Shares of Nykaa plunged nearly 10% this week following its underwhelming Q1 results, while DroneAcharya emerged as the biggest winner following key business updates from the startup

New-age tech stocks saw a new addition this week, as blockchain and IT development startup Yudiz Solutions got listed at a 12% premium at INR 185 apiece on the NSE SME platform

In the broader market, Sensex fell 0.57% to 64,948.66 and Nifty 50 declined 0.61% to 19,310.15 this week

With the Q1 FY24 earnings season coming to an end, Indian new-age tech stocks succumbed to the weakness in the broader domestic and global equity markets and witnessed a significant slump this week.

A majority of new-age stocks, including Paytm, IndiaMart, Tracxn, Zomato, Cartrade Technologies, EaseMyTrip, and Nykaa, fell in a range of 0.1% and 10% this week. The decline in Nykaa and EaseMyTrip shares was largely driven by their Q1 financial results.

Nykaa also emerged as the biggest loser, declining 9.8% this week, hurt by its lower-than-expected quarterly earnings.

Despite pressure in the broader market, DroneAcharya, RateGain, ideaForge, Nazara Technologies, and PB Fintech rose this week, gaining in a range of 0.1% and over 5%.

DroneAcharya once again emerged as the biggest winner, with its shares zooming 5.5% on the BSE following several business updates from the startup. The drone startup said it has entered into a memorandum of understanding (MoU) with a leading university in the Philippines to provide drone pilot training and drone data processing training to the local government units of the country.

Besides, DroneAcharya also won a tender from the Karnataka State Remote Sensing Applications Centre (KSRSAC) under which it would supply various drone systems and provide drone pilot training courses to the staff of the Karnataka Forest Department.

On the other hand, Nazara’s gains this week were led by the announcement of its $500K investment in Israel-based game developer Snax Games.

Meanwhile, the list of new-age tech stocks saw a new addition this week, as blockchain and IT development startup Yudiz Solutions got listed at a 12% premium at INR 185 apiece on the NSE SME platform.

In the broader market, Sensex fell 0.57% to 64,948.66 and Nifty 50 declined 0.61% to 19,310.15 this week. The market was shut on August 15 on the occasion of Independence Day.

“World equity markets, including India, are under the grip of a sharp rise in US bond yields which has led to currency depreciation in China and other emerging markets. This has prompted investors to park their funds in safe haven dollar securities by exiting risky equity assets,” said Amol Athawale, VP of technical research at Kotak Securities.

He said the consolidation phase in local markets could continue for some more time as worries over further interest rate hikes in the US and other key economies, high inflation and slowing growth in China would curb appetite for equity as an asset class in the near term.

It must be noted that India’s CPI inflation surged to 7.44% in July from 4.87% in June, its highest level since April 2022.

Commenting on the outlook, Pravesh Gour, senior technical analyst at Swastika Investmart, said macroeconomic indicators, trends in global stock markets, and foreign institutional investors (FIIs) activities will be pivotal in shaping market trends in the coming days.

Now, let’s take a detailed look at the performance of some of the new-age tech stocks this week.

