Following its lacklustre September quarter earnings, travel tech platform Yatra emerged as the biggest loser this week, falling 6%

Eight new-age tech stocks gained during the week, with Nykaa becoming the biggest winner, up almost 12%

Meanwhile, other gainers during the week included MapmyIndia (up about 9%), RateGain (up over 8%), Mamaearth (up almost 4%), and Zaggle and PB Fintech (both up over 7%)

Amid the ongoing market volatility, a majority of Indian new-age tech stocks slumped this week. Of the 19 new-age tech stocks under Inc42’s coverage, as many as 11 stocks fell in a range of 0.1% to 6% on the BSE this week.

Shares of travel tech platform Yatra plunged 6%, becoming the biggest loser of the week. The fall in the stock price came on the back of its not-so-appealing September quarter (Q2) results released during the week.

Meanwhile, of the remaining new-age tech stocks that gained during the week, Nykaa emerged as the biggest winner, up almost 12%.

It must be noted that this week’s performance of stocks also includes the one-hour special Muhurat trading on the day of Diwali (November 12).

Meanwhile, other gainers during the week included MapmyIndia (up about 9%), RateGain (up over 8%), Mamaearth (up almost 4%), and Zaggle and PB Fintech (both up over 7%).

In the broader market, benchmark indices Sensex (up 1.37%) and Nifty50 (up 1.58%) ended the week at 65,794.73 and 19,731.8, respectively.

After witnessing a rally earlier in the week, the market closed in the red as selling in financial and banking stocks dragged the market following the RBI tightening norms on personal loans.

Speaking on the broader market performance this week, Dr Joseph Thomas, head of research at Emkay Wealth Management said that the surge earlier in the week was the result of lower inflation numbers and the consequent expectations of a longer pause in the central bank rate action. The fall in oil prices in international markets also facilitated better markets.

“The fall in the Bank Nifty occasioned by the tightening of the risk weightage norms for banks and NBFCs to curtail the unrestricted growth in unsecured loans resulted in a rather damp trading to close the wee,” he said.

Meanwhile, several analysts opined that global uncertainties would continue to influence the domestic market in the coming weeks.

This week had four trading sessions with Tuesday (November 14) being a holiday on the occasion of Diwali Balipratipada.

Now, let’s dig deeper into the performance of some of the major new-age tech stocks this week.

