Eight out of the 14 new-age tech stocks under Inc42’s coverage gained this week, with Nykaa emerging as the biggest gainer with a 7% rise

CarTrade Tech, PB Fintech, EasyMyTrip, and Delhivery, among others, witnessed a decline, falling between 1% to over 5% on the BSE

In a volatile week, benchmark indices Sensex and Nifty50 ended about 0.1% and 0.2% higher, respectively; overall market sentiment remains bullish

New-age tech stocks continued to exhibit strength for the second consecutive week even as the broader Indian equity market witnessed volatility this week.

Eight out of the 14 new-age tech stocks under Inc42’s coverage gained this week, with Nykaa emerging as the biggest winner with a 7% rise.

Zomato, Paytm, IndiaMart InterMESH, MapmyIndia, Fino Payments Bank, Paytm, and RateGain also rose in the range of 0.4% to 6% on the BSE.

However, CarTrade Technologies, PB Fintech, Tracxn Technologies, EasyMyTrip, DroneAcharya, and Delhivery witnessed a decline, falling between 1% to over 5% on the stock exchange.

With the Q4 and FY23 earnings season coming to an end, the domestic market is reacting to global cues and other macroeconomic factors, which resulted in large volatility in the market this week.

Despite falling in two straight sessions mid-week, benchmark indices Sensex and Nifty50 managed to end the week in green. While Sensex rose 0.1% to 62,547.11, Nifty50 ended 0.2% higher at 18,534.10.

“Nifty closed higher, driven by positive factors such as the US debt ceiling resolution which boosted investor confidence. Besides, senior Fed officials also hinted at no interest rate hike in June, while 12% year-on-year growth in GST collections in May indicated strong economic growth in India,” said Prashanth Tapse, senior VP (research) at Mehta Equities.

Analysts are of the opinion that the overall sentiment in the domestic equity market remains bullish and all eyes are now on the upcoming policy meeting of the Reserve Bank of India (RBI).

Now, let’s dig deeper into understanding this week’s performance of some of the new-age tech stocks.