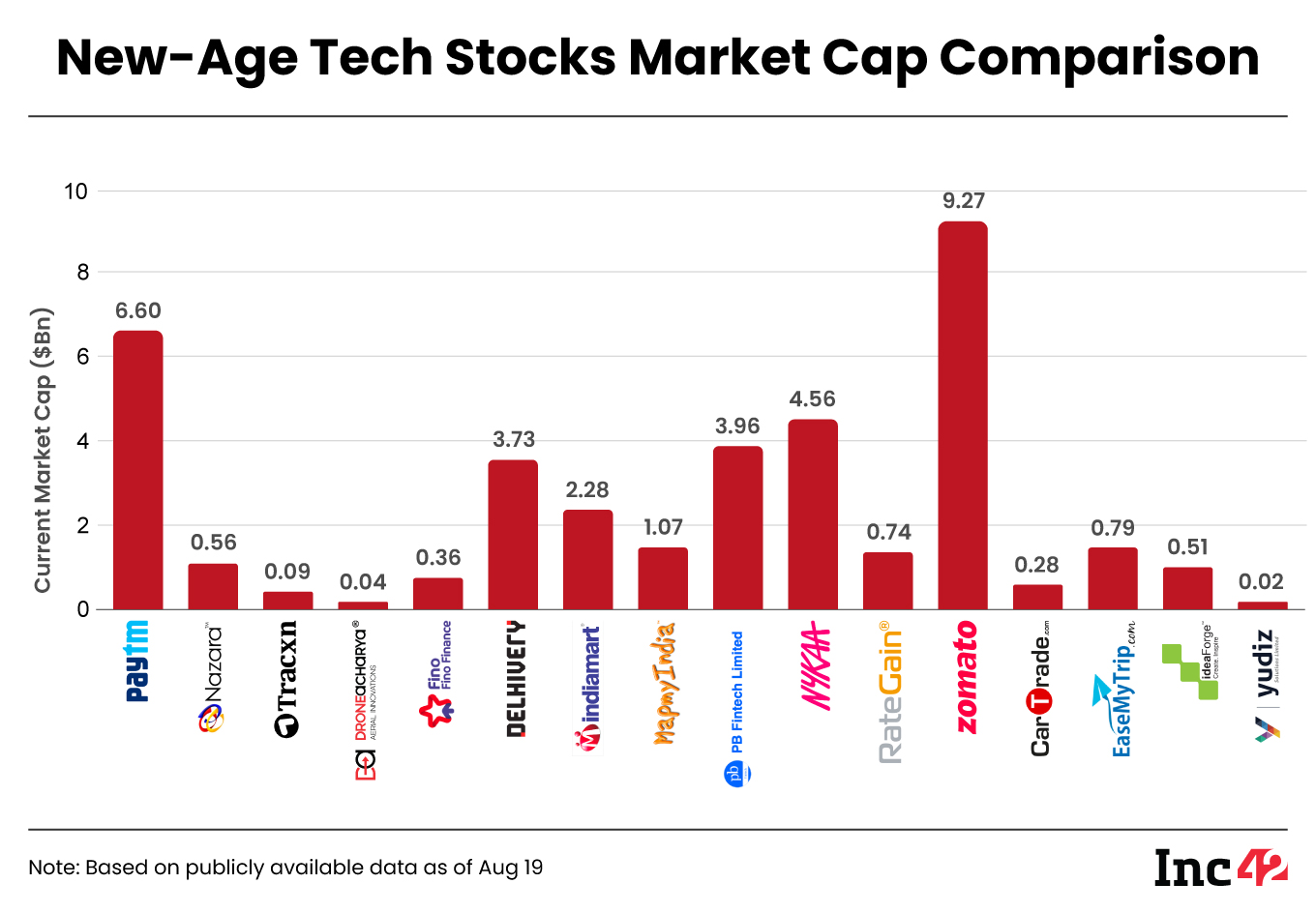

The 16 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $34.45 Bn as against 15 stocks ending last week at $34.96 Bn.

