The startup plans to use the fresh capital to expand its geographical footprint, grow the team across risk, engineering, analytics and sales, as well as scale up its loan portfolio

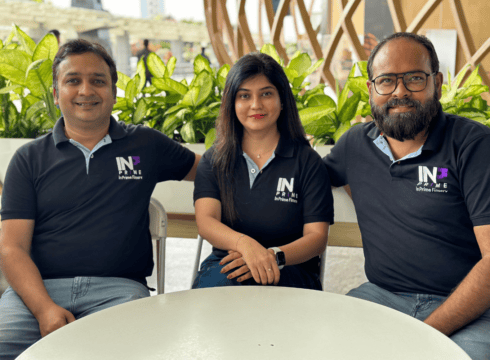

InPrime, founded by Rajat Singh, Manish Raj and Sneh Thakur in 2021, provides financial services to the country’s informal economy

Earlier, the startup secured $1.45 Mn in its seed funding from InfoEdge Ventures, Titan Capital, Kettleborough VC and other marquee investors

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Bengaluru-based non banking financial company (NBFC) InPrime Finserv has raised Series A funding of $3 Mn (around INR 24 Cr) led by Matrix Partners India.

Existing investors InfoEdge Ventures, Titan Capital and Kettleborough VC also participated in the round.

The startup plans to use the fresh capital to expand its geographical footprint, grow the team across risk, engineering, analytics and sales, as well as scale up its loan portfolio.

InPrime, founded by Rajat Singh, Manish Raj and Sneh Thakur in 2021, provides financial services to the country’s informal economy.

In April last year, the startup received certificate of registration (COR) from the Reserve Bank of India (RBI) to operate as an NBFC. Earlier, it has secured $1.45 Mn in its seed funding from InfoEdge Ventures, Titan Capital, Kettleborough VC and other marquee investors.

Its hybrid model, built on the ‘India Stack,’ integrates digital footprints from credit bureaus, bank accounts and other sources, along with comprehensive on-field assessments.

“With the ongoing digital revolution in India, our objective is to provide these customers with superior products and services, ushering in a technology-led financial inclusion 2.0 for informal economy customers at scale, “ Singh said.

Avnish Bajaj, founder and managing director, Matrix Partners India, said, “A core part of India’s economic growth is driven by small and medium businesses in the informal sectors of ‘Bharat’. InPrime’s objective of serving this sector with tailored products to help them be part of the $5 Tn and then $10 Tn Indian GDP is incredibly inspiring and necessary.”

Inc42’s analysis forecasts the domestic fintech market to reach a market size of $2.1 Tn by 2030, with a projected 18% CAGR from 2022. Within this, lending tech is anticipated to dominate, constituting the majority at $1.3 Tn.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.