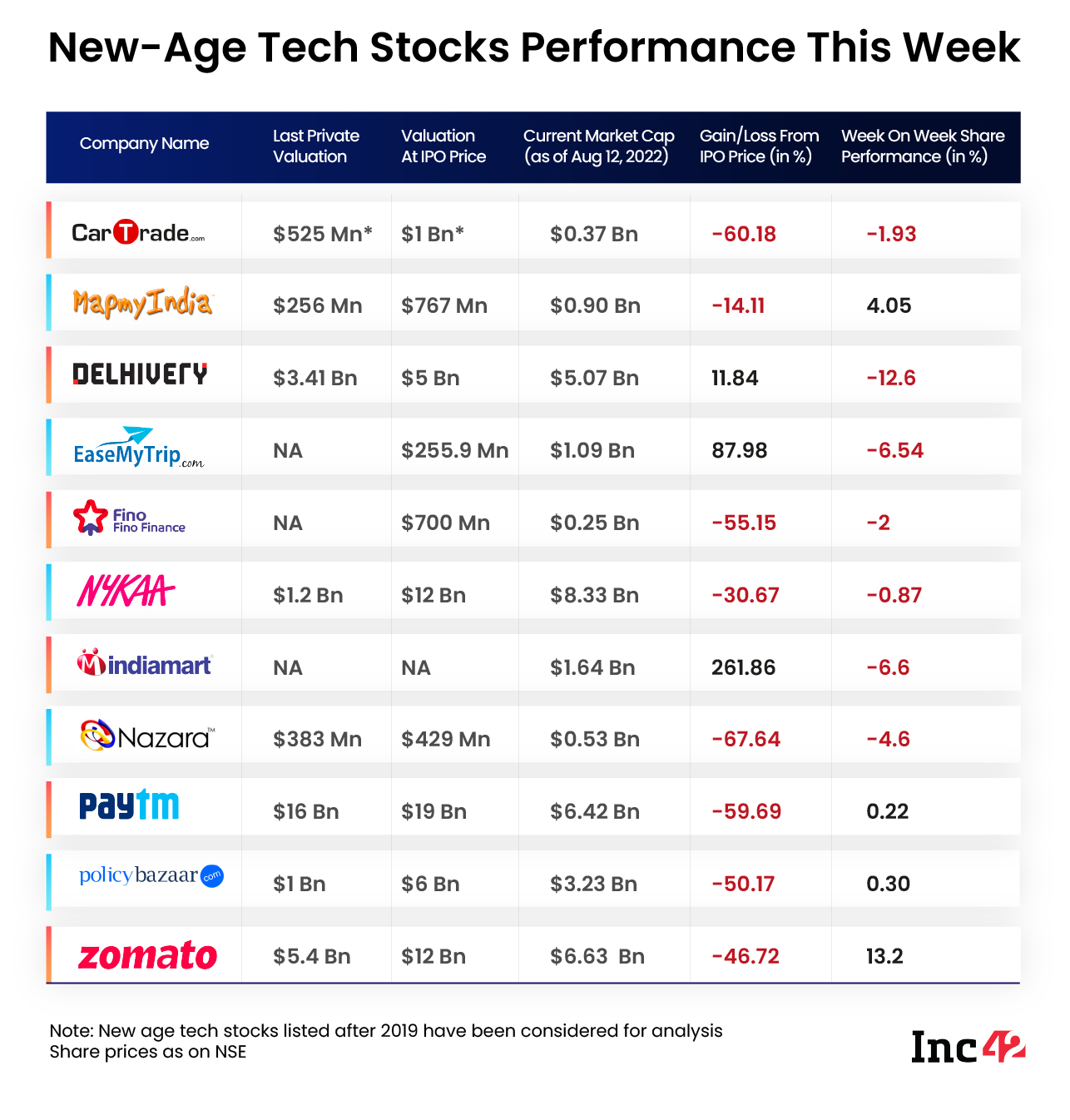

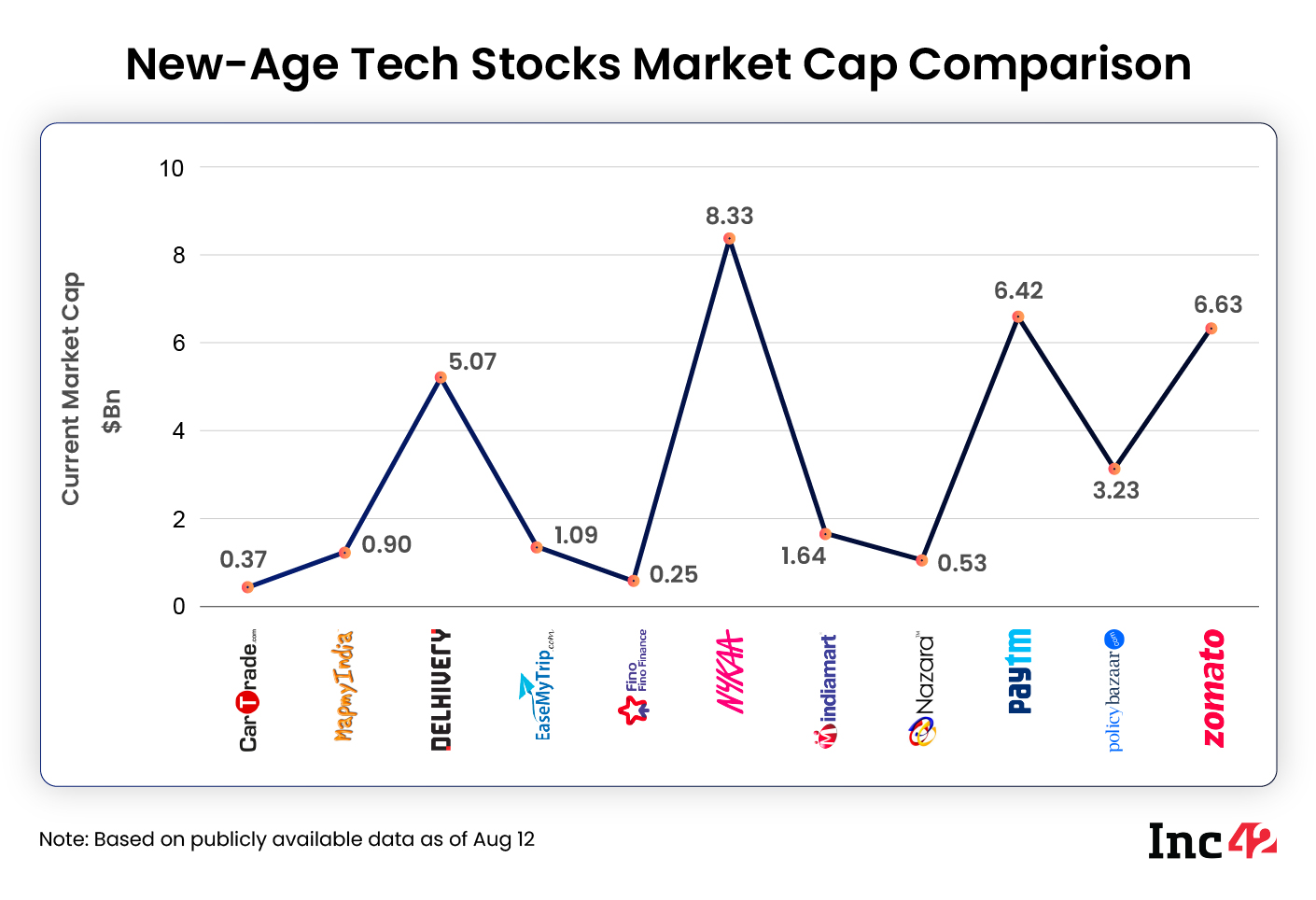

The 11 new-age tech stocks ended the week with a combined market cap of around $34.28 Bn, slightly lower than $34.39 Bn Bn last week.

Delhivery Shares Fall After Q1 Results

Shares of the logistics startup plunged about 7% to INR 599.9 on the BSE on Wednesday (August 10) after it reported widening of its loss by 208% to INR 399.3 Cr in Q1 FY23.

The losing streak continued in the next two sessions as well and the stock ended Friday 1.4% lower at INR 555.35 on the BSE.

On a quarter-on-quarter (QoQ) basis, its loss widened as much as 233% from INR 119.8 Cr reported in Q4 FY22.

Meanwhile, Delhivery’s total income grew only 31% year-on-year (YoY) to INR 1,794.5 Cr in the June quarter.

