The fund will lead or co-lead funding rounds worth $25-$40 Mn in four to five growth-stage tech startups operating in the consumer internet and enterprise software space

Logistic SaaS startup Fareye, healthcare startup Ayu Health and tech infra startup Probo are some of the startups backed by it

It said that its portfolio companies have together raised more than $1 Bn to date

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Fundamentum Partnership has raised $227 Mn for its second fund to invest in Indian startups. The fund has been oversubscribed by $77 Mn from its initial corpus of $150 Mn.

The fund will write off cheques between $10 Mn and $15 Mn in growth-stage tech startups operating in the consumer internet and enterprise software space for a period of three to four years. It will also make follow-on investments in the selected startups.

In addition, the fund will lead or co-lead funding rounds worth $25-$40 Mn in four to five growth-stage tech startups every year.

“The second fund is significantly oversubscribed. We plan to continue the same strategy as used in Fund I – investing in tech-driven enterprises from India. We like to back missionary entrepreneurs who have an unwavering focus on customer experience,” said Sanjeev Aggarwal, cofounder and general partner of Fundamentum.

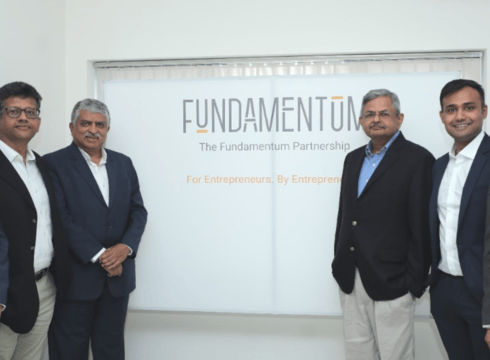

Founded in 2017 by industry veterans Nandan Nilekani and Sanjeev Aggarwal, Fundamentum is a tech-focussed investment firm. Besides investing in startups, the VC company also provides mentorship to startups. Logistic SaaS startup Fareye, healthcare startup Ayu Health and tech infra startup Probo are some of the startups backed by it.

Fundamentum initially had a corpus of $100 Mn which was extended to $200 Mn. It primarily participates in $10Mn to $25 Mn fundraising rounds, according to its LinkedIn profile.

“Digital acceleration has dramatically increased technology spending across the world. India has all the ingredients in place—capital, entrepreneurs, stories of success, and liquidity. In this decade, we will see entrepreneurs making a material impact on the country at scale as the digital intensity of society increases,” Nilekani said.

Fundamentum’s first fund invested in early-stage to growth-stage startups including PharmEasy and Spinny that entered the unicorn club. Its portfolio companies have together raised more than $1 Bn, according to the statement.

A slew of other venture capital funds has also been set up in recent times. Flipkart Ventures’ $100 Mn fund, All In Capital’s $10 Mn fund, Cactus Venture Partners’ maiden fund and Stride Ventures’ second fund are some of the newly launched VC funds.

Interestingly, Fundamentum’s second fund, which will back growth-stage Indian startups, has launched at a time when growth-stage startups have lost their luster in the business ecosystem. At the moment, several growth-stage startups are striving hard for survival owing to unfavorable market conditions.

Besides this, investors also seem reluctant to back growth-stage startups and are instead closely scrutinising these startups and asking them to yield profits.

In such a scenario, industry players such as Ola, Meesho, Unacademy and Cars24, among others are adopting cost-cutting measures to trim expenses. Pivoting the business is another business strategy that is commonly used to keep the wheels turning.

_________________________________________________________________________________

Update|19th July, 4.30 PM

The story has been updated to include details of Fundamentum’s fund

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.