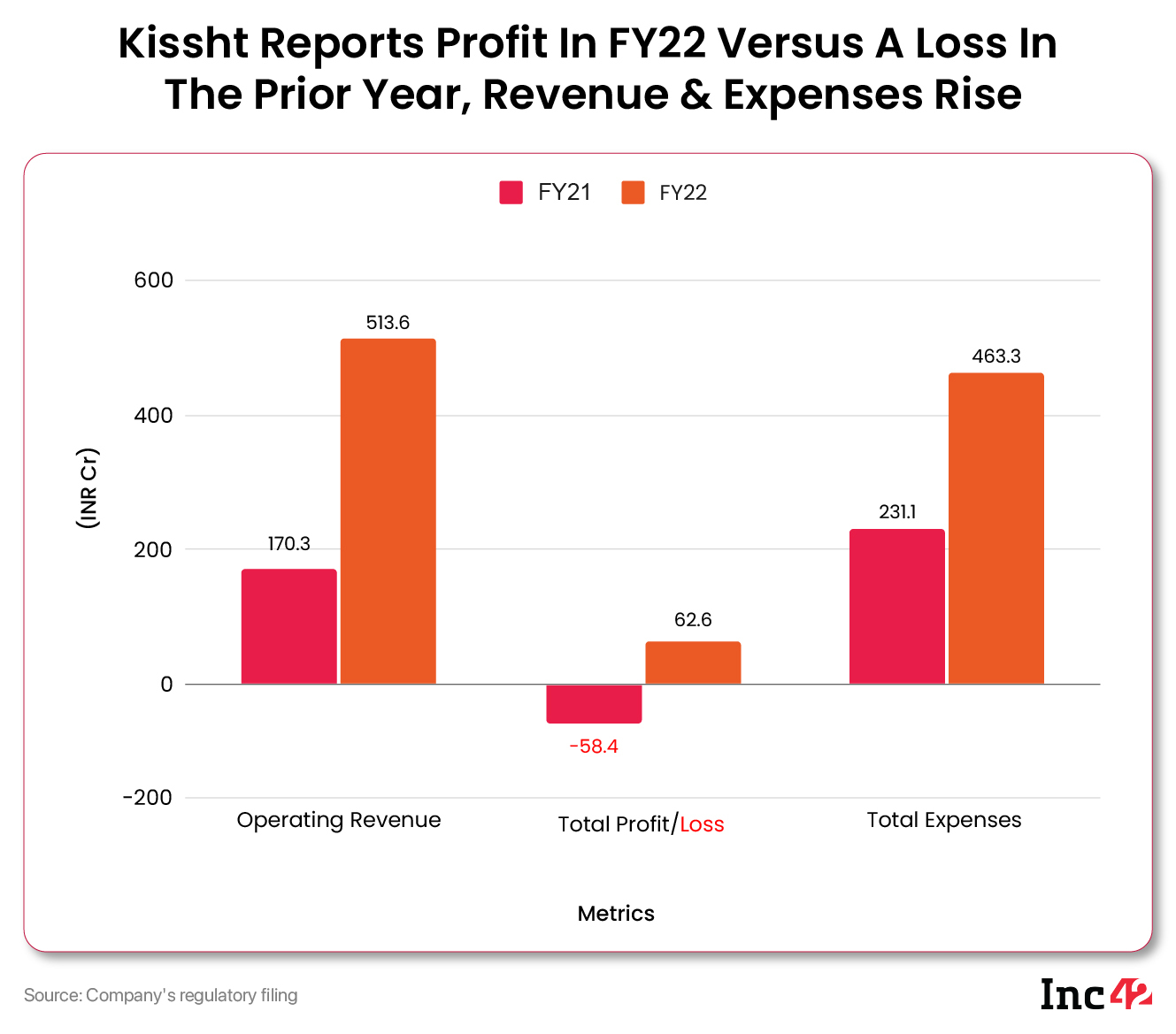

Hit by the Covid-19 pandemic, Kissht had reported a loss of INR 58.4 Cr in FY21

The startup’s operating revenue grew over 3X to INR 513.6 Cr in FY22 from INR 170.3 Cr in FY21

Total Expenses rose over 2X to INR 463.3 Cr in FY22 from INR 231.1 Cr in FY21

Mumbai-based fintech startup Kissht reported a consolidated profit of INR 62.6 Cr in the financial year 2021-22 (FY22) as against a loss of INR 58.4 Cr reported in the previous year, as per the regulatory filing of its parent entity OnEMI Technology Solutions.

