This is the second debt issue by Navi, after having raised around INR 600 Cr in May 2022 in a public issue ahead of its IPO

The public issue of NCDs will offer up to five series of investment options with tenures of up to 36 months

The allocations for different categories stand at 20% for QIBs, 20% for corporates and 30% each for HNIs and retail individuals

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

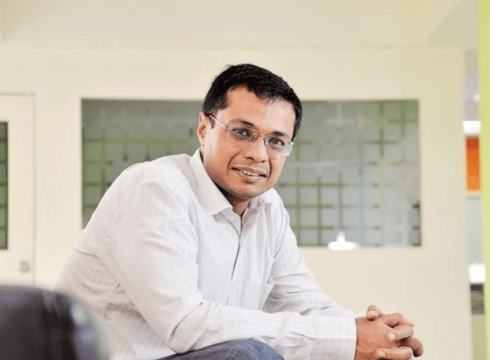

Sachin Bansal’s IPO-bound fintech unicorn Navi Finserv is going to raise up to INR 500 Cr through the public issue of Non-Convertible Debentures (NCDs). The issue opens on Monday (July 10), and the subscriptions will close on July 21, with an option for early closure.

This is the second debt issue by Navi, after having raised around INR 600 Cr in May 2022 in a sector-first move, as mentioned in its updated draft red herring prospectus (DRHP) last year.

The public issue of NCDs will offer up to five series of investment options with tenures of 18 months, 27 months, 27 months, 36 months and 36 months. The fintech unicorn said that the effective yields would be 10.18% per annum for the first series, 10.73% for the second series, 10.78% for the third series, 11.01% for the fourth series and 11.01% for the fifth series.

Further, the company said it would make coupon payments monthly, except for the third and fifth series, for which it will make annual payments. The allocations for different categories of investors stand at 20% for Qualified Institutional Buyers (QIBs), 20% for corporates and 30% each for High Networth Individuals (HNIs) and retail individuals.

The debentures issue is rated A Stable by the Credit Rating Information Services of India Limited (CRISIL) and India Ratings. JM Financials will be the Lead Manager for the issue.

Speaking on the fundraise, Sachin Bansal, cofounder of Navi Group, said, “Through our second public debt issue, we are looking to further diversify our borrowings profile, thereby reinforcing our commitment to serving our customers at scale, with greater agility and flexibility.”

Navi’s parent company Navi Technologies filed its DRHP in March 2022 to raise INR 3,350 Cr through an IPO. The entire fundraise will be a fresh issue, meaning Bansal, who has already invested around INR 4,000 Cr into Navi to date, will not dilute his stake in the IPO.

The IPO proceeds will be used to invest INR 2,370 Cr in Navi Finserv (NFPL) and another INR 150 Cr in Navi General Insurance Limited (NGIL). The rest of the amount will be allocated to general corporate purposes. Navi has not disclosed its IPO valuation yet, but the company is looking at $2-2.5 Bn, sources close to the developments told Inc42 earlier this year.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.