The EOW FIR alleges that the fraud at GoMechanic began way back in 2017, when the company was in talks with investors for a seed funding round

One of the biggest red flags came in the company’s transactions with an entity named Parcit which was involved in circular invoicing and inflating income for GoMechanic

The Parcit transactions resulted in a loss of at least INR 101.59 Cr to GoMechanic, according to the FIR which was registered after a complaint by the company's investors

The Delhi Police’s Economic Offences Wing has registered an FIR against the four cofounders of gomechanic

The complaint was jointly filed by Orios Venture Partners, Peak XV Partners (Sequoia Capital) as well as Chiratae Ventures.

As reported exclusively by Inc42 in August, GoMechanic’s three major investors approached the EOW to probe the role of the four cofounders in misreporting financials and any potential misappropriation of funds.

That complaint was formally registered as an FIR by the EOW on October 20, 2023, under Section 120-B, 409, 420, Sections 465, 467, 468, 471 and 477-A of the Indian Penal Code, 1860, which cover cases of fraud, dishonesty and cheating, among others.

Inc42 has seen a copy of the FIR, which names founders Amit Bhasin, Kushal Karwa, Rishabh Karwa and Nitin Rana, along with other senior officials, Prateek Jain (VP, finance), Yogesh Narnawat (senior executive, finance), Vishambar Sharma (VP, admin) and others as the accused.

More importantly, for the first time, we are able to get information about what exactly happened at GoMechanic in the years leading up to the founders confessing to misreporting numbers and fudging account statements.

Interestingly, the FIR does not arrive at the total amount involved in the alleged fraud. The three complainants said a thorough investigation is required to unearth the extent to which such financial records were cooked up and falsified.

“Instead of using our investment of over Rs 200 crore towards the legitimate business activity of the company, the accused have fraudulently abused their authority as directors, agents, and employees of the company to commit criminal breach of trust by diverting and siphoning the capital/funds for personal and ulterior uses,” the FIR reads.

GoMechanic Fraud Began At The Seed Stage

Shockingly, the FIR states that the alleged fraud at GoMechanic began way back in 2017, when the company was in talks with investors for a seed funding round. It must be noted that GoMechanic was incorporated in May 2016.

As per the FIR, these details were shared by the founders with the shareholders during meetings in January 2023, when the controversy first broke out. Here’s the full text from the FIR that indicates how the fudging began in 2017.

“Started from the seed round when we were doing a business of 7-8 crores per annum. Founders went to the investor and committed that the Company does a business of 12-13 crores. Came back from the meeting saying we have to do something because we have committed to the investor saying that we do business of 12-13 crores and they will not fund otherwise. The CA said that he will do some adjustments. Then what we started doing is that we started the concept of flagship workshops — the arrangement was that they will transfer all of their ‘payments’ to GoMechanic — GoMechanic will inflate the commission and transfer less to these workshops and then as and when the business grows we will work together.”

Thus, the company showed inflated revenues of INR 12 Cr-INR 13 Cr, while expenses were being incurred basis the actual revenue of around INR 7 Cr-INR 8 Cr revenue.

“In order to bridge the gap on the net margin, we started inflating EBITDA. As and when the gap increased. it became a substantial one and we were showing a GMP of INR 200 Cr for an actual GMP of INR 50 Cr,” the FIR added.

Falsified Bank Statements

Further, the EOW has stated that management personnel such as Narnawat, a senior executive in the finance team, sent falsified bank statements to investors, including Stride Ventures.

The bank statements sent to Stride claimed that the company had a positive balance of INR 19.92 Cr on July 29, 2022, when in reality the balance was a negative INR 10 Cr at that time.

“Line items in the bank statements have been fraudulently and deliberately altered and falsified to inflate the balance by approximately INR 30 crores to mislead stakeholders, including the recipient of the entail [Stride].”

Investors also alleged falsification of accounts through round tripping of cash, and inflation of revenue in audited financial statements.

For instance, GoMechanic’s audited FY22 financial statement records ‘market support income” of INR 24,95 Cr under “revenue”, but a majority of this amount — INR 23.98 Cr — recorded against ten entities was proved to be fictitious and unsupported by any actual identifiable transactions as per the forensic audit ordered by the investors.

