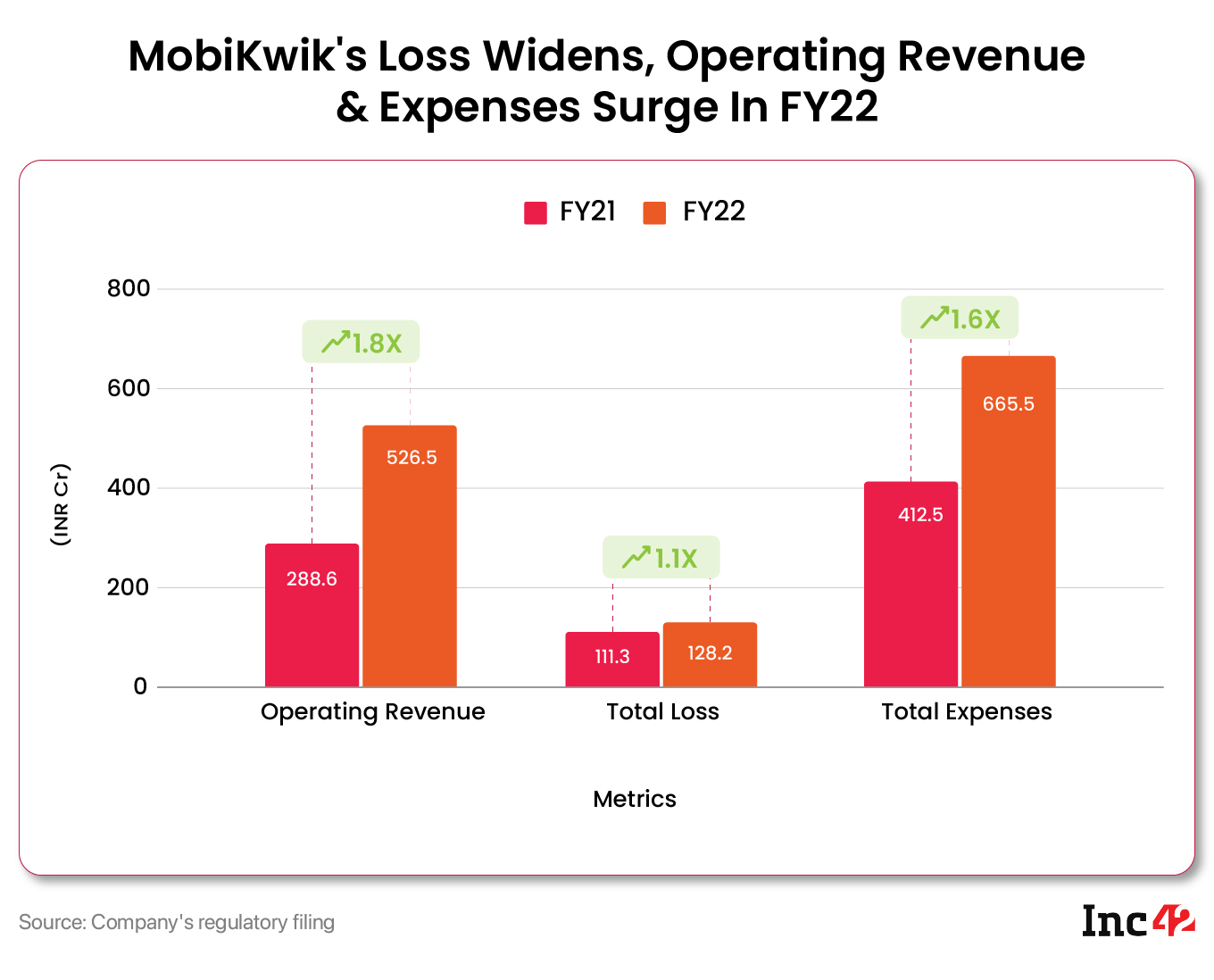

This continues MobiKwik’s streak of growing losses since FY20 when it reported a loss of INR 99 Cr and a loss of INR 111 Cr in FY21

