SUMMARY

Previously, Future Retail’s independent directors had asked CCI to nullify the deal as Amazon “concealed facts, made misrepresentations to the CCI to seek approval for its investment in Future Coupons

Providing an email thread between Amazon India’s legal head Rakesh Bakshi and Jeff Bezos, Future claims that Amazon had always sought to invest in Future Retail which was restricted by FDI norms, thus it took the “twin-entity investment” route

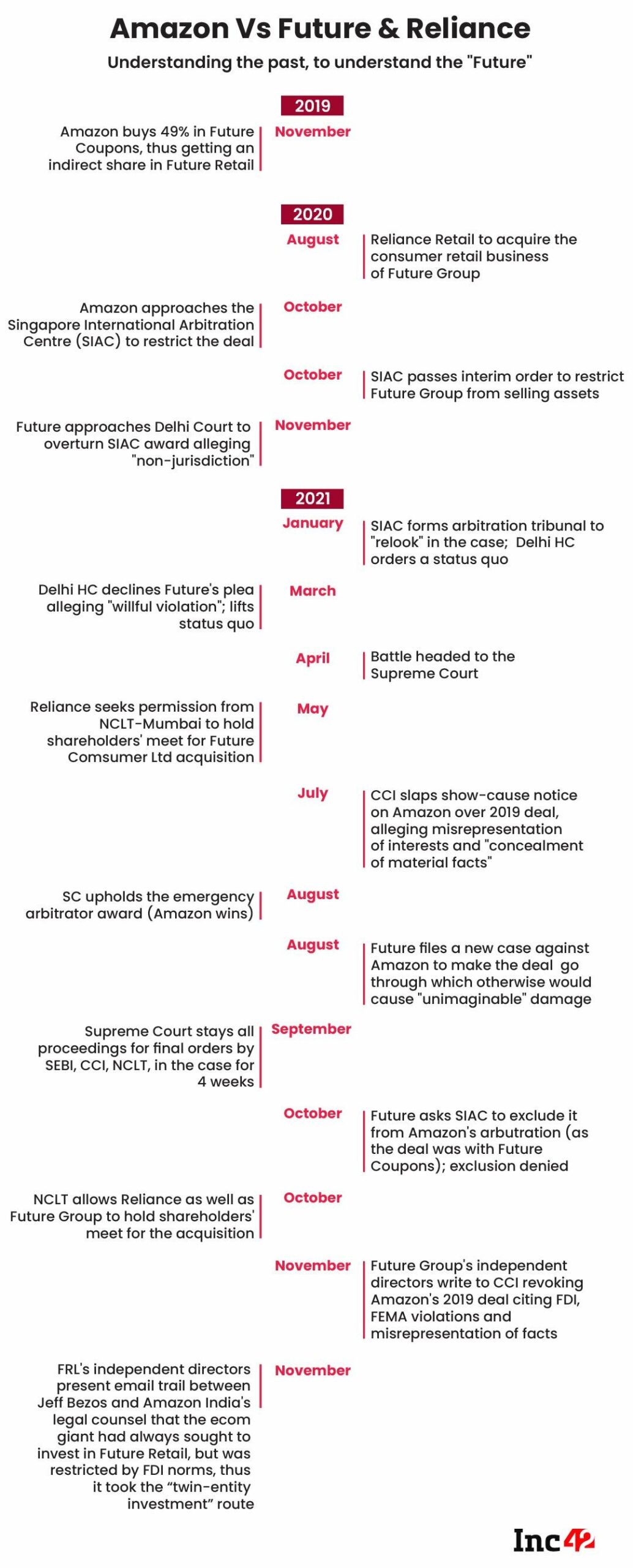

In 2019, Amazon acquired 49% in Future Coupons, which holds a 7.3% stake in Future Retail, thus making Amazon a 3.58% stakeholder in Future Retail — the business that is set to be acquired by Reliance Retail

Future Retail Ltd’s (FRL) Independent Directors have written a second letter to the Competition Commission of India (CCI), and this time with proof. FRL’s directors have disclosed new documents in a letter to the country’s antitrust watchdog citing Amazon always wanted to invest in FRL, but couldn’t, due to FDI restrictions on retail entities.

The email added that the restrictions arising out of the 2018 Press Note 2 notification prohibited ecommerce marketplaces from exercising ownership or control over sellers’ inventory on their platform. This led to a change in the investment structure, with Amazon investing in a twin-entity investment structure, through Future Coupon’s.

The email between Rakesh Bakshi, Head, legal and assistant general counsel, Amazon India, and Jeff Bezos reveals the startling details on how Amazon viewed and planned to enforce its agreements, the letter claimed. It said Bakshi’s email stated that due to foreign investment policy restrictions, Amazon will use a “twin-entity investment” structure to invest in FRL.

While at the point of the deal, Amazon had stated that it intended to invest in FCPL because of its “unique business model and strong growth potential”, FRL asserts that it was never the case. The independent directors alleged that Amazon determined the price paid for the FCPL shares based on FRL’s valuation.

In September 2019, Amazon informed the CCI that it had proposed to acquire 49% stakes in Future Coupons. The deal had reportedly also mentioned a list of 30 entities with whom the Future Coupons could not transact, including Reliance Retail, a subsidiary of Reliance Industries Limited.

While the restraint was on Future Coupons, Future Coupons owns 7.3% shares in Future Retail. Through this transaction, Amazon had also managed to acquire around a 3.58% stake in Future Retail — the business that is set to be acquired by Reliance Retail.

Aiming to bolster their case against Amazon, FRL seeks to revoke the 2019 deal between the US ecommerce major and Future Coupons. This will eventually lead to making void Amazon’s case against Future Group.

Not only will it result in the cancellation of CCI approvals given for Amazon’s all transactions with Future Group, but it will also commensurate fines and penalties by ED and other enforcement bodies.

The move comes shortly after Future Retail’s (FRL) independent directors, wrote to the anti-trust watchdog. It had stated that Amazon received CCI’s nod to the deal for investment in FCPL, and not for acquiring strategic, material and special rights over FRL similar to FRL’s shareholders.

The directors stated in the letter that Amazon “concealed facts, made misrepresentations to the CCI to seek approval for its investment in Future Coupons, a promoter holding company.”

Reiterating the directors’ statements, CAIT, too wrote a letter to the CCI, stating that ecommerce major had made false statements. It had added that only a levy of penalty will not suffice and will be illegal

Regardless of the Amazon-Future Group contract, Future Group in August 2020 announced a deal with Reliance Retail, Amazon took to the SIAC. Consequently, the Reliance – Future deal has been bitterly contested by Amazon through the Singapore Arbitration.

Escalating the matter from the SIAC to Delhi HC, now, a decision by the Supreme Court is pending over a petition filed by the US-based ecommerce major.