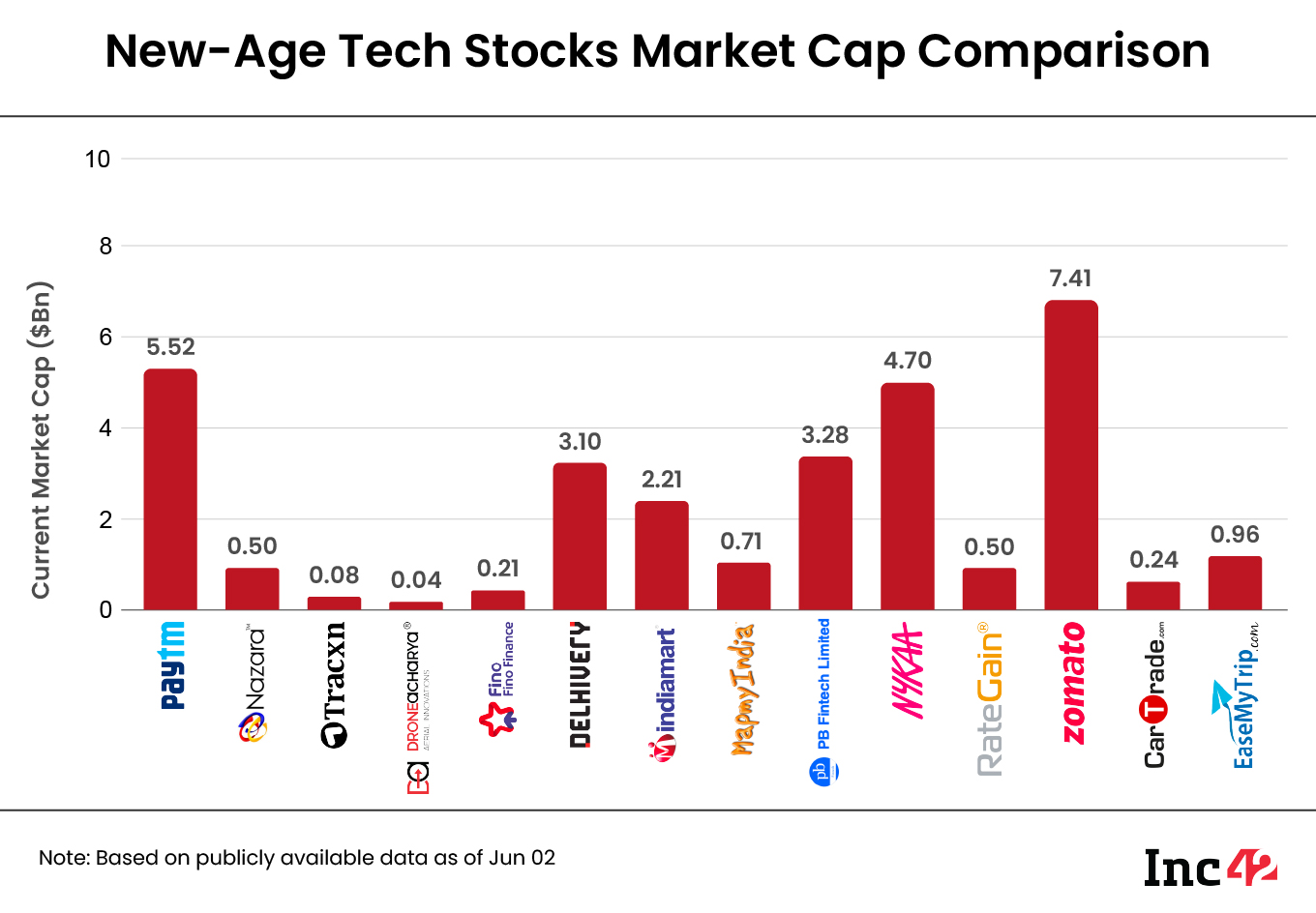

The 14 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $28.96 Bn versus $29.1 Bn last week.

