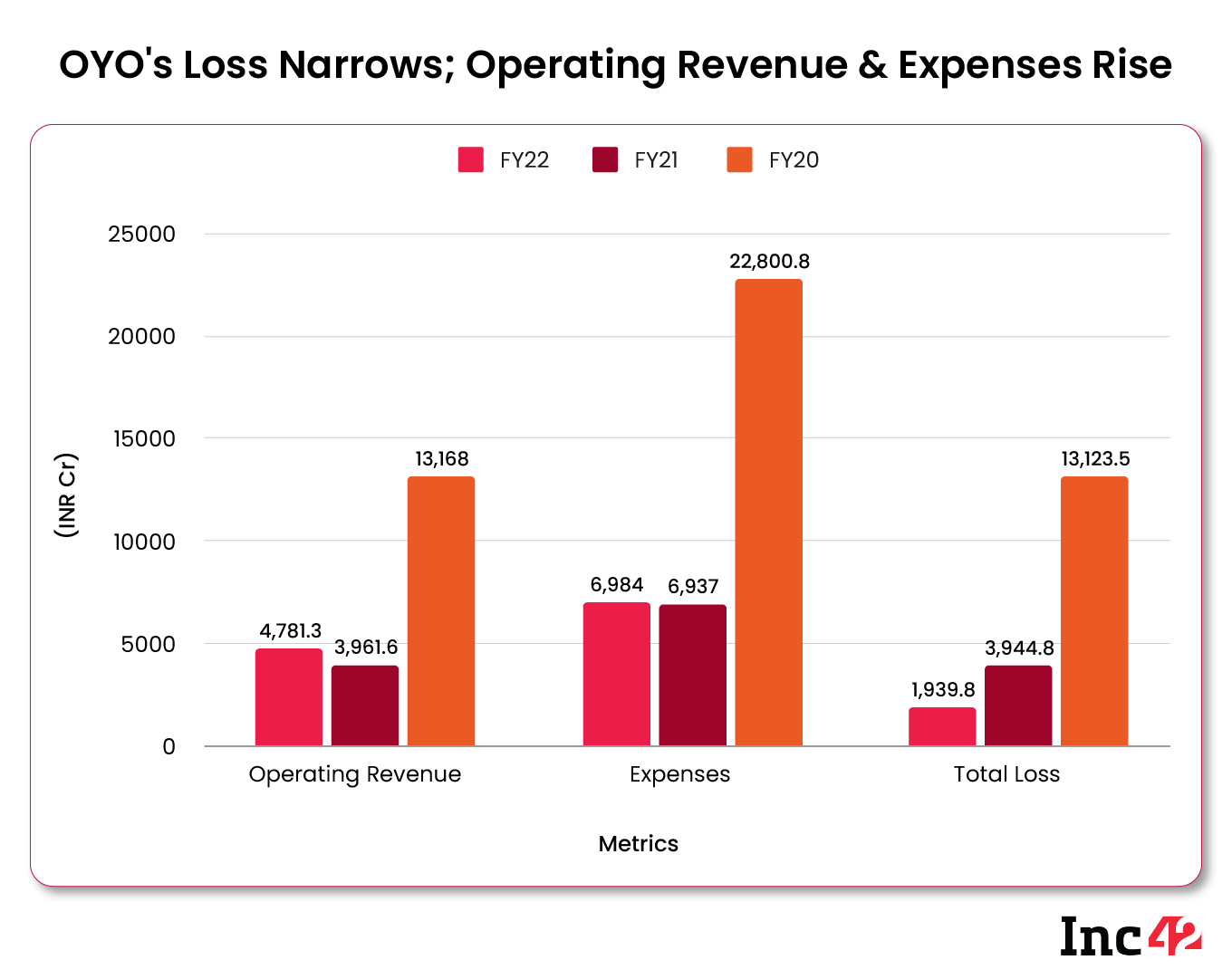

OYO’s revenue from operations rose 20.6% to INR 4,718.3 Cr in FY22, but was far below the pre-pandemic level

The startup was able to control the rise in expenses, with its total expenses growing marginally to INR 6,984 Cr in FY22

OYO also reported a positive EBITDA of INR 10.57 Cr in the first quarter of FY23

Ritesh Aggarwal-led Oravel Stays Limited, which runs popular hotel chains OYO, narrowed its loss after tax by almost 51% to INR 1,939.8 Cr in the financial year 2021-22 (FY22) from INR 3,944.8 Cr in FY21.

Meanwhile, the Gurugram-based startup reported a net loss of INR 413.8 Cr for the April-June quarter of FY23. However, it had a positive EBITDA of INR 10.57 Cr during the quarter.

The startup disclosed its financials for FY22 and the first quarter of FY23 in an addendum to its draft red herring prospectus (DRHP) filed with the Securities and Exchange Board of India (SBEI). The hospitality unicorn filed its DRHP in October last year for a $1.2 Bn initial public offering (IPO).

Revenue Far Below Pre-Pandemic Level

OYO’s total revenue grew to INR 4,905.2 Cr in FY22 from INR 4,157.3 Cr in FY21, while revenue from operations rose 20.6% to INR 4,718.3 Cr from INR INR 3,961.6 Cr in FY21.

While the relaxations in Covid-19 restrictions led to the rise in operating revenue, it was still nowhere close to the revenue from operations in the pre-pandemic year. In FY20, the startup’s revenue from operations stood at a whopping INR 13,168 Cr.

OYO

It is interesting to note that 76% of OYO’s revenue from operations in FY22, i.e. INR 3,642.5 Cr, came from outside India, whereas the remaining INR 1,138.8 Cr came from India. The startup has been generating more revenue from foreign countries for a few years now. It has a presence in China, UK, UAE, Brazil, among others.

Meanwhile, OYO’s revenue from operations stood at INR 1,459.3 Cr during the first quarter of FY23.

Expenses Under Control

OYO’s total expenses rose marginally to INR 6,984 Cr in FY22 from INR 6,937 Cr in the previous year. In comparison, its total expenses stood at INR 22,800 Cr in the pre-pandemic FY20.

The hospitality startup’s operating expenses rose 3.6% to INR 2,873.8 Cr in FY22 from INR 2,772.7 Cr in FY21. Operating expenses comprise service components of lease, lease rentals, loss from bookings, food and beverage expenses, power costs, transformation expenses, among others.

Employee benefit expense also rose to INR 1,861.7 Cr in FY22 from INR 1,742.1 Cr. However, other expenses declined to INR 1,205.6 in FY22 from INR 1,469.5 Cr in FY21 on the back of a decrease in marketing expenses and brokerage commission.

In FY22, OYO spent a mere INR 38.5 Cr on marketing expenses, a significant drop from INR 140.5 Cr in FY21. The spending on brokerage commission also plunged to INR 170.2 Cr in FY22 from INR 546.4 Cr in FY21.

Meanwhile, its expenses stood at INR 1,910.5 Cr in the first quarter of FY23.

According to its DRHP, OYO plans to raise INR 8,430 Cr through public listing. The IPO will comprise a fresh issue of shares worth INR 7,000 Cr, while the remaining amount would be raised through an offer-for-share (OFS).

Earlier, Inc42 reported that the startup may reduce its IPO size by over 30% and also list at a lower valuation.

Ad-lite browsing experience

Ad-lite browsing experience