Stockal claims to have processed more than $750 Mn worth of global investment transactions over the last 18 months

In 2021, Stockal expanded into MENA with an office in Dubai and partnerships in UAE, Oman and Bahrain

Some of Stockal’s competitors are Interactive Brokers, Vested Finance, Scripbox, and DriveWealth

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Bengaluru-based investment platform Stockal has raised $9 Mn as a part of its Series-A funding round. The round saw participation from investors including Hashed, PEAK6, ARC Group Ventures, Trica, 7Square, AZ Ventures, Czar Capital and Riso Capital.

The fresh capital will be used for international expansion plans as Stockal is planning to foray into the South East Asian markets.

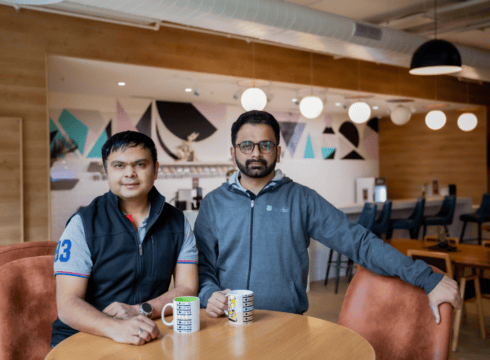

Founded in 2016 by Sitashwa Srivastava and Vinay Bharathwaj, Stockal helps retail investors make cross-border investments. Its product offerings include stocks and ETFs, stacks and cash management. It helps investors to digitally open and operate overseas investing accounts. It also utilises bid data that helps investors in making decisions about investments.

Stockal claims to have processed more than $750 Mn worth of international investing transactions over the last 18 months. In 2021, it expanded into MENA with an office in Dubai and partnerships in UAE, Oman and Bahrain.

In 2021, Stockal closed a $4 Mn Pre-Series A round from HDFC Bank and HDFC Securities, ScaleX Partners, Aroa Ventures, Cadenza Capital, July Ventures, among others. Before that, in 2015, it raised an undisclosed amount in angel funding from Helion Ventures’s R Natarajan and Copal Amba’s Mohan Alexander.

Some of its competitors are Interactive Brokers, Vested Finance, Scripbox, and DriveWealth.

In April 2022, Silicon Valley and Mumbai-based investment startup Vested Finance raised $12 Mn in a Series-A funding round led by Ayon Capital. Existing investors Tenoneten, Ovo Fund, Wedbush Ventures, IPV, and Upscale also participated in the funding round.

Vested Finance also saw the participation of new investors including 9Unicorns, angel investors Ankur Warikoo, Dhruvil Sanghvi, and Saumil Parekh, along with content creators Akshat Shrivastava, Mukul Malik, Sharan Hedge, Dhruv Rathee, Shashank Udupa, and others.

In November 2021, Upstox entered the unicorn club after raising $25 Mn at a valuation of $3 Bn in the ongoing funding round led by existing investor Tiger Global.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.