Since its listing on the Indian stock exchanges in May this year, Delhivery shares have performed extremely well. Its shares recently rallied to touch a record high of INR 699.95 in July. Delhivery’s market capitalisation also crossed INR 50,000 Cr mark last month.

However, several brokerages with positive ratings on Delhivery have revised their ratings downwards following the June quarter results. Credit Suisse downgraded the stock to ‘neutral’ from ‘outperform’, while Edelweiss Securities also downgraded it to ‘hold’ from ‘buy’.

On the other hand, ICICI Securities, which had a ‘hold’ rating, downgraded the stock further to ‘sell’, and IIFL Securities maintained a ‘sell’ rating.

IIFL Securities said that the quarter’s performance partly reflected the execution challenges, which may weigh high on Delhivery’s ambitions.

Delhivery shares are expected to trade sideways in the upcoming week, said Kunal Shah, senior technical analyst at LKP Securities. The lower-end support stands at around INR 540, while it would face resistance at around INR 600.

Delhivery shares are currently trading over 12% higher than the listing of INR 493 on the BSE.

Paytm’s Mixed Performance

Paytm’s parent entity One 97 Communications began the week by gaining over 6% on Monday (August 8). The positive sentiment following its good Q1 FY23 results was visible at the beginning of the week.

Last week, Paytm shares closed 16% higher on the BSE as the digital payments startup reported narrowing of its loss sequentially.

However, the shares shed some gains in the following sessions, and ended around 5% lower on Friday to settle at INR 787.15 on the BSE.

The blow to Paytm shares came after reports emerged that advisory firm Institutional Investor Advisory Services India Limited (IiAS) asked the startup’s shareholders to vote against the proposal of reappointing Vijay Shekhar Sharma as the company CEO.

Besides, Paytm on Friday said it disbursed 2.9 Mn loans in July, up 296% YoY, aggregating to a total loan value of INR 2,090 Cr ($264 Mn) during the month. In the three months ending June 2022, Paytm reported total loan disbursals of 8.5 Mn.

On the other hand, Paytm’s digital payments platform reported loan disbursements at an annualised run rate (ARR) of over INR 25,000 Cr ($3 Bn) in July. It stood at over INR 24,000 Cr in June.

Other factors such as the Reserve Bank of India’s (RBI’s) guidelines on digital lending published this week could have also affected Paytm’s performance this week. However, international brokerage Goldman Sachs said that the RBI guidelines remove a key regulatory overhang from Paytm.

“We think these guidelines should result in limited-to-no impact on Paytm’s business/ monetization model, and should help remove one of the key overhangs on the stock,” said the Goldman Sachs analysts.

Paytm stocks are currently trading in a strong uptrend, said LKP Securities’ Shah. “The weakness of the stock would start below the level of 720. Overall, I am expecting the stocks for next week to be sideways. The upside resistance is 850 and the downside support stands at 720,” he added.

Policybazaar’s Uncertainty

PB Fintech, the parent company of insurtech startup Policybazaar, reported a consolidated net loss of INR 204.33 Cr in Q1 FY23, up 84% YoY, on Wednesday (August 10).

On the other hand, its operating revenue surged 112% YoY to INR 505.18 Cr in the quarter.

It said that its insurance business is witnessing a steady shift in business mix towards rural India. In FY22, about 59% of Policybazaar’s insurance business came from non-Tier-I cities.

A day after the results, Policybazaar shares gained 4%, ending Thursday’s session at INR 583.1. However, it shed some of its gains on Friday to settle at INR 573.10 on the BSE.

Policybazaar shares have been volatile for quite some time now. In July end, the shares touched their record low of INR 457.6.

As per analysts, there are several reasons for the volatility in the stock, including possible regulatory tweaks in the insurtech segment, the Insurance Regulatory and Development Authority of India (IRDAI) setting growth targets for non-life insurers, the data breach incident, among others.

“For Policybazaar the trend is on the downside. It is forming a lower high, lower low formation on the daily chart. However, in the last 10 days we have seen some buying actions on the lower level,” said Shah.

The stock is expected to witness fresh buying momentum only above the INR 600 level. Once INR 600 is surpassed, it could go towards the level of INR 650. If INR 540 is taken as the downside, there could be further selling pressure again towards the level of 500 on the downside. So, currently, it’s a wait-and-watch situation, Shah added.

Ad-lite browsing experience

Ad-lite browsing experience