The Gurugram-based startup has plans to get listed in the Indian bourses in 2022, but has shelved the IPO till market volatility clears

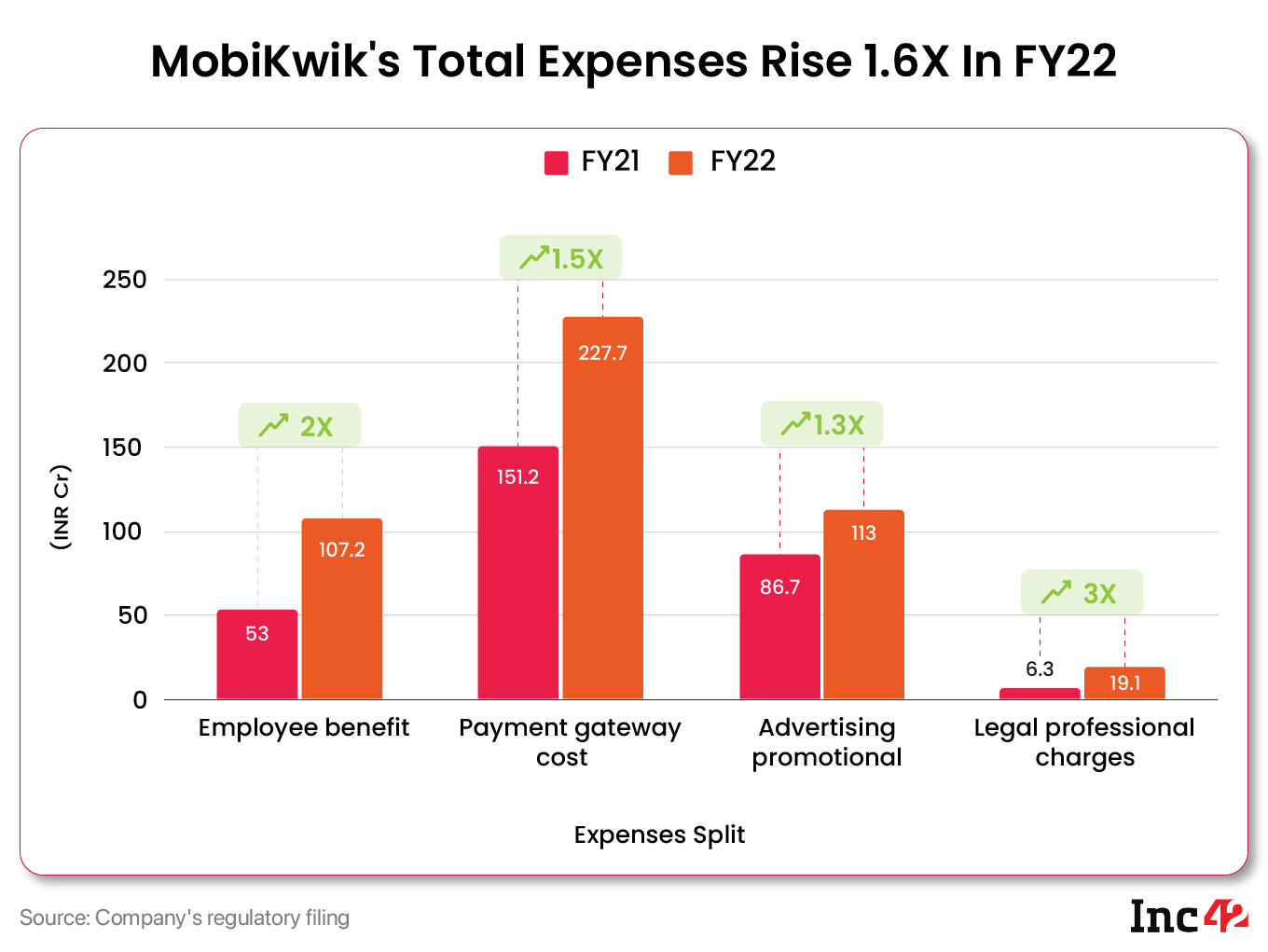

MobiKwik’s total expenses in FY22 shot up by over 61% YoY to INR 665.5 Cr with payment gateway costs contributing a significant 34% to the overall costs

Fintech unicorn MobiKwik, which has reportedly put its INR 1,900 Cr IPO plans on hold, has widened its consolidated losses by roughly 15% in the fiscal year 2022 (FY22) at INR 128.2 Cr as against a loss of INR 111.3 Cr in the prior fiscal year.