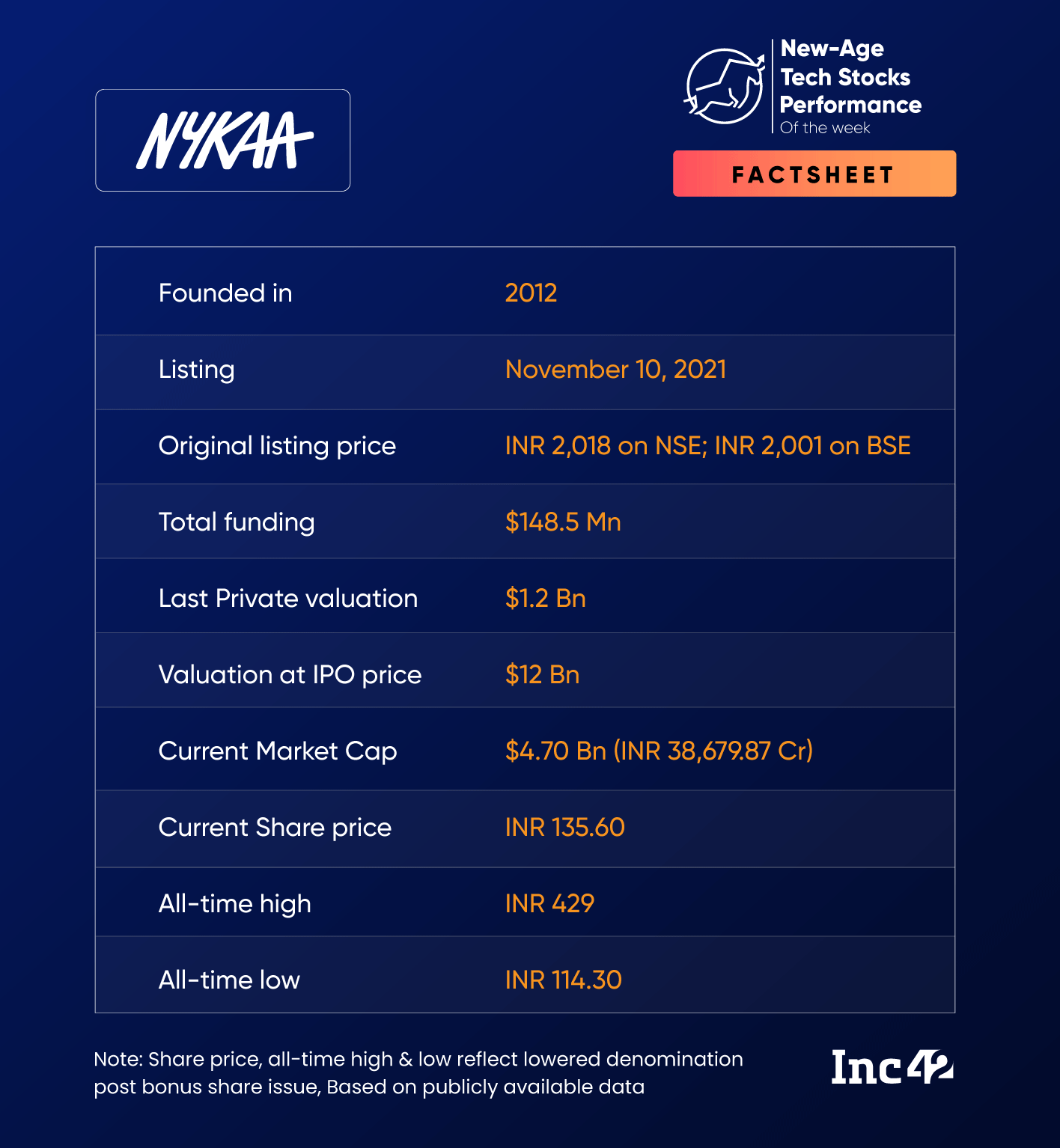

Nykaa Emerges As The Biggest Winner

Shares of Nykaa reversed the downward trend seen since April by gaining momentum by the end of the week to emerge as the biggest winter among its peers.

Shares of Nykaa jumped 7.5% on the BSE on Friday, ending the week at INR 135.6. Overall, the stock gained 7.4% this week.

Despite Nykaa’s Q4 FY23 earnings indicating signs of slowdown in business, its shares have gained 8% since the announcement of its results.

Commenting on the stock, Ganesh Dongre, senior manager, technical research at Anand Rathi, said Nykaa has a long growth trajectory from here on.

Currently, the stop loss for the stock is around INR 115-INR 118 level, said Dongre, who has a target of over INR 150 for Nykaa. While there could be a slight dip in the coming week, the trend is upward and the best call on the stock would be to buy on dips, he added.

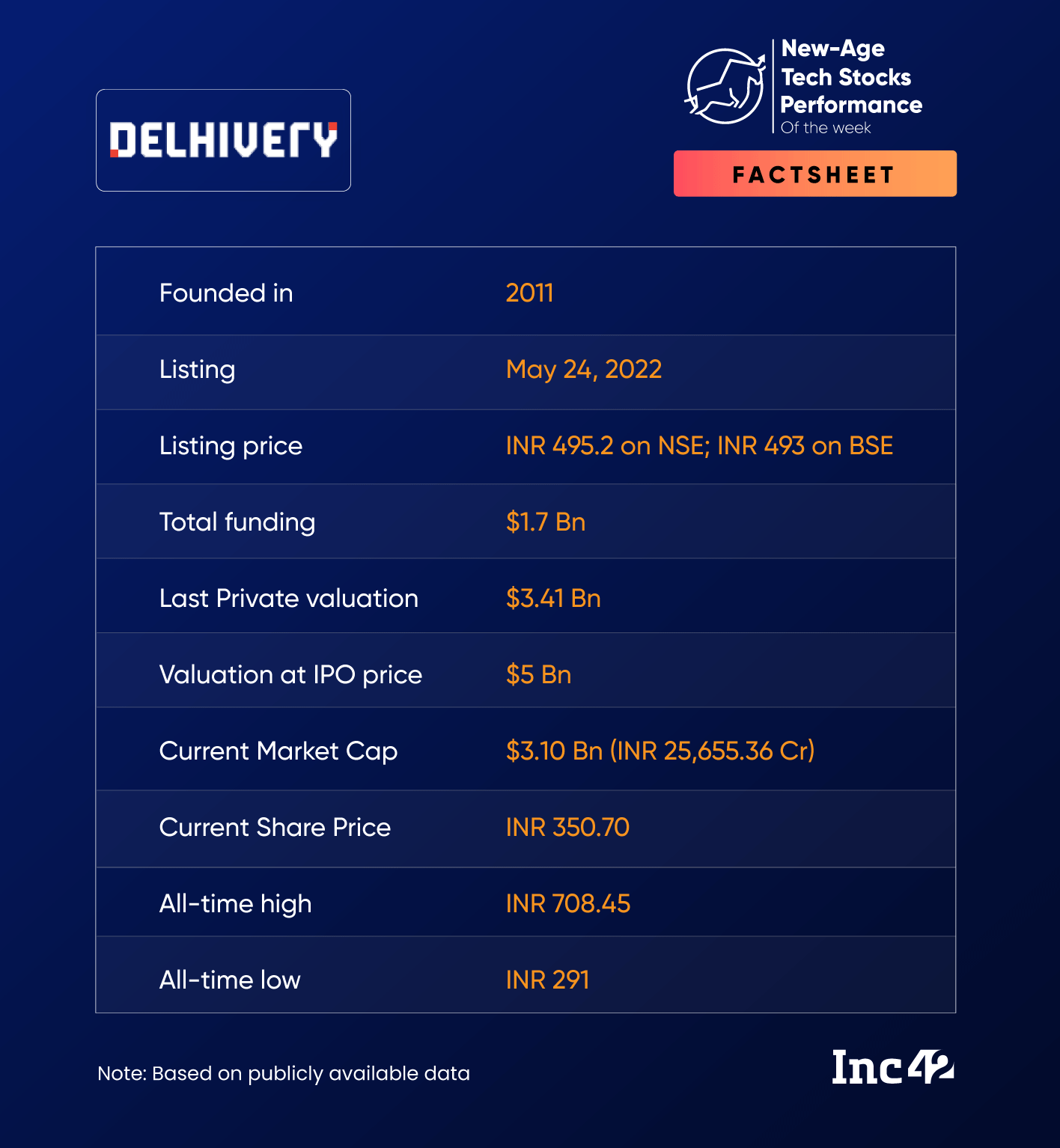

Delhivery The Biggest Loser

Despite the overall bullish sentiment for new-age tech stocks, shares of Delhivery slipped 5.3% to INR 350.70 on the BSE this week.

However, this weak performance was in line with the decline seen by other Indian logistics players like Allcargo, Aegis Logistics, and VRL Logistics.

Shares of Delhivery have fallen almost 3% on the BSE in the last two weeks since the logistics unicorn reported a 32% widened net loss of INR 158.6 Cr in Q4 FY23.

Recently, the company also announced a strategic investment Vinculum, which is expected to enable omnichannel retailing for D2C enterprises and quick commerce companies.

“The stock will see a reversal from INR 320-INR 350 zone and try to reach INR 380 in the next one to two weeks. Once it closes above that level, then we will see a sharp bounce, which can go beyond INR 400,” Dongre said about Delhivery.