Recovering from the hit due to the Covid-19 pandemic in FY21, the startup’s operating revenue also grew over three-fold to INR 513.6 Cr in FY22 from INR 170.3 Cr in FY21. The lending tech startup which offers small-ticket loans to its users saw its total revenue rising to INR 517.2 Cr in FY22 from INR 175.9 Cr in the previous fiscal year.

Kissht earned the highest revenue of INR 291.6 Cr from processing fees on its platform, which was followed by marketing income at INR 92.8 Cr.

Kissht had projected its revenue at INR 500 Cr with a profit of INR 50 Cr in the fiscal year and as per its filing, the startup has succeeded in going well beyond that.

Founded in 2015 by Krishnan Vishwanathan and Ranvir Singh, Kissht enables online and offline shopping on merchant stores by providing quick and easy EMI at the point of sale. The RBI-registered NBFCs that have tied up with Kissht take care of credit assessment, KYC processing, credit approval, and financing of consumer loans for the purchase of goods and services on its platform.

Kissht currently seems to be benefitting from the economic recovery in the country post-pandemic, which has led to a massive surge in demand. As per a recent Credit Bureau Report, India’s lending market grew 11.1% year-on-year (YoY) to INR 174.3 Lakh Cr in FY22.

Kissht claims to currently handle 3.5 Mn customers with over 500 online and 3,000 offline partners providing credit to the shoppers.

It is pertinent to note that the startup managed to improve its bottom line despite an over 2X rise in its total expenses to INR 463.3 Cr in FY22 from INR 231.1 Cr in FY21.

