The founder and partner of 100X.VC, Ninad Karpe, noted that constant and transparent communication is always a good habit to have

Sometimes, immature and irrational spending habits of founders can give birth to nasty situations: Karpe said

Highlighting one of the greatest things about Indian founders, Dr Sharma said that they can sniff out opportunities to innovate

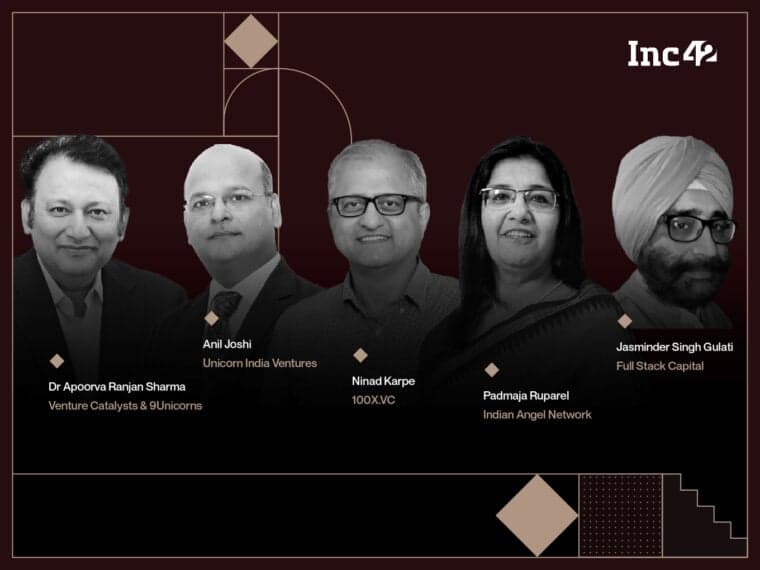

During a panel discussion at Inc42’s MoneyX, investors talked about the good and bad behaviours of founders, which they have observed during their careers.

Ninad Karpe, the founder and partner of 100X.VC, noted that constant and transparent communication is always good to have. “Good news always flows from founders, but I hate to be the last man in the room to get bad news.”

Speaking about bad behaviour, Karpe highlighted the irrational spending habits of founders after raising funds. “Sometimes, immature and irrational spending habits of founders can give birth to nasty situations,” Karpe said.

Echoing similar sentiments, Padmaja Ruparel, the cofounder of Indian Angel Network, said that using the runway on purchases is also an example of unsavoury behaviour that some founders demonstrate.

Meanwhile, Dr Apoorva Ranjan Sharma, the cofounder of Venture Catalysts and 9Unicorns, said that even after raising millions of dollars in capital, many founders take governance for granted. “It is not only their future but also the ecosystem which gets bad vibes. It’s important to have good governance, especially for startup founders,” she added.

Highlighting one of the greatest things about Indian founders, Dr Sharma said that they can sniff out opportunities to innovate.

The MoneyX panel’s comments come as India’s startup ecosystem has been rocked by multiple instances of corporate governance lapses at Indian startups. From GoMechanic and Broker Network to Mojocare and Zilingo, there have been instances of sales figures being fudged, money being siphoned off and exorbitant spending.

Presented in partnership with Peak XV Partners, supported by Venture Catalysts, JSA, Samsung, IVCA Associates, Indian Angel Network, JIIF and Marwari Catalysts, MoneyX is aimed at bringing the driving forces of the Indian startup ecosystem under a single roof.

Ad-lite browsing experience

Ad-lite browsing experience