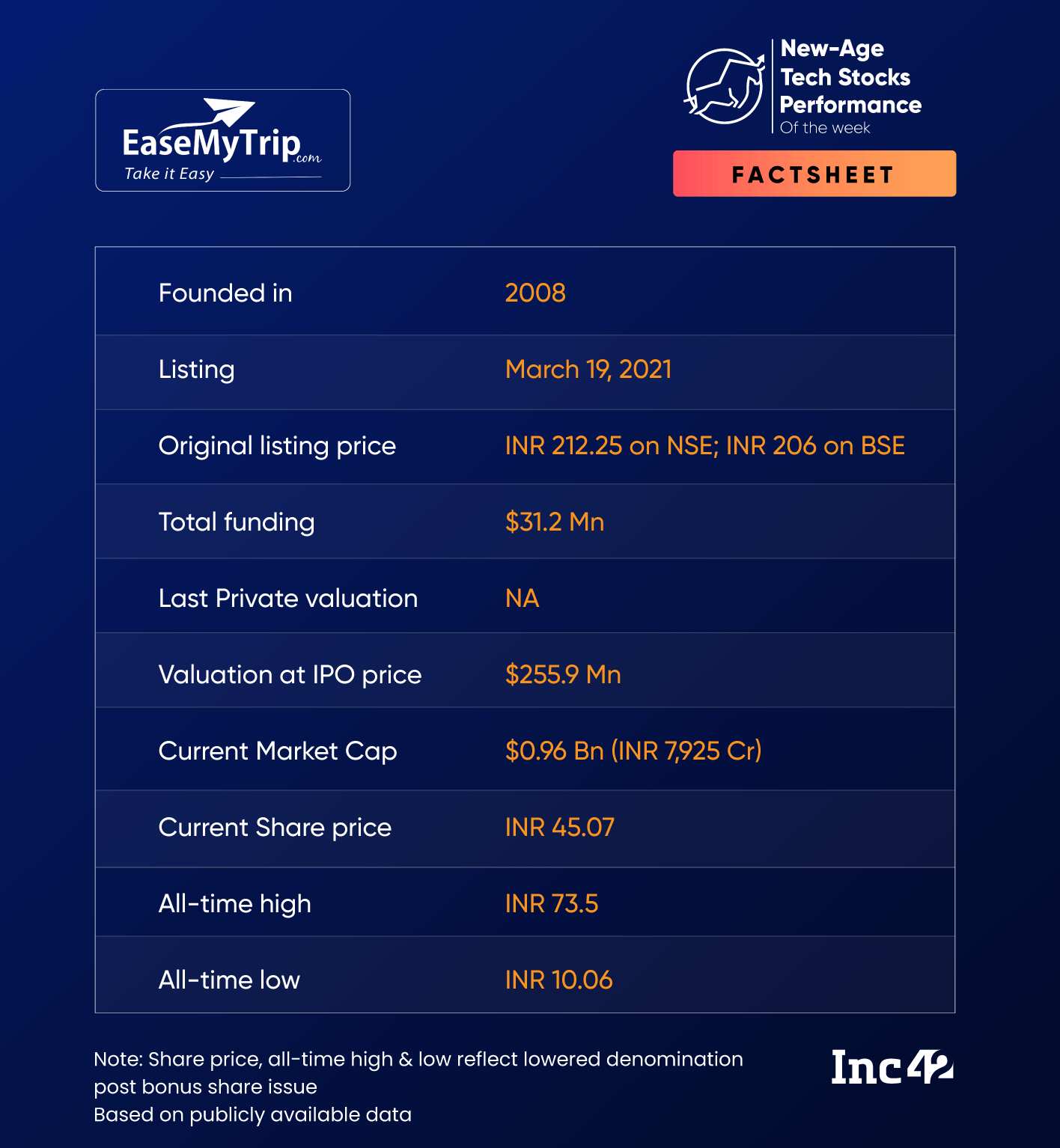

EaseMyTrip’s Q4 Results Fail To Cheer Investors

Shares of EaseMyTrip have remained range bound since the end of March this year. Its Q4 FY23 results published last Friday also failed to add any momentum to the stock.

Shares of the traveltech startup fell almost 3% this week, ending the last session at INR 45.59 on the BSE.

While EaseMyTrip reported a 33.1% YoY increase in net profit to INR 31.1 Cr, on a sequential basis, its profit fell 25.4% in the March quarter. Operating revenue also saw a 14% decline sequentially to INR 116.6 Cr, while it rose 91.5% YoY.

However, the company remains bullish about its performance and said it hopes to continue to grow the business profitably.

Anand Rathi’s Dongre said that the stop loss for the stock is INR 40 while the target is INR 50. In the coming week, EaseMyTrip stocks will try to rally to INR 48-INR 52 zone, he added.

Ad-lite browsing experience

Ad-lite browsing experience