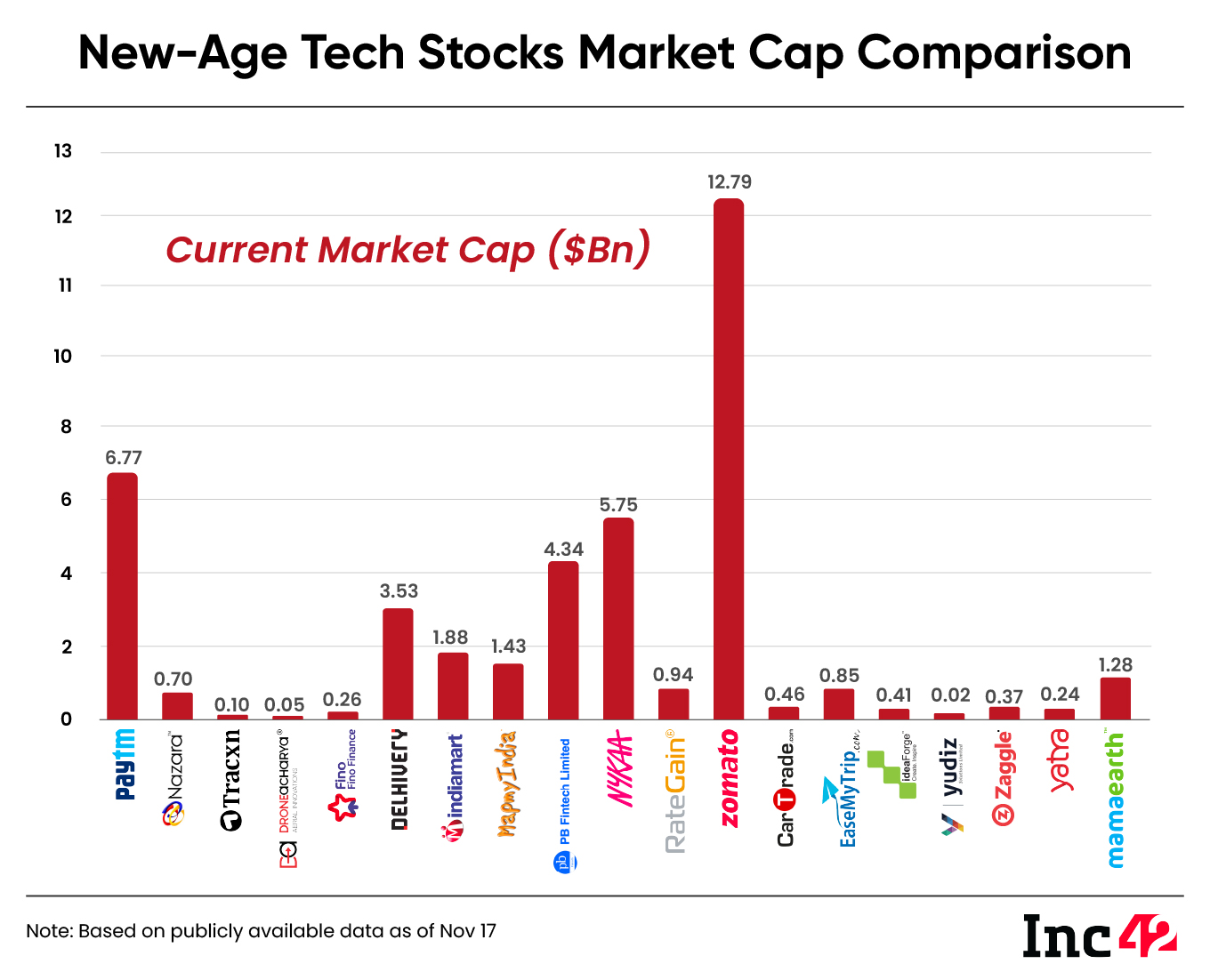

The total market capitalisation of the 19 new-age tech stocks under Inc42’s coverage stood at $40.56 Bn at the end of this week as against $40.45 Bn last week.

Yatra Becomes The Biggest Loser After Slipping Into Loss In Q2

Shares of Yatra slumped sharply in two consecutive sessions following the release of its Q2 FY24 results on Tuesday. The stock fell 6.3% in the two sessions but ended the week in the green.

Overall, the stock was down 6%, making it the biggest loser this week.

It is pertinent to note that Yatra Online posted a consolidated net loss of INR 17.1 Cr in Q2 versus a net profit of about INR 6 Cr in Q1 FY24.

On a year-on-year (YoY) basis, the loss surged about 11X while revenue increased only 14% YoY to INR 94.1 Cr.

The company continues to remain under pressure despite a rebound in the global as well as domestic travel market.

Yatra was listed on the Indian stock exchange in September this year at a discount against an issue price of INR 142. The stock was listed at INR 127.50 on the NSE and INR 130 on the BSE.

Currently, Yatra’s shares are trading at INR 130.55 on the BSE, marginally above its listing price.

SoftBank Ditches Delhivery Yet Again

SoftBank’s SVF Doorbell (Cayman) Limited offloaded 2.49% of its stake worth INR 738.6 Cr in the logistics unicorn on Friday (November 17) in a bulk deal, leading to a sharp decline in Delhivery’s stock price on the day.

Shares of Delhivery rose 1.5% during the week but slumped 3.5% on Friday, ending the week at INR 399.8 on the BSE.

As of the quarter ended September 2023, SVF held 10.6 Cr shares of Delhivery or a 14.46% stake in the company. In the new bulk deal, SVF offloaded 1.8 Cr shares of the logistics major.

Notably, the Japanese tech conglomerate sold 2.8 Cr Delhivery shares worth INR 954.2 Cr in March as well.

On the back of a surge in the share price, Delhivery added to SoftBank’s gains. As of June 30, 2023, its gains from the company stood at $259 Mn.

Shares of the logistics unicorn are currently training almost 21% higher year-to-date (YTD).

In Q2 FY24, Delhivery’s net loss narrowed 59.5% YoY of INR 102.9 Cr.

Reiterating its price target (PT) of INR 500 and a ‘buy’ rating on the stock, ICICI Securities, in a recent research report, noted that any volatility in the stock price would be a good opportunity to enter.

The brokerage also believes that, from Q3 FY24, there would be a reversion to Delhivery’s adjusted EBITDA profitability on a sustainable basis, given ecommerce shipment volumes trending upwards again after a lull of a year.

