Kissht Works In The Consumer Lending Space, Provides Collateral Free Loans

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Mumbai-based fintech startup Kissht has raised $2 Mn from Hyderabad-based early-stage venture capital firm Endiya Partners, and Ventureast. Kissht app provides collateral-free loans to users.

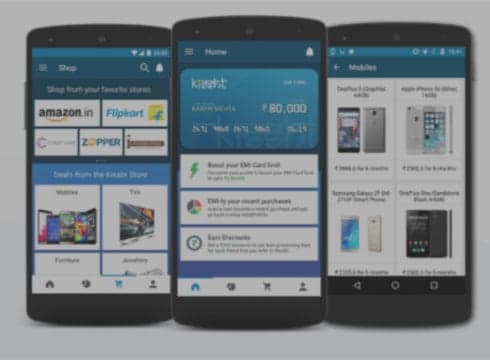

Founded in 2015 through the Kissht app users can buy various items within the app. These items include mobiles, laptops, jewellery, and electronics.

Commenting on the investment, Sateesh Andra, MD, Endiya Partners said, “We have a large population, a decent number of smartphones, and bank accounts. However, while we have about 600 Mn debit cards, credit cards are only about 30 Mn in India, which is a huge gap underlining the opportunity for consumer lending companies.”

How Kissht Works

Once logged in on the app, users can see in-app merchant partners or choose to buy items from the Kissht store. Via the app, a user can upload documents and make the down payment and pay the processing fees.

For customers with ongoing loans, Kissht provides an option to check the available line of credit. Also, users can make an early payment or view upcoming EMIs and invoices for the same.

“Going forward, we will be a data and analytics company enabling consumers to get loans from banks and NBFCs working with us as lending partners,“ said Krishnan Vishwanathan, CEO, Kissht.

Apart from this, Kissht also provides cash loans that can be used for house renovation, holidays, purchase of consumer durables, education, short-term loan for equipment purchase, short-term working capital, etc.

The company claims to have a fixed rate of Interest which is charged on a monthly reducing basis. Users can avail flexible return tenures of up to 60 months and repay loans in installments.

Indian Consumer Lending Space

The Indian fintech market is forecasted to touch $2.4 Bn by 2020, a two-fold increase from the market size currently standing at $1.2 Bn.

Earlier this month, consumer lending startup MoneyTap raised about $12.3 Mn funding in a round led by Sequoia India. Existing investors New Enterprise Associates and Prime Venture Partners also participated in the round. In May 2017, Pune-based fintech startup EarlySalary raised $4 Mn Series A funding from IDG Ventures India (IDGVI) and Dewan Housing Finance Corp Ltd (DHFL). This was followed by another consumer lending startup EzCred raising more than $1 Mn from a consortium of investors.

Apart from Kissht other startups in the consumer lending space include Lendingkart, FlexiLoans, KredX, Capital Float, etc.

(The development was reported by ET)

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.