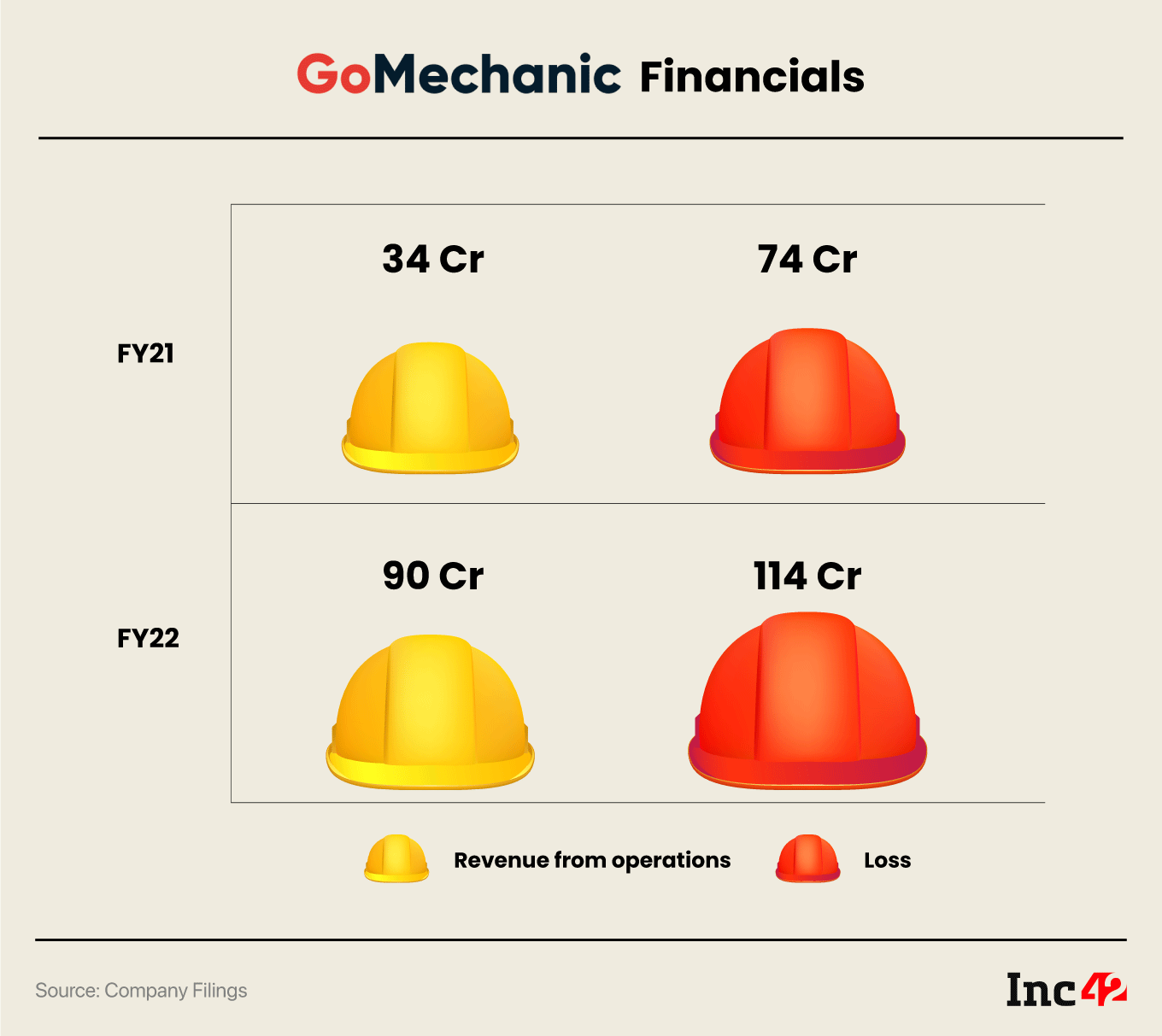

GoMechanic reported revenue from operations of INR 34.1 Cr in FY21, which grew 2.6X to INR 90.5 Cr in FY22 (March 2022). Its expenses grew faster in the fiscal, surging from INR 74 Cr to INR 210 Cr. As a result, the losses ballooned to INR 114 Cr ($15 Mn as per 2022 rates) from INR 74 Cr ($10 Mn as per 2021 rates) a year ago.

It must be noted that the company’s filings for FY22 show a higher loss for FY21 than its earlier financial filings for FY21.

In the FY21 numbers reported and approved by the board in October 2021, the losses stated were INR 27.4 Cr. In its FY22 filings reported and approved by the board in September 2022, the losses for FY21 grew to INR 74 Cr.

It is not yet clear how this adjustment was made because there is no explanation for the same attached in GoMechanic’s filings. But at least some of these corrections are likely to have been because of the wildly disparate monthly income that was being reported to investors.

For instance, the FIR alleges that investors received falsified monthly income statements (MIS) in November 2022, a few weeks before founders confessed to the fabrication of numbers.

