Meesho’s board passed a special resolution to issue 65,12,342 equity shares to Meesho Inc at an issue price of INR 2,408 per share

Meesho said that its flagship ‘Mega Blockbuster Sale’ clocked about 3.34 Cr orders this year, witnessing nearly 60% YoY growth in transacting users

In September last year, the social commerce startup raised $570 Mn in a funding round led by Fidelity Management and B Capital Group

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Social commerce startup Meesho has received $192 Mn from its parent entity, Meesho Inc amid the festive season sale.

Meesho had last raised $570 Mn in a funding round led by Fidelity Management and B Capital Group in September 2021.

As per the startup’s regulatory filings with the Ministry of Corporate Affairs, Meesho’s board passed a special resolution to issue 65,12,342 equity shares to Meesho Inc at an issue price of INR 2,408 per share, translating to a total amount of INR 1,568.17 Cr ($192 Mn), on September 9.

“The internal movement of funds is a part of our larger treasury strategy as aligned with our Board and is a normal BAU practice. This is not related festive season or any other aspect of our operations,” said Meesho in an official statement.

The infusion of funds took place ahead of the start of the festive season sale which plays a crucial role in driving the yearly sales of all ecommerce companies. The festive sales of Meesho, Amazon and Flipkart began last week.

Meesho, in a separate statement on Thursday, said that its flagship ‘Mega Blockbuster Sale’ clocked about 3.34 Cr orders, witnessing nearly 60% growth in transacting users year-on-year (YoY).

In fact, the overall ecommerce sales are seeing an uptrend this year during the festive season. Earlier this week, consulting firm Redseer said that ecommerce platforms in India recorded sales worth INR 24,500 Cr ($3.5 Bn) during the first four days of this year’s festive season sales, up almost 1.3X compared to last year.

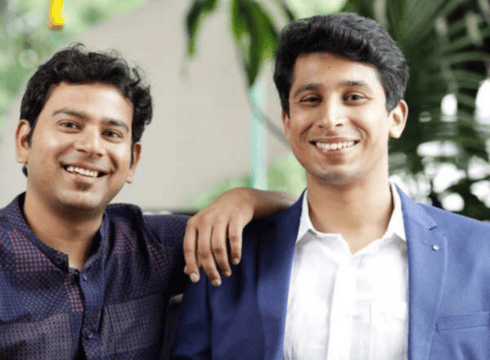

Founded in 2015 by Vidit Aatrey and Sanjeev Barnwal, Meesho is an online reseller network for small and medium businesses (SMBs). Started with the aim to challenge the duopoly of Amazon India and Flipkart in India, Meesho’s marketplace today provides small businesses access to millions of customers.

In fact, stating how ecommerce giant like Amazon is falling behind new-age social commerce startup Meesho, brokerage firm Bernstein recently said, “Newer players like the Softbank-funded Meesho ($5 Bn GMV) are winning the faster growing Tier 2/3 cities where Amazon has struggled to gain traction given low pricing and ‘zero commissions’.”

As per various reports, Meesho is currently eyeing an IPO in the next two years. However, it continues to be a loss-making entity.

While Meesho hasn’t reported its financials for FY22 yet, its net loss widened 62.5% to INR 498.6 Cr in FY21 from INR 306.6 Cr reported in FY20. On the other hand, its revenue from sales stood at INR 792.8 Cr during the year, a 2.5X increase from INR 306.9 Cr witnessed in FY20.

The development was first reported by Entrackr.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.