Thirteen of the 18 new-age tech stocks under Inc42’s coverage tanked anywhere between 0.35% to more than 10% as weak market sentiment continued to drag down the markets

Yatra was the biggest loser (fell 10.3%) this week, followed by Paytm (down 9.27%), Policybazaar (down 7.69%) and Zomato (fell 6.66%)

CarTrade, DroneAcharya, IndiaMART, MapmyIndia, and RateGain were the new-age tech stocks which bucked the bearish trend this week

It was another subdued week for Indian new-age tech stocks as geopolitical tensions and weak global cues continued to drag down the broader market.

Thirteen out of the 18 new-age tech stocks under Inc42’s coverage fell in a range of 0.35% to over 10% this week. While recently-listed Yatra was the biggest loser, with the stock crashing 10.3%, Paytm was at the second position with a decline of 9.27%.

Policybazaar and Zomato fell 7.69% and 6.66% week-on-week, respectively.

On the other hand, Cartrade led the list of winners, with the stock rising 3.73% during the week. The company also announced that it would shut down the auto sales division of OLX, which it acquired recently.

DroneAcharya (up 3.18%), IndiaMART (up 1.62%), MapmyIndia (up 1.28%) and RateGain (rising 0.24%) were the other new-age tech stocks which bucked the bearish trend this week.

It must be noted that IndiaMART and RateGain released their financial results for the quarter ended September on Friday (October 27), while DroneAcharya also published its financials for the first half of FY24 on Friday.

While IndiaMART’s net profit rose by a meagre 2% year-on-year (YoY) to INR 69 Cr in Q2 FY24, traveltech SaaS startup RateGain saw its consolidated profit after tax (PAT) more than double YoY to INR 30.04 Cr in Q2 FY24.

Meanwhile, drone maker DroneAcharya Aerial Innovations saw its profit soar 2,932% YoY to INR 3.97 Cr in the first half (H1) of FY24.

In the broader market, benchmark indices Sensex and Nifty50 rose 1.01% to close at 63,782.80 and 19,047.25, respectively, on Friday, after three consecutive trading sessions of decline this week. The market was closed for trading on Tuesday (October 24) on the occasion of Dussehra.

Overall, Sensex and Nifty50 fell 2.51% and 2.71%, respectively, during the week.

Speaking to Inc42, Ganesh Dongre, senior manager of technical research at Anand Rathi, attributed the fall to the Israel-Hamas war and other global concerns.

“The current market selloff is due to the ongoing Israel-Hamas war, potential interest hike by the US Federal Reserve and rising bond prices. Despite this, FIIs are buying, which implies that there is little panic so far in the market. So, the outlook likely points towards consolidation,” added Dongre.

Amol Athawale, vice president of technical research at Kotak Securities, said he expects the market to complete another round of corrections. He believes there would be selling pressure in the market for a while, which is likely to lead to consolidation.

Now, let’s take a detailed look at the performance of some of the major new-age tech stocks this week.