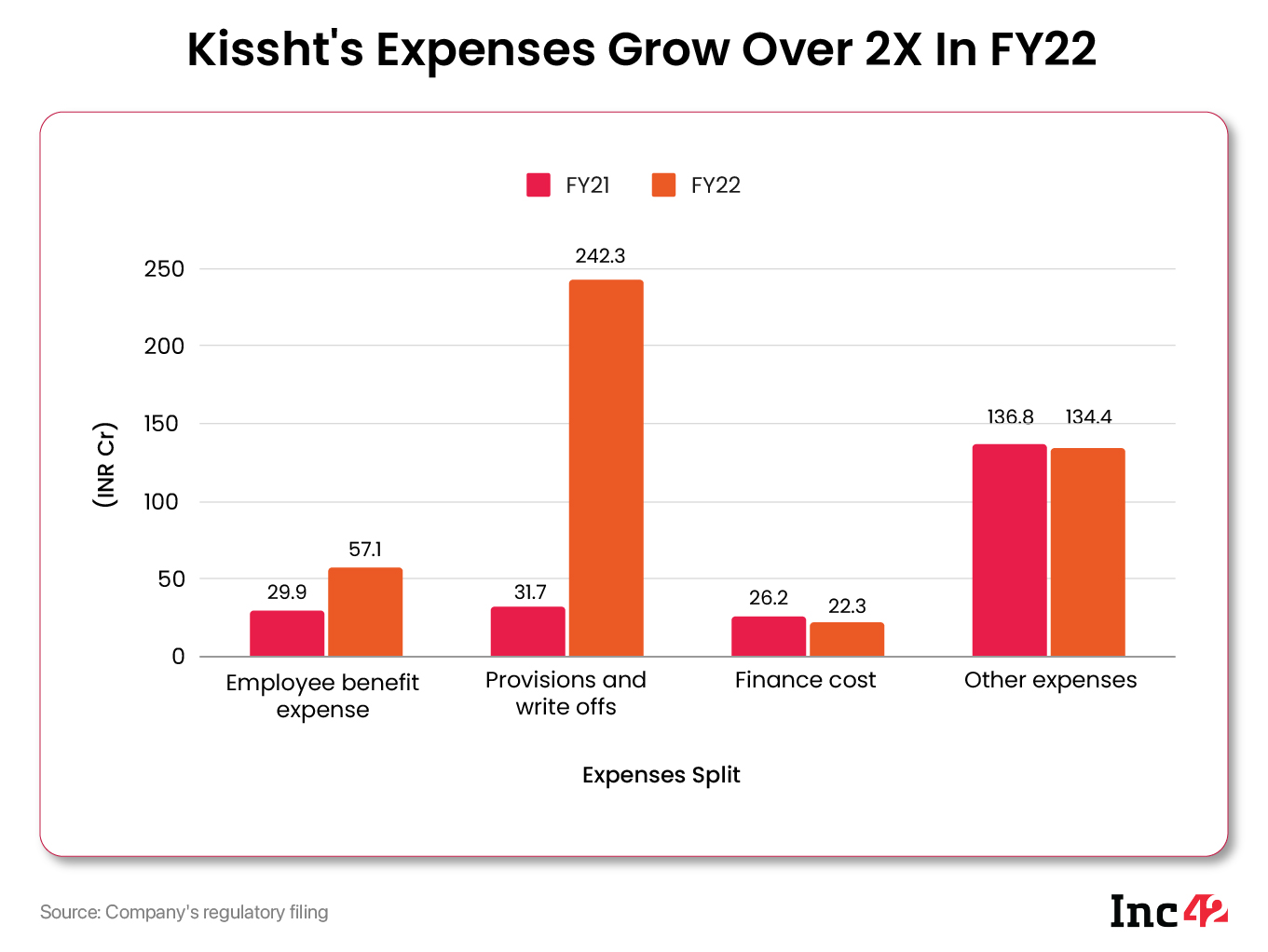

The biggest contributor to its total expenses during FY22 were provisions and write-offs amounting to INR 242.3 Cr, which stood at only INR 31.7 Cr in the prior fiscal year. Kissht wrote off bad debts amounting to INR 110.2 Cr during the year, a whopping 371% rise from INR 23.4 Cr of bad debt written off in FY21.

The startup’s other expenses, excluding write-offs and provisions and including business support charges, bank and payment gateway charges, and credit information services, declined 1.7% to INR 134.4 Cr in FY22.

Meanwhile, its employee benefit expenses jumped almost 91% to INR 57.1 Cr as against INR 29.9 Cr in FY21. Salaries and wages paid to the employees contributed almost 70% to the total expenditure on employee benefits.

The startup had additional employee compensation expenses of INR 11.6 Cr in FY22, which was null in FY21.

On the other hand, Kissht managed to bring down its finance cost to INR 22.3 Cr in FY22 from INR 26.2 Cr reported in FY21.

During FY22, Kissht also raised fresh funding. In January this year, it raised INR 100 Cr ($13.2 Mn) in a funding round led by Trifecta Capital and Northern Arc to expand its scale of operations and further enhance product offerings such as credit cards for small businesses and shops.

In FY23, Kissht once again announced an $80 Mn fund raise led by Vertex Growth and Brunei Investment Agency in June this year and its foray into credit-backed cards and the launch of a millennial focussed brand product Ring.

With a total fund raise of about $114.75 Mn so far, the startup is reportedly valued at $500 Mn.

Kissht’s competitors include the likes of Lendingkart, Capital Float, KredX, and FlexiLoans.

As per an Inc42 report, digital lending in India is expected to grow to a $1.3 Tn market opportunity by 2030. Pegged at $270 Bn in 2022, the market size is projected to grow at a compound annual growth rate (CAGR) of 22% between 2022 and 2030.

Ad-lite browsing experience

Ad-lite browsing experience