The second fund is nearly double the size of its previous fund, which the VC firm closed last year at $106 Mn

Arkam Ventures will look to write larger early stage checks with the new fund to secure a bigger stake in early stage startups

Arkam Ventures has made 18 investments so far, including startups such as smallcase, KreditBee and Jar

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Early stage venture capital (VC) firm Arkam Ventures has launched a second fund with a target corpus of $180 Mn. The fund is nearly double the size of its previous fund, which the VC firm closed last year at $106 Mn.

In an interview with TechCrunch, the firm’s partners said they were hopeful to retain support from international institutional investors and family offices for the new fund.

Arkam Ventures’ last fund was backed by the likes of British International Investment Plc, Nippon India Digital Innovation, Evolvence Group, Capria and SIDBI, along with other global funds of funds, HNIs and Indian family offices. Individual investors including Info Edge’s Sanjeev Bikhchandani, Flipkart’s Binny Bansal and Paytm’s Vijay Shekhar Sharma also backed its maiden fund.

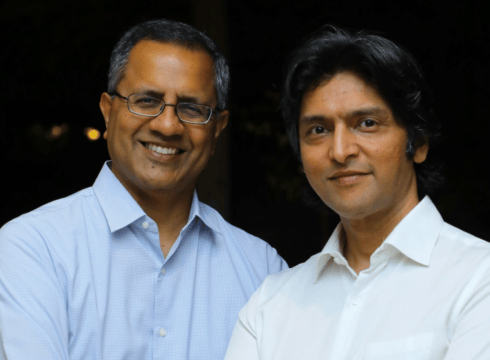

The VC firm will look to write larger early stage checks with the new fund to secure a bigger stake in early stage startups, Bala Srinivasa, cofounder and managing director of the fund said.

Typically, Arkam Ventures comes in at the Pre-Series A to Series B stage, with an individual cheque size between INR 10-20 Cr.

Arkam Ventures has made 18 investments so far, including startups such as smallcase, KreditBee, Jar, Smartstaff, Jai Kisan, Signzy, SpotDraft, Wint Wealth, Invact, Mudrex, BestDoc and Jumbotail.

Arkam’s fund launch joins a growing list of homegrown and Indian VC firms that are accumulating dry powder to invest in local startups. VC and private equity (PE) firms have raised capital to the tune of $3 Bn this year so far, per data put together by Inc42.

Last week, the likes of Blume Ventures, Lumikai, Airavat Capital and Avaana Capital made fund announcements.

This comes as VC firms are grappling with closing new funds, and having to reduce target size as global macroeconomic headwinds have prevailed over the past 18 months or so. For instance, earlier this month, Tiger Global fell short of the $6 Bn target for its new fund by 55%, managing to raise around $2.7 Bn.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.