This continues MobiKwik’s streak of growing losses since FY20 when it reported a loss of INR 99.1 Cr.

The rise in FY22 losses came despite a 1.8X jump in operating revenue. MobiKwik saw its operating revenue grow to INR 526.5 Cr in FY22 as against INR 288.6 Cr reported in FY21.

As per its filings, the revenue is earned through commission income from sale of recharge, bill payments and merchant payments; fees for money transfer service from user’s wallet to bank account; revenue from share in interest income, processing fee and servicing of loans; revenue from technology platform services; income from payment gateway services and income from advertisement/sale of space.

It is not clear which of these services brought in the most revenue for the company. In FY21, the bulk of the revenue was contributed by the payments gateway business (Zaak Epayment Services Private Ltd), which brought in INR 159 Cr in revenue in FY21. But the standalone FY22 numbers are not available.

Where MobiKwik Spent In FY22

Founded in 2009, MobiKwik joined the much-celebrated unicorn club in October 2021 after some of its employees exercised their employee stock option plans (ESOPs). In June 2021, MobiKwik also raised $20 Mn from the United Arab Emirates (UAE) sovereign wealth fund Abu Dhabi Investment Authority.

The startup was also planning to get listed in the Indian bourses in the same year.

However, after Paytm’s lacklustre market debut, MobiKwik has stalled its IPO plans and is still waiting for the right time.

MobiKwik’s total expenses in FY22 shot up by over 61% YoY to INR 665.5 Cr with payment gateway costs contributing a significant 34% to the overall expense.

The startup, which provides various financial services including buy now pay later (BNPL), insurance, gold loans, among others, saw its payment gateway costs rise to INR 227.7 Cr from INR 151.2 Cr reported in FY21.

MobiKwik also spent a significant INR 113 Cr in advertising and promotional expenses in FY22 versus INR 86.7 Cr spent in this bucket in FY21.

Despite several challenges for tech startups in late 2021 and in the first few months of 2022 which led to downsizing and layoffs, MobiKwik increased its employee benefit expenses in FY22. The fintech startup’s expenditure in this bucket more than doubled to INR 107.2 Cr in FY22 from INR 52 Cr spent during FY21.

Besides, as a BNPL and loan services provider, MobiKwik had to spend INR 91 Cr in financial guarantee expenses in the year as against INR 58.4 Cr spent during FY21.

If its lending business continues to become a major portion of the revenue, this particular cost component would continue to rise.

It is pertinent to note that MobiKwik’s decision to stall its IPO coincides with similar developments at several other tech startups such as OYO, boAt, Snapdeal, Pine Labs and others. Most recently, Droom has withdrawn its IPO plans amid market volatility.

MobiKwik’s postponement of the IPO can also be studied in light of the current stock market performance of the other newly listed Indian tech startups. From Paytm to Policybazaar, Nykaa to Zomato, a majority of these startup stocks are down in the range of 40%-60% currently, compared to their listing prices.

In fact, MobiKwik’s unlisted shares had to also bear the brunt of the bearish sentiment as its share price had significantly declined in the grey market just after Paytm’s listing and subsequent decline.

After postponing the IPO plans, MobiKwik recently raised INR 55 Cr in debt from VC firm BlockSoil and alternate investment fund Karnation in a funding round.

However, now all eyes will be on whether the 13-year-old fintech startup can finally snap its loss-making streak ahead of a potential second tilt at the public markets.

Ad-lite browsing experience

Ad-lite browsing experience