SUMMARY

Twelve out of the 16 new-age tech stocks under Inc42’s coverage gained in a range of 0.2% and over 7% this week

Delhivery, IndiaMart, ideaForge, and Tracxn were the only losers this week, declining between 1% and 4% on the BSE

In the broader market, Sensex fell 0.1% to 64,886.51 while Nifty 50 declined 0.23% to 19,265.8 this week, largely due to the weakness in global markets

Indian new-age tech stocks largely witnessed a northbound movement this week despite the weakness in the broader domestic equity market.

Twelve out of the 16 new-age tech stocks under Inc42’s coverage gained in a range of 0.2% and over 7% this week, while EaseMytrip emerged as the biggest winner with 7.3% gain on the BSE.

Other gainers of the week included MapMyIndia (jumped 7.1%), Paytm (up 4.6%), CarTrade Technologies (up 3.8%), Nykaa (rose 2.8%), and Zomato (up 1.7%).

Meanwhile, Delhivery, IndiaMart, ideaForge, and Tracxn were the only losers this week, declining between 1% and 4% on the BSE.

In the broader market, Sensex fell 0.1% to 64,886.51 while Nifty 50 declined 0.23% to 19,265.8 this week. The indices fell sharply in two consecutive trading sessions on Thursday and Friday, largely due to the weakness in global markets.

“Markets tumbled sharply tracking weak global equities, as rapidly-rising bond yields continue to weigh on the sentiment. Bets for more Fed rate hikes continue to boost bears’ confidence ahead of Jerome Powells’ speech at the annual Jackson Hole Symposium event,” said Prashanth Tapse, senior VP (research) at Mehta Equities.

Tapse sees a possibility of a massive sell-off in the domestic market amid deteriorating technical and fundamental catalysts that are denting sentiments.

The market is also expected to react to the upcoming annual general meeting of Reliance Industries on (August 28).

Besides, India’s Q2 GDP and Purchasing Managers’ Index (PMI) data in the coming week, along with cues from China, foreign investor activities, and fluctuations in the dollar index and US bond yields, will play a pivotal role in shaping market dynamics throughout the week, said Santosh Meena, head of research at Swastika Investmart.

Now, let’s take a detailed look at the performance of some of the new-age tech stocks this week.

