We are investing in startups at a stage when there is nothing but founders, said Padmaja Ruparel, cofounder of Indian Angel Network

Venture Catalysts cofounder Apoorva Ranjan Sharma emphasised that if an investor helps build brands, getting good startups wouldn't be an issue for them

Speaking at Inc42's MoneyX, multiple speakers highlighted the need to increase the participation of domestic capital in the Indian startup ecosystem

Early stage investing is about trusting the founders and investing in the founding team of startups, experts said at Inc42’s MoneyX.

“We are investing in startups at a stage when there is nothing but founders. These people are ready to fly. The question is how do we enable them,” said Padmaja Ruparel, cofounder, Indian Angel Network (IAN).

She was part of a panel discussion on early stage investing. The session also saw participation from Venture Catalysts cofounder Apoorva Ranjan Sharma, 100X.VC founder & partner Ninad Karpe, Unicorn India Ventures managing partner Anil Joshi and Full Stack Capital founder Jasminder Singh Gulati.

IAN invests in early stage startups in the range of $50K to $7-8 Mn. It has invested in over 225 startups till date. Commenting on her philosophy of investing in founders, Ruparel said, “We have had failures but not a single one due to their corporate governance or regulatory issues.”

Meanwhile, Sharma said if a firm or an investor helps build brands, getting good startups wouldn’t be an issue for them. “If you do help build big brands, good startups would naturally come to you,” he said.

Elaborating on this, Sharma said Silvassa-based peanut butter brand MYFITNESS’ founders wanted Venture Catalysts to invest in the D2C brand as the VC firm helped build companies like OYO. Sharma said the VC firm invested $1 Mn in the brand and got 60X returns withing two years. MYFITNESS was later bought by Mensa Brands.

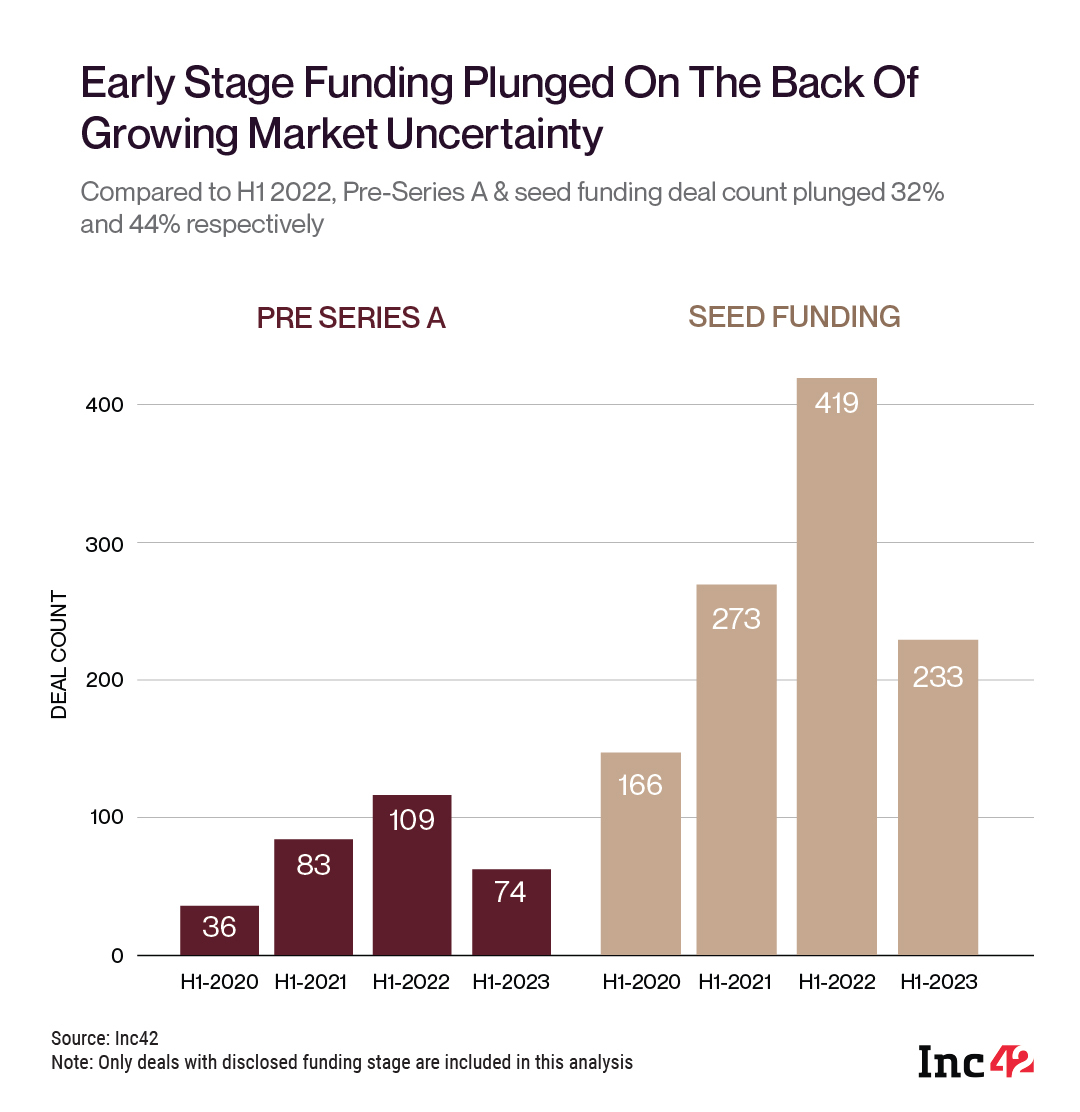

Early stage investments are mostly done through angel funds, syