The $1.5 Mn seed round also saw participation from existing investors Antler India and several angel investors

Bold Finance ties up with local jewellery stores to turn them into its branches and provide gold loans to consumers

The startup currently has a strong presence in Mumbai, and aims to expand its branches to Maharashtra and enter Gujarat in 2023

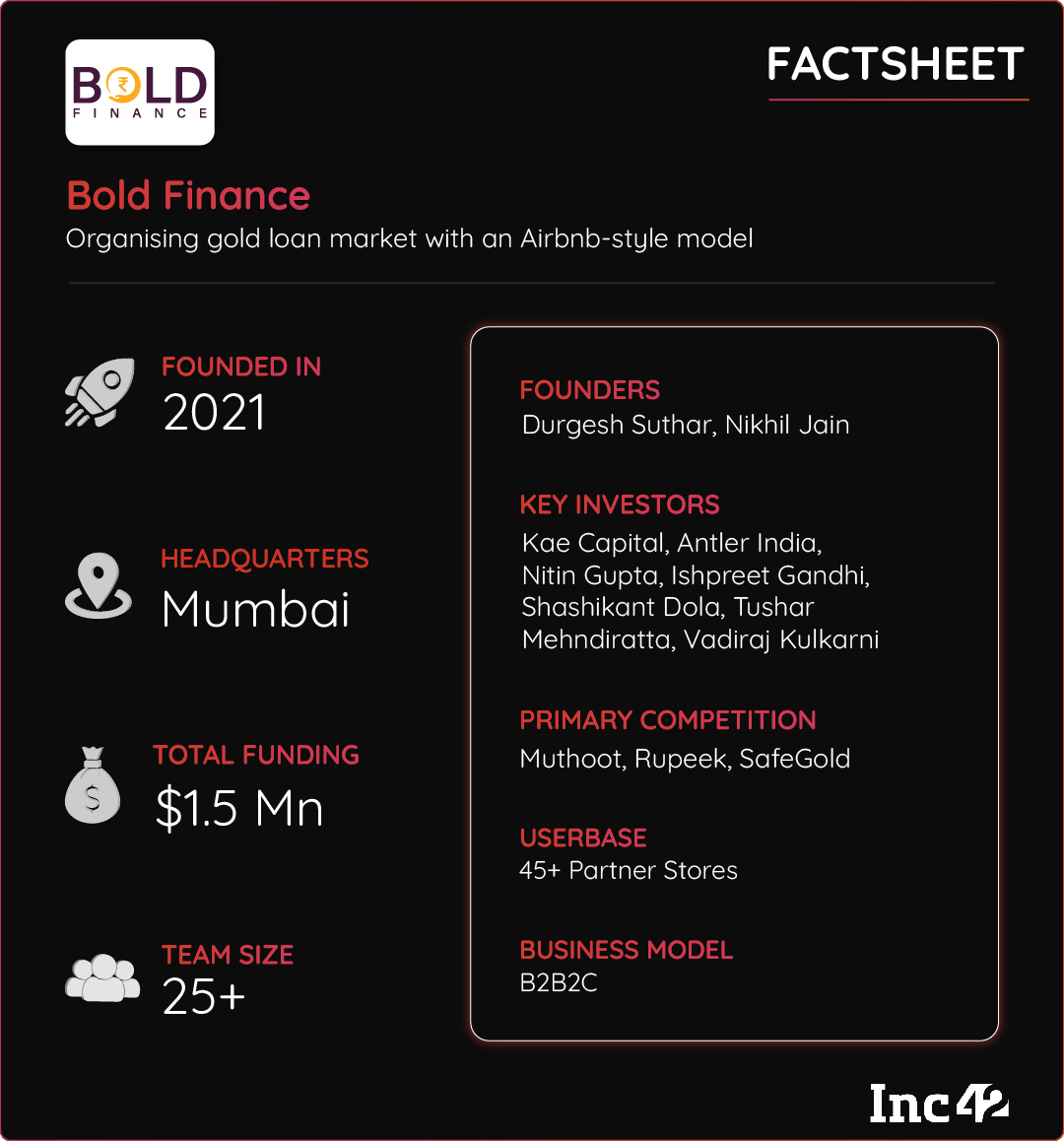

Fintech startup Bold Finance has raised a seed funding of $1.5 Mn in a round led by Kae Capital. The funding round also saw participation from existing investors Antler India and Uni Cards’ Nitin Gupta, Stride Venture’s Ishpreet Gandhi McKinsey’s Shashikant Dola, Avail Finance’s Tushar Mehndiratta, ITC PSPD’s Vadiraj Kulkarni and others.

The Mumbai-based startup, founded by IIT Roorkee alumni Nikhil Jain and Durgesh Suthar, offers gold loans to customers by partnering with jewellery stores across the city. It currently has a network of 45+ stores and plans to grow the number to over 150 by FY23.

The startup claims that 65% of the $130 Bn Indian gold loan market is unorganised and managed by pawnbrokers, money lenders, jewellers, HNI, among others. Customers have poor user experience owing to low-to-nil digital experience and lack of transparency. Sometimes the customers also have to pay interest rates as high as 30% per annum.

Targeting this consumer base that relies on traditional gold loan providers, Bold Finance is building a tech layer to dispense loans. It helps jewellers earn extra income by operating their stores as branches of Bold Finance.

In an interaction with Inc42, Suthar stated that the startup is building a distributed finance tech platform, which will allow it to scale to multiple branches while de-risking capex and opex costs.

Bold Finance’s Business Model

One of the most interesting aspects of Bold Finance’s business is that it has a hyperlocal presence. The startup is banking on the credibility of local jewellery stores to create trust among end consumers.

Bold Finance’s cofounder Jain told Inc42 that 80% of the people who avail gold loans belong to lower and middle-class families. “Since customers need it urgently, they rely on hyperlocal neighbourhoods to get such loans. Bold Finance is smartly placed to cater to such customers and deliver safe, fast and trusted loans in the market.”

A customer’s journey begins by visiting one of the jewellery store-turned-Bold Finance branches and providing loan requirements and KYC details. The customer walks out of the branch with the loan amount deposited in a Bold Finance-created virtual account.

On the backend, Bold Finance provides an app to the jewellers, who put in the customer information and an underwriter from the Bold Finance team evaluates the profile accordingly.

Since gold loans are secured loans, the turnaround time is quite low and the loan is provided to the customer in their virtual accounts. The repayment schedule can be managed by the consumer on the customer app.

The startup claims that the operating costs of its branches are significantly lower in comparison to that of banks, NBFCs and at-home lenders.

The gold loan-as-a-service startup has partnered Fincare Small Finance Bank to provide loans and keep the gold in its vault. It earns revenue by earning an interest margin. The startup takes care of consumer experience, credit underwriting, KYC, loan management, payouts, logistics, and more.

While the startup did not disclose its total user base and the number of loans it has disbursed, it claims to be growing 20% month-on-month (MoM). It has a strong presence in Mumbai and plans to build a network of Bold Finance stores in Maharashtra and move to Gujarat in the next calendar year.

In the next three years, the startup, which competes with the likes of Rupeek, MyShubhLife and IndiaGold, plans to have a loan book of $2 Bn and 9,000 stores across the country.

Ad-lite browsing experience

Ad-lite browsing experience