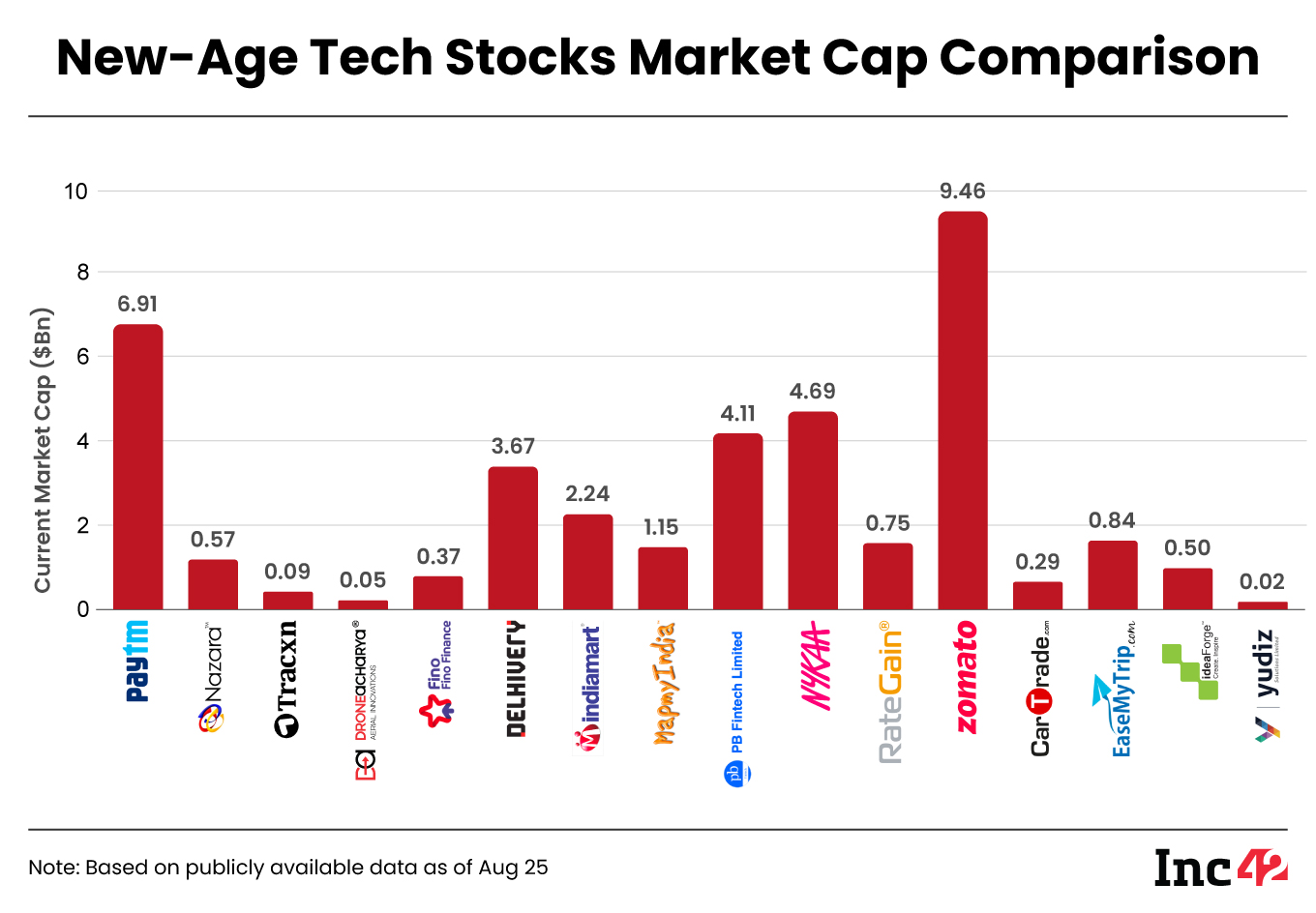

The 16 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $36.36 Bn as against $34.45 Bn last week.

Ant Group Offloads 3.6% Stake In Paytm

Antfin (Netherlands) Holding B.V. sold 2.27 Cr shares or 3.6% stake of Paytm worth over INR 2,037 Cr on Friday.

The latest share offloading came shortly after Antfin transferred 10.3% Paytm stake to founder Vijay Shekhar Sharma’s Resilient Asset Management via an off-market transaction.

At the end of the June quarter, Antfin held 15.09 Cr shares or 23.79% stake in Paytm.

Paytm shares saw a major jump mid-week, however, it ended Friday’s trading session in the red at INR 899.3 on the BSE. Overall, Paytm shares rose 4.6% this week.

It is pertinent to note that Paytm also published its annual report for FY23 this week in which CEO Sharma informed stakeholders about the company’s intention to disrupt the small mobile credit market in the country.

“By helping enable digital loan collection on app, we are now creating a small revolution for financial inclusion, where a loan of as small as a few hundred rupees can be disbursed and collected at very minuscule cost,” Sharma said.

Following a significant rally in its shares in the last few months, the shares of the fintech major have gained almost 70% year to date (YTD).

Rupak De, senior technical analyst at LKP Securities, said Paytm is currently in an uptrend and the support for the stock is at INR 880.

“If it sustains above INR 880, then the uptrend might continue. Else, there could be some consolidation,” De said, adding that the overall trend is sideways to positive.

The target for the stock in the medium term is INR 1,160 and it is INR 1,000 for the short term, he said.

EaseMyTrip Biggest Winner

After a significant downfall since last month, shares of traveltech giant EaseMyTrip regained momentum this week. Its shares jumped 7.3%, ending Friday’s session at INR 40.1 on the BSE.

It is pertinent to note that EaseMyTrip was the second-biggest loser among the new-age tech stocks last week, with its share nosediving 7.5%. Its shares were largely hurt by Q1 results where it reported a decline in profit.

However, this week, the stock gained in three consecutive sessions to emerge the biggest winner.

LKP Securities’ De said that the stock is facing a near-term resistance at INR 42, which, if cleared, would make it rally towards INR 48 in the short term.

EaseMyTrip’s support lies at INR 38, he added.

While most of the new-age tech stocks have bounced back this year after the sharp falls in 2022, shares of EaseMyTrip are trading 24% lower YTD.

Zomato’s Monetisation Experiments

Almost a month After Zomato started levying a platform fee of INR 2 per order for select users, the foodtech major increased the fee to INR 3 for some users in Tier II cities this week.

While the fee was initially levied only on select users, the company told Inc42 that it would ultimately be applicable to all customers. However, the development is currently in the experiment stage.

It must be noted that Zomato has been trying and testing different ways to increase its revenue. It also became profitable in the June quarter of FY24.

Meanwhile, the lock-in period for investors who received Zomato shares following the Blinkit deal in August last year ended this week. As per reports, SoftBank is now looking to offload its shares in the company via block deals and book profit.

Shares of Zomato slumped 3% on Friday alone, ending the week at INR 90.94 on the BSE. However, the shares gained 1.7% this week.

The current support for the stock is at INR 88, said LKP Securities’ De. Till the time Zomato manages to sustain above this level, there is a chance that it will move towards INR 108-INR 110 in the short term.

However, if the stock goes below INR 88, it could tank further till INR 82, De added.