The round also saw participation from a host of angel investors including Acko,1mg and Clovia's cofounder's

Startup plans to use the fresh capital to improve its existing tech stack, team expansion and scaling up its asset under management

LoanKuber uses technology to access essential financial services and offer mortgage-based financing solutions to small and medium-sized enterprises

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Fintech startup LoanKuber has raised Pre-Series B funding of $3.5 Mn (around INR 29.4 Cr ) co-led by Inflection Point Ventures and TRTL VC in a mix of debt and equity infusion.

The round also saw participation from Auxano, LetsVenture, Mavuca Capital as well as angel investors, including Acko’s cofounder Ruchi Deepak, 1mg’s cofounder Prashant Tandon and Clovia’s cofounder Pankaj Vermani.

The Delhi-based startup plans to use the fresh capital to improve its existing tech stack, team expansion and scaling up its asset under management.

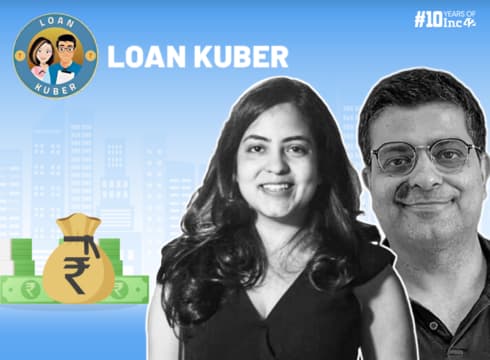

Founded by Saurabh Nagpal and Saumya Nagpal in 2018, LoanKuber uses technology to access essential financial services and offer mortgage-based financing solutions to small and medium-sized enterprises.

“We are grateful to our investors for their unwavering trust and support throughout our journey that has been instrumental in our progress so far. The social sector is complex, and driving meaningful change in underserved communities requires more than just financial resources. it demands a deep understanding of the unique challenges these communities face,” said Saurabh Nagpal.

The startup aims to build an AUM of INR 180 Cr in the next 12 months.

LoanKuber competes against the likes of NAKAD, LendingKart and KredMint.

India’s fintech space has been gaining a lot of traction from a host of investors.

For instance, in July Hyderabad-based fintech startup Validus Fintech Services secured an undisclosed capital as a part of its seed funding round from AUM Ventures and a clutch of strategic investors.

In the same month healthcare-focused fintech startup Care.fi secured debt funding of $2.6 Mn (around INR 21 Cr) from Trifecta Capital and UC Inclusive Credit for business expansion and talent acquisition.

Similarly in March, fintech startup FREED raised INR 60 Cr ($7.5 Mn) in its Series A funding round led by Sorin Investments and Multiply Ventures to expand its reach and improve technology.

As per Inc42 report, the fintech ecosystem’s lending space stood at more than $270 Mn in FY22, making it the fastest growing segment.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.