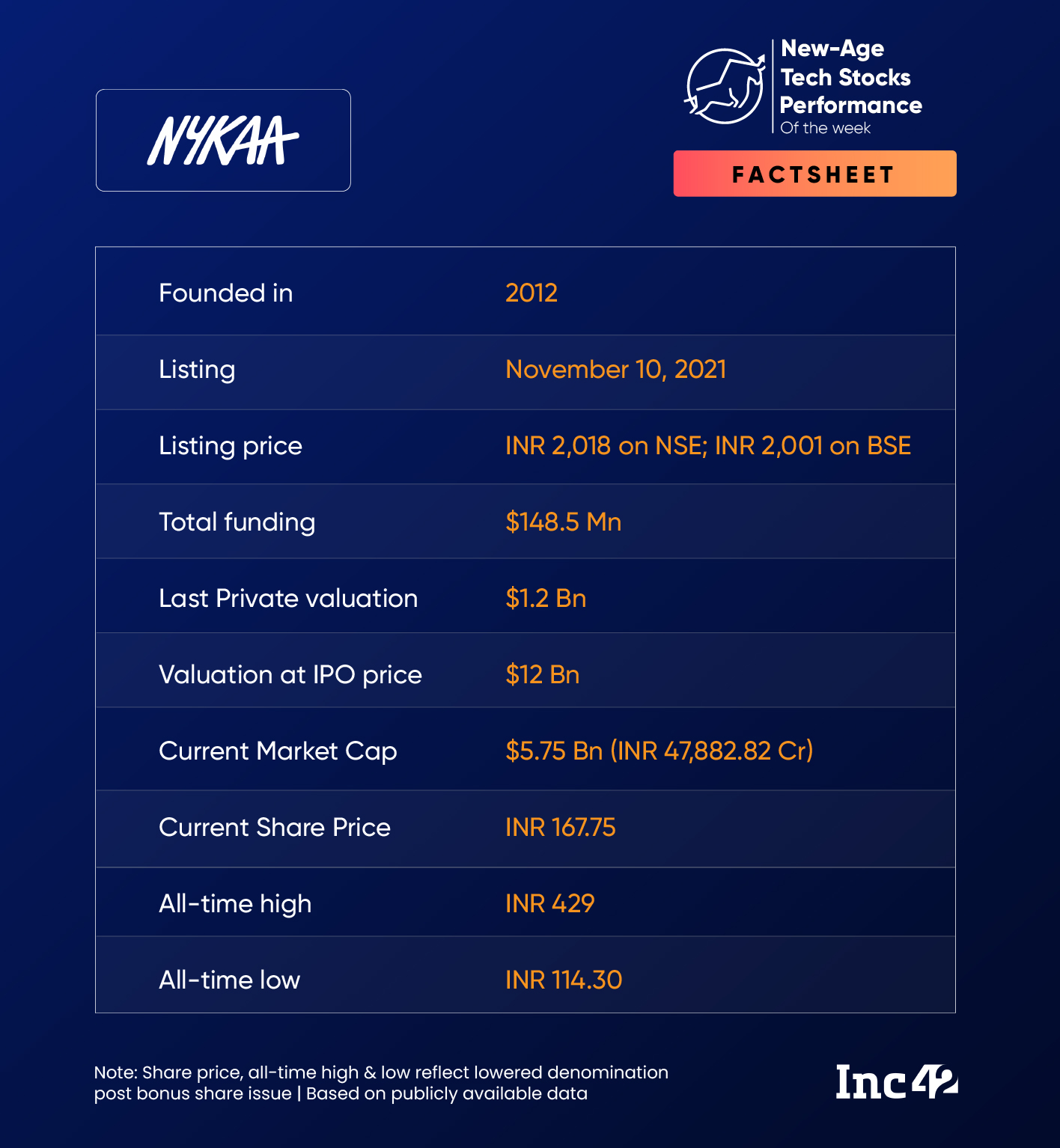

Nykaa At A Level Last Seen In December 2022

Shares of Nykaa rallied in all four sessions this week, rising 11.9% on the BSE. On Friday alone, the stock saw a sharp jump of 9.5%, ending the week at INR 167.75 on the BSE, a level last seen in mid-December last year.

While it is not clear what led to the sudden spike, we must note that the stock has been witnessing an uptrend since last week after it reported September quarter earnings with a 50% YoY rise in profit to INR 7.8 Cr.

Meanwhile, brokerage firm Geojit Research published a research note on Nykaa on Friday, upping its PT to INR 165 from INR 149 earlier.

“We believe, in the long run, Nykaa’s persistent efforts to build a client base, foster collaborations with new companies and expand offline and online operations will boost the profitability,” the brokerage said.

However, Geojit also believes that Nykaa’s rising costs due to investments in technology and infrastructure facilities, along with increased media spending for branding, would keep expenses high and impact the company’s operating performance in the medium term.

Following the jump this week, Nykaa has started trading in the positive zone this year, with its shares trading 8.4% higher YTD.

Ad-lite browsing experience

Ad-lite browsing experience