Lendingtech and insurtech will lead the fintech ecosystem with a total market opportunity of $955 Bn, according to an Inc42 report

The two segments currently have six unicorn startups and 18 soonicorns

Unfulfilled credit needs, low insurance penetration and increasing awareness are some of the factors which will drive growth in the two sectors

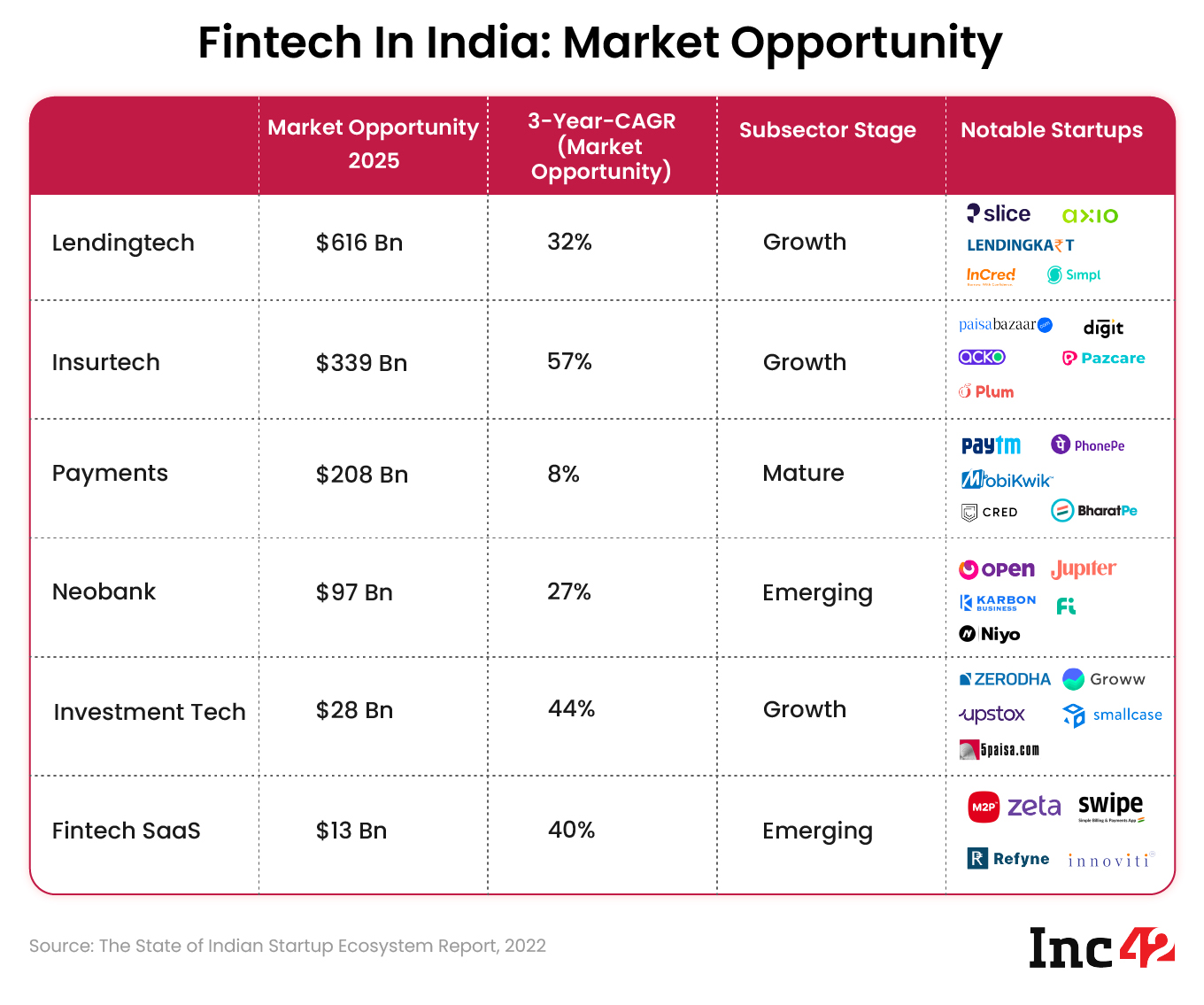

Fintech is the largest ecosystem within the overall Indian startup ecosystem, producing the second-highest number of unicorns and most soonicorns. India’s fintech market opportunity is expected to reach $1.3 Tn by 2025. Within this market opportunity, lendingtech and insurtech are poised to have the largest share at a combined 73%, according to Inc42’s ‘The State of Indian Startup Ecosystem Report, 2022’.

Lendingtech and insurtech will lead the fintech ecosystem over the next few years, with a total market opportunity of $955 Bn. Lendingtech and insurtech are also the fastest-growing subsectors within the fintech landscape, expected to grow at a CAGR of 32% and 57%, respectively, between 2022 and 2025.

While there are several reasons for the two subsectors providing the most prominent market opportunities for current and future fintech startups, the low penetration of these services within India is the most significant growth driver.

India’s Thirst For Credit

At Inc42’s Fintech Summit 2022, Zerodha founder and CEO Nithin Kamath said that lending is one of the biggest opportunities in fintech because of the demand for credit in India.

“That is a large opportunity; most people in the country don’t have sufficient money. How someone will underwrite this risk is a secondary issue, but that is a large TAM (total addressable market),” the Zerodha CEO said.

One of the most curious cases in digital lending is credit cards. According to data from the Reserve Bank of India (RBI), the penetration rate of credit cards in the country stands at only 5.55%, which is just 77 Mn credit cards in a country of 1.4 Bn people.

The MSME segment is also very important for the B2B digital lending players. A report by the International Finance Corporation (IFC) noted that 85% of MSMEs remain underserved in terms of credit. Further, only 20% of these financing gaps were fulfilled by formal credit.

The IFC report added that the total demand for finance in the MSME sector stood at INR 87.7 Lakh Cr ($1.4 Tn). Of this, INR 69.3 Lakh Cr was credit demand and the rest was demand via equity. The demand-supply gap is driving the growth of B2B lendingtech startups, with two unicorns in the segment already.

A huge demand, coupled with an underserved population, will see lendingtech’s TAM reach $616 Bn by 2025, almost double than that of second-placed insurtech.

From the perspective of the startup ecosystem, there are three lendingtech unicorns – Yubi (formerly CredAvenue), OneCard and Oxyzo. There are also 15 soonicorns from the lendingtech subsector, translating to almost 50% of the total 33 soonicorns from fintech, according to Inc42 data.

While two of the three digital lending unicorns serve enterprise customers, the latest addition of OneCard is proof of the increasing demand for personal credit, be it credit cards or loans.

Government Intervention Strengthening The Sector

Without clarity on regulations, it’s the customer who suffers. As per the findings of the working group for digital lending (WGDL), set up by the RBI, as many as 600 out of the 1,100 lending apps available for Indian Android users across 80 application stores were illegal.

Most fake apps also have links to foreign entities and are being investigated on money laundering charges. Innovations in emerging sectors like digital lending are critical, and startups are innovating with new products and services. However, government intervention ensures that the customers are protected.

Recently, the RBI issued the much-awaited guidelines for digital lending, which further cleared up the regulatory hurdles around the same. The regulations are likely to increase the cost of credit, but will also develop more customer trust in the system and introduce more transparency, ultimately protecting the customers.

Before that, the RBI prohibited non-bank PPI issuers from loading prepaid payments instruments (PPIs) using credit lines, which threw several fintech startups such as slice and Jupiter Edge into disarray. Soon thereafter, Uni also relented, suspending its 1/2 and 1/3 Cards for the time being.

Under its Payments Vision 2025, the RBI has proposed several changes to the payments ecosystem, including merchant discount rate (MDR) considerations.

Recently, the central bank also floated a discussion paper seeking views on changes in charges for payment systems, including the popular UPI. However, the discussion on charging UPI transactions created a furore, following which the Ministry of Finance clarified that there is no plan to levy charges on UPI transactions.

Increasing Awareness Of Insurance Among Indians

As per the Insurance Regulatory and Development Authority’s (IRDAI’s) data, only around 4.2% of Indians had insurance in FY21. However, the insurance regulator estimates that insurance premiums will rise rapidly over the next 10 years, with life insurance premiums reaching INR 24 Lakh Cr ($317.98 Bn) by FY31.

At the same time, insurtech is the fastest-growing segment in the fintech ecosystem. According to Inc42 data, insurtech is growing at a CAGR of 57%. This means that between 2021 and 2025, the market opportunity for insurtech will increase by 6X.

India currently has three insurtech unicorns – Digit Insurance, Acko and PolicyBazaar. While the number is the same as lendingtech, the latter subsector leaves insurtech in the dust in terms of future unicorns. Turtlemint is the only insurtech soonicorn compared to 15 lendingtech soonicorns.

India’s low insurance penetration, along with a post-COVID rise in awareness related to having life or health insurance, has helped insurtech startups record rapid growth. Further, insurance companies have developed a digital ecosystem, making buying insurance easy for customers.

Startups are also curating innovative insurance products for customers to suit their needs, with better underwriting solutions and have higher reach in Tier 2+ cities. All of these factors have seen insurtech emerge as a lucrative fintech subsector for starting up.

Fintech Has The Biggest Market Opportunity

Removing digital lending and insurance, the remaining 27% of the market opportunity in the fintech sector is shared between fintech SaaS, payments, neobanking and investment tech. The fintech ecosystem’s total market opportunity at $1.3 Tn by 2025 will leave behind the likes of ecommerce, edtech and consumer internet.

Generally, Indians trust established organisations with money-related matters, be it insurance, investments or credit. However, with Indian startups curating better and more flexible products for the digital population, it is easy to see why fintech represents such a lucrative market opportunity.

While the occasional regulatory changes by the authorities to protect consumer interest will create some hurdles for the startups in the fintech sector, those who can overcome them are most likely to succeed given the big market opportunity.

Ad-lite browsing experience

Ad-lite browsing experience