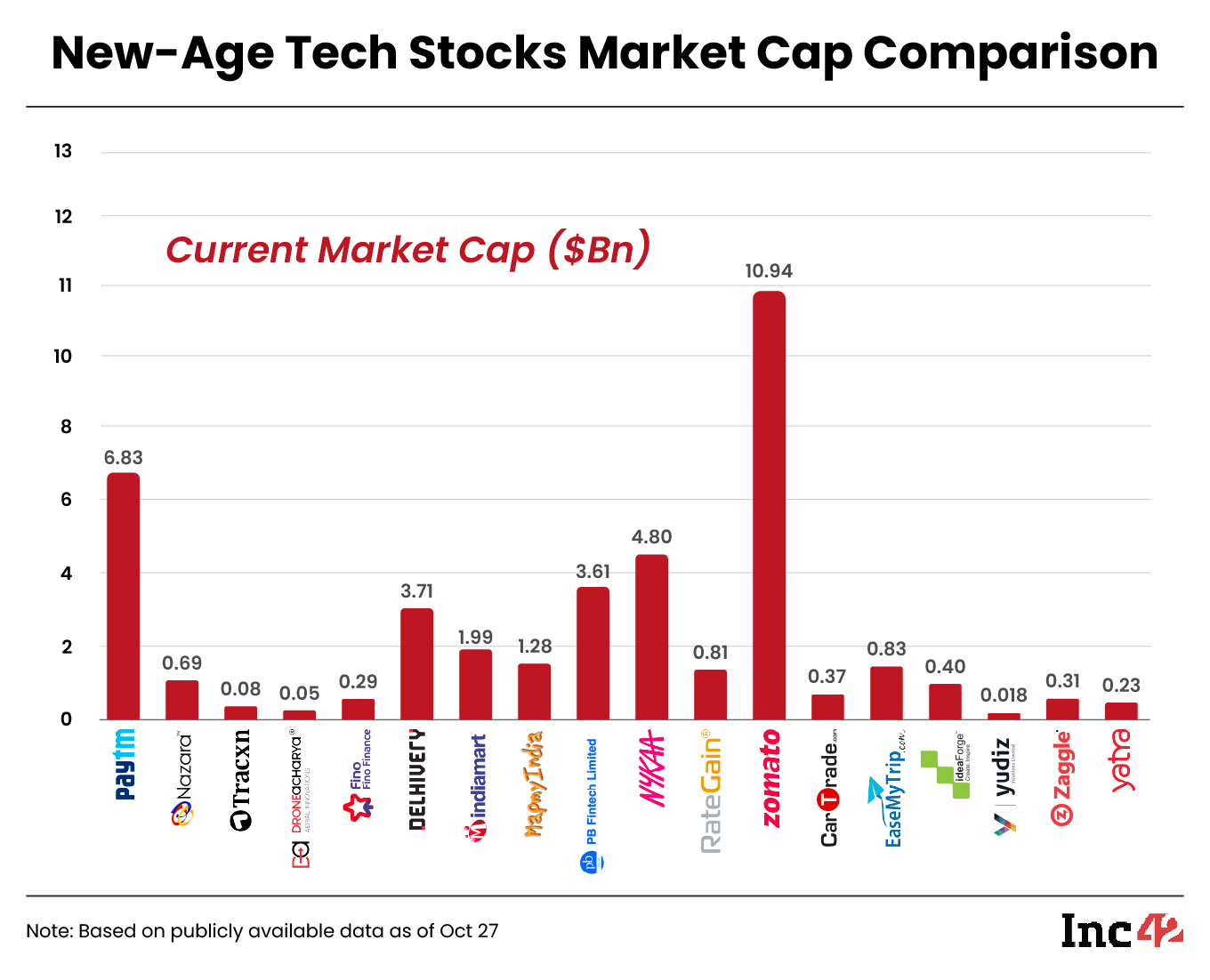

The total market capitalisation of the 18 new-age tech stocks under Inc42’s coverage stood at $37.24 Bn at the end of this week as against $39.08 Bn last week.

Paytm’s Bull Run Ends

Shares of Paytm fell 9.27% this week, as the stock’s bull run ended amid the bloodbath at Dalal Street.

The stock ended the week at INR 895.85 on the BSE on Friday as it witnessed selling pressure despite reporting healthy Q2 numbers. The fintech juggernaut reported a 49% YoY fall in consolidated net loss to INR 291.7 Cr in Q2 FY24 even as operating revenue jumped 31% YoY to INR 2,518.6 Cr.

Despite the fall this week, Kotak Securities’ Athawale said the stock is holding on to the ‘higher bottom formation’ and is still on the positive side despite corrections.

He, however, cautioned that shares of Paytm are likely to consolidate going forward. “For traders, INR 860 would be the immediate support stop loss,” added Athawale.

Meanwhile, online stock trading platform Tradingo’s founder Parth Nyati heaped praises on Paytm despite the weekly bearish trend and said, “The company is expected to sustain this improvement in contribution margin and operational efficiency, which will support ongoing profitability. With its extensive user base, diverse use cases, and robust technology platform, Paytm is poised for revenue growth and a shift to substantial profitability starting in FY25E.”

In The News For:

- Fintech giant Paytm became the official sponsor for the ongoing 37th edition of the National Games, being held in Goa

- Paytm founder Vijay Shekhar Sharma launched an INR 30 Cr fund to invest in Indian artificial intelligence (AI) and electric vehicle (EV)-related startups