The Worst Is Still Not Over For Nykaa

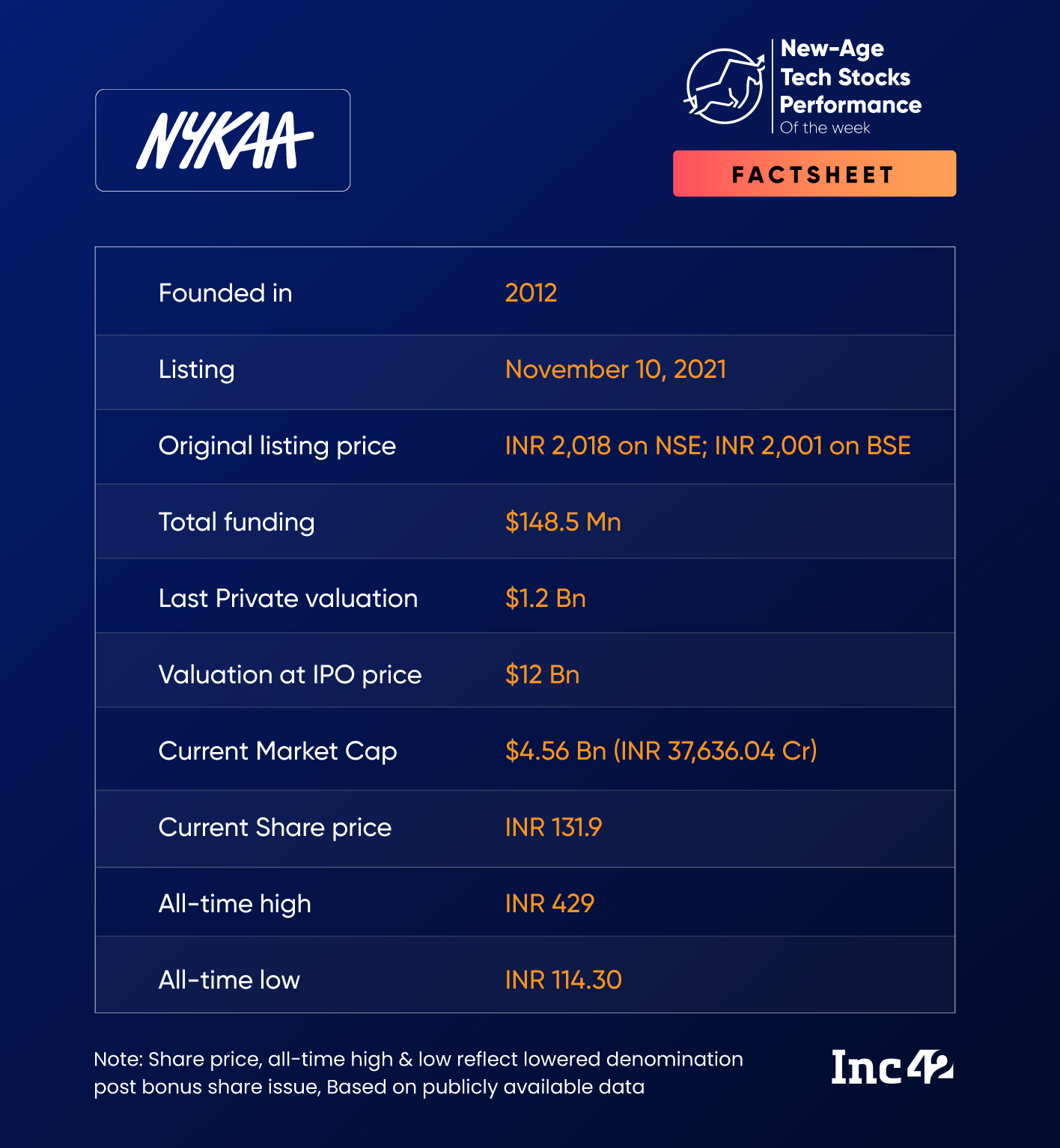

Helped by the improvement in market sentiment for new-age tech stocks, shares of Nykaa had been witnessing some improvement since May this year. However, its shares slumped once again this week, falling almost 10% on the BSE, as its Q1 FY24 earnings failed to cheer up investors.

The shares slumped to end the week at INR 131.9 on the BSE.

In The News For:

- Nykaa posted a net profit of INR 5.4 Cr in Q1, an 8.2% year-on-year (YoY) rise. While its beauty business continued to grow, Nykaa Fashion’s growth remained muted for another quarter.

- Nykaa will be excluded from the Nifty Next 50 and Nifty 100 indices from September 29.

- Brokerages remained divided on the stock after the Q1 results but the startup saw several price target cuts.

Commenting on the stock, Jigar S Patel, senior manager, technical research analyst at Anand Rathi, said that Nykaa is currently in a correction mode and it might fall further. The best price for buying the stock would be around INR 125-INR 127 level.

The stop loss for the stock is around INR 115 and the target is INR 160, he added.

Deep Discounts Hurt EaseMyTrip’s Bottom Line In Q1

Traveltech major EaseMyTrip on Monday (August 14) reported a 21.8% YoY decline in its profit after tax (PAT) to INR 25.9 Cr in Q1 FY24, which was also a 16% decline, sequentially.

The bottom line took a hit despite a 41.5% YoY jump in operating revenue to INR 124 Cr and the startup reporting a record quarterly gross booking revenue (GBR) of INR 2,371 Cr in Q1.

EaseMyTrip cited the discounts provided by it to its customers across segments from June 1-10, 2023 to celebrate its 15th anniversary as the reason for the fall in its profit.

Following the results, EaseMyTrip shares slumped 7.5% in the next three consecutive sessions in the week, ending Friday’s session at INR 37.36 on the BSE.

Anand Rathi’s Patel said that the stock looks a bit weak right now and might fall further till INR 30-INR 34 level, which would be the ideal price to buy the stock.

After this, the stock is expected to bounce back and might jump to INR 40-INR 41 in the coming weeks, he added.

RateGain Shares Touch A New All-Time High

Shares of RateGain have touched several record highs following its Q1 earnings, published last week. This week the stock touched an all-time high at INR 604.85 on Thursday (August 17).

Overall, the shares of the traveltech SaaS startup jumped 5.3% this week, making it the second biggest winner. It ended Friday’s session at INR 571.75 on the BSE as the shares fell 4.2% from Thursday’s close.

RateGain’s PAT almost tripled YoY to INR 24.9 Cr in Q1 FY24, while operating revenue jumped 79.8% YoY to INR 214.5 Cr.

Currently, RateGain is one of the few new-age tech stocks that is trading at a higher price than the listing price. Its shares are currently trading over 56% higher than their listing price.

However, Patel is of the opinion that it is not the right time to buy the stock. “Fresh buy will only get triggered around INR 520-INR 530 level,…from there, one can wait till the target of INR 620,” he said, adding that there is a possibility of a small correction till INR 520-INR 530.

Ad-lite browsing experience

Ad-lite browsing experience