SUMMARY

In FY21, till December 31, 2020, the company had a profit before tax (PBT) margin of 14.52%, compared to 12.22% in FY20

The company also cut its advertising spending by nearly two-thirds in FY2021 after the pandemic impacted its operations

The company said 88.44% of the unique visitors to CarTrade-owned sites in the financial year 2021 were organic visitors

Automobiles marketplace CarTrade has revealed how it built on the profitability it had first achieved in FY2019 over the course of the past two years. In its draft red herring prospectus for its initial public offering (IPO), CarTrade reported being the only online automobile marketplace in India to achieve profitability in FY20.

It attributed this to the asset-light approach it has taken with a larger focus on technology, and falling fixed costs thanks to economies of scale. This is seen in the consistently improving profit margins at a contribution level and as a whole.

In FY21, till December 31, 2020, the company had a profit before tax (PBT) margin of 14.52%, compared to 12.22% in FY20, 13.28% in 2019 and a negative margin of 1.97% in 2018. Similarly, its adjusted EBITDA margin has improved to 26.46% in FY21 (9 months), from 22.71%, 24.42% and 6.00%, respectively in the previous three full fiscals.

So how did the company shore up these numbers in the light of the pandemic that had already impacted the business?

How CarTrade Curbed Its Customer Acquisition Cost

The primary area for cost-cutting was advertisement, marketing and sales promotion expenses, which amounted to INR 7.7 Cr from March 2020 to December 2020, which came up to 4.11% of the total income in the nine months in the fiscal year 2021. In comparison, in FY2020, CarTrade spent INR 24 Cr (7.56% of its total income).

This was facilitated by a renewed focus on organic acquisition by targeting search rankings and through content marketing through Carwale and Bikewale, both of which CarTrade claimed outperformed rivals on Google. As a result, 88.44% of the unique visitors to CarTrade-owned sites in the financial year 2021 were organic visitors, the company said.

“Our advertisement, marketing and sales promotion expenses per unique visitor on CarWale, CarTrade and BikeWale has decreased to ₹2.33 in the nine months ended December 31, 2020, compared to ₹10.88 and ₹8.91 in the financial years 2020 and 2019, respectively. Going forward, we plan to further optimize our customer acquisition costs through investments in technology and product and content which will improve customer experience and thus our traffic.”

In effect, the customer acquisition cost (CAC) has fallen by 78.5%, which is significant and has a direct impact on the massive jump in profit margins. “Having well-known brands significantly enhances our ability to drive traffic to our websites and apps and to attract new customers. The strength of our brands is evidenced by our Google Trend scores,” the company added.

While advertising spending has fallen between March and December 2020, the revenue has not stalled, suggesting that the focus on organic acquisition has paid off to a large extent. On a consolidated level, till December 2020, the company has reported income of INR 189.6 Cr for FY21 (9 months) with a net profit of INR 85 Cr, compared to revenue of INR 318 Cr, which resulted in a net profit of INR 31.2 Cr in the year ending March 2020.

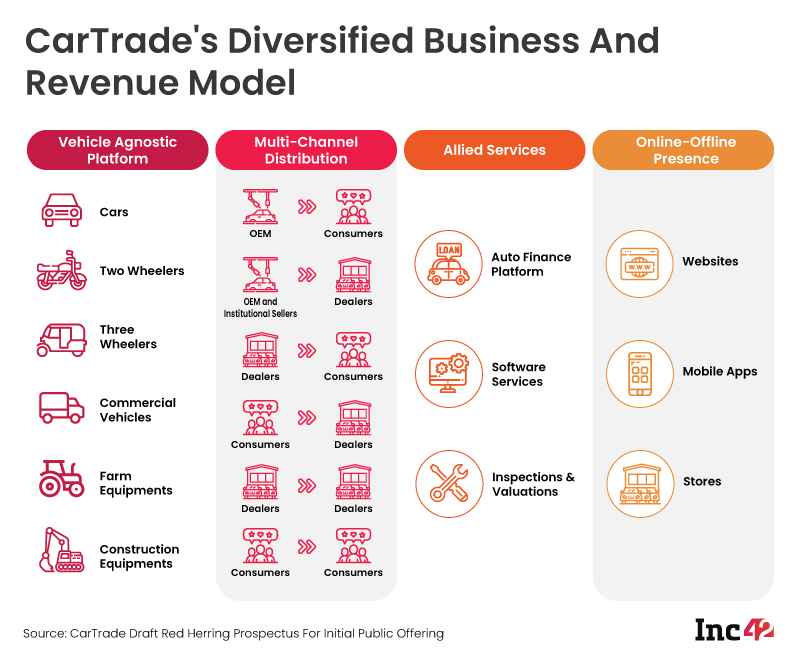

Diversified Revenue Allows Greater Flexibility For CarTrade

CarTrade said that its pan-India operations cover new and used automotive categories, which includes passenger cars, two-wheelers, commercial vehicles, farm equipment and construction equipment.

The company’s subsidiaries include Shriram Automall India Limited, Adroit Inspection Services Pvt Ltd, CarTrade Exchange Solutions India Pvt Ltd, CarTrade Finance Pvt Ltd and Augeo Asset Management Pvt Ltd.

In FY2021, the company claims to have recorded an average of 25.66 Mn unique visitors per month across its consumer platforms CarWale, CarTrade and BikeWale, while its Shriram Automall auto auction site witnessed 814,316 auction listings.

This omnichannel and multi-category approach has helped CarTrade get a bigger reach among the dealer base as well as higher visibility among consumers, the company claimed. “Our multi-vehicle approach increases our efficiencies and profitability as our services and technology can be leveraged and applied across vehicle categories.”

Finally, the company added that being a data-reliant operation, it is relying on AI and machine learning to do much of the heavy lifting and automating the processes involved at each stage in a typical car purchasing or selling experience. It said the flexible architecture is not only a competitive edge but also reduces the cost of operations across the value chain.

In fact, CarTrade said that the data it collects through its various platforms such as CarTrade, Carwale, Bikewale, CarTrade Exchange, Shriram Automall, its CRM tool Autobiz and other offerings is a key competitive advantage. “We have designed our technology platforms with a view to integrating the collection of data from multiple relevant access points.”