Zomato, Too, Stumbles

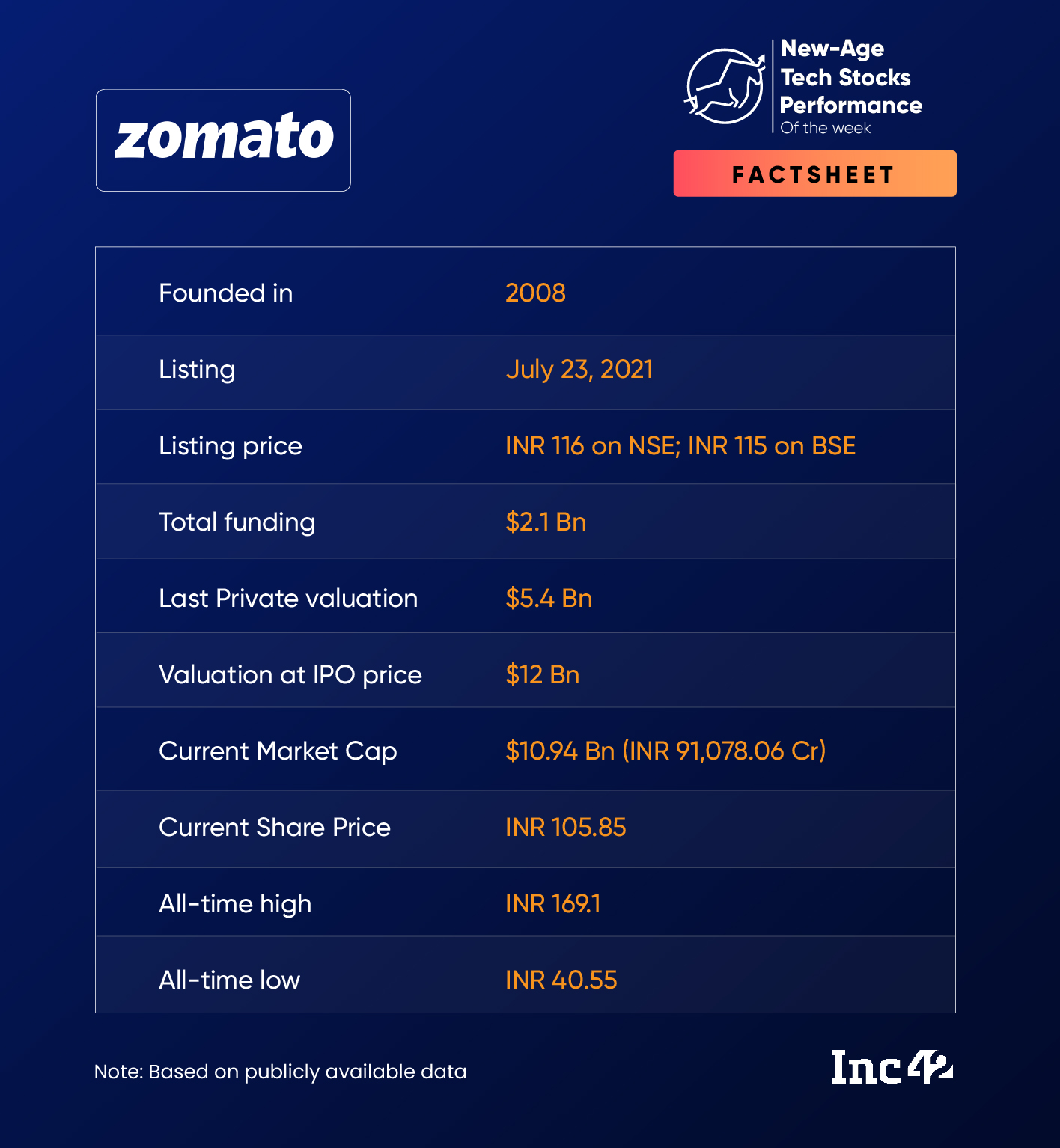

With Q2 financial results just round the corner, the markets also battered Zomato on the bourses.

Shares of the foodtech giant tanked 6.66% over the course of the volatility-prone week, ending the week at INR 113.4 on the BSE. Market capitalisation also declined over 9% week-on-week to $6.83 Bn at the end of Friday’s session.

The downward trend came after weeks of positive growth in the share price on the back of its maiden profitable quarter in Q1 FY24. That said, all eyes are now on the company to see if it is able to sustain the momentum and clock another profitable quarter in the second quarter of FY24.

Anand Rathi’s Athawale continues to be bullish on the stock despite it surging more than 78% on a year-to date (YTD) basis.

“Broadly speaking, I think INR 100 would be the support level for the shares over the short term. If the stock is selling above INR 100, then, I believe that consolidation or the range bound formation will likely continue. So, on the higher side, INR 113 to INR 115 is possible,” Athawale said.

Meanwhile, Ivy Growth Associates’ Prateek Toshniwal told Inc42 that Zomato’s long-term prospects appear promising on account of limited disruption from competitors and the Indian food delivery space largely being a duopoly.

“Strong network effects, branding, last-mile delivery, and user behavior support the positive outlook for Zomato. Blinkit is expected to boost revenue and EBITDA. India’s online food delivery market, while smaller compared to the US and China, presents substantial growth potential driven by urbanisation, nuclear families, and busy lifestyles,” another analyst told Inc42.

PolicyBazaar Tanks Nearly 8%

Emulating the broader trend in the market, intense selloff battered shares of PolicyBazaar this week. The stock tanked 7.69% this week to end Friday’s trading session at INR 668.90 on the BSE.

While the stock opened the week on a sluggish note, it recovered somewhat, straddling between highs and lows, as it pared some losses in the week’s final trading session.

Its market capitalisation declined to $3.61 Bn on Friday from $3.92 Bn a week ago.

It must be noted that the shares of PolicyBazaar, like its peer new-age tech stocks, have been on an upward trend this year. The stock is trading 49.13% higher YTD.

Commenting on the stock, Kotak Securities’ Athawale said PB Fintech looks weak on the technical charts and might see profit booking in the short term.

Ad-lite browsing experience

Ad-lite browsing experience