While by November 2022, the company claimed to be earning INR 194.11 Cr as gross revenue, the actual revenue was approximately INR 100 Cr, indicating a near-2X inflation for this period.

Between March 2022 and July 2022, investors were also shown inflated liquid cash positions of the company in monthly statements. GoMechanic’s VP of finance Jain is said to have inflated the cash balances in a range of INR 10 Cr to INR 39 Cr over this period in each monthly statement.

The GoMechanic-Parcit Connection

One of the biggest red flags in the GoMechanic story came in its transactions with an entity named Parcit (registered as Parcit Autocrazy Private Limited).

Parcit is not directly related to GoMechanic, nor is it a subsidiary of the company. But according to Ministry Of Corporate Affairs records, accessed by Inc42, the mobile number associated with the incorporation belongs to GoMechanic VP [Prateek] Jain. Further, GoMechanic founder Nitin Rana’s email is also mentioned on the MCA file for the company.

We can see that Parcit reported INR 63.66 Cr as revenue in FY21, up nearly 4X from the INR 18 Cr it reported in FY21. The company stated a profit of INR 76.01 Lakh in FY21.

Coming back to the FIR, investors allege that GoMechanic wanted to work with Parcit as the latter was engaged in the business of the buying and selling of auto spare parts, a vertical that GoMechanic had entered in October 2020.

GoMechanic told investors it would provide financial support to Parcit to onboard vendors and other activities. Between April 2020 to January 2023, Parcit received a number of fund transfers from GoMechanic as per the FIR.

Approximately INR 264.98 Cr was transferred to Parcit, but the payment could not be linked to any underlying business transactions as per forensic auditors. Then INR 200.37 crores was received by GoMechanic from Parcit, again without links to any actual business transactions. The gap of INR 64.81 Cr is alleged to have been syphoned by founders and other accused.

Further, GoMechanic made purchases worth INR 45.34 Cr from Parcit and received sales INR 2.45 Cr as sales consideration in the same period. But in the FIR, investors allege that no invoices or other supporting documentation was found for these sales and purchases. “Therefore it appears that a net fictitious liability of INR 42.89 crones has been created in the books of the Company [GoMechanic] through potentially fake sales and purchase transactions.”

The FIR also claims that Parcit was involved in circular trading by selling auto spare parts to certain parties and purchasing auto spare parts from the same parties.

Payments for these transactions were made through the vendor financing facilities provided to Parcit by GoMechanic. These funds would come back to Parcit when it sold parts to the same vendors, which were then paid back to GoMechanic’s vendor financing partners.

Investors alleged that since Parcit was unable to pay the amounts borrowed by it under vendor financing facilities, an amount of INR 67.74 Cr was settled by the lenders of Parcit (post 14.01.2023) through utilisation of the GoMechanic’s assets.

The Parcit transactions resulted in a loss of at least INR 101.59 Cr to GoMechanic, including a potentially fictitious liability of at least INR 42.89 Cr.

Did Founders Gain From GoMechanic’s Distress Sale?

Eventually, two months after the allegations surfaced in January 2023, GoMechanic was acquired by a consortium led by Lifelong Group, a majority shareholder in GoMechanic rival Servizzy.

At the time, sources told Inc42 that the deal saw write-offs by all GoMechanic equity investors, while the venture debt investors in the company managed to recover some funds. According to reports, Stride Ventures recovered INR 100 Cr through the deal, but Inc42 could not independently verify this information and nor did Stride Ventures comment on this speculation.

But now, the FIR has revealed a twist in this M&A deal. Investors claimed that they exited the company at a significant loss and sold all of their shares for zero consideration to GoMechanic cofounder Bhasin on March 23, 2023.

“As things stand, We/the Investors have effectively lost all our investment in the Company and the Accused Persons are therefore jointly and severally liable to be prosecuted and punished for the offence under Section 420 IPC.”

In effect, this means that the Servizzy deal, announced a week later on March 29, 2023 did not involve any of the investors, but it was actually cofounder Bhasin that sold the company to Servizzy.

Inc42 has reached out to Stride Ventures and other investors at GoMechanic for clarity on who saw the proceeds from the acquisition by Servizzy and Lifelong Group.

At the time of the acquisition, one source close to the investor group, indicated that the forensic audit might complicate the liability situation for Servizzy in this case. For now, the EOW investigation is likely to take several months to be completed.

Meanwhile, at least two of GoMechanic’s founders have moved on to new ventures, as reported by Inc42 in July. Rishabh Karwa and Nitin Rana are currently working on two separate and unnamed new startups, even as the EOW investigates their role in the GoMechanic saga.

Ad-lite browsing experience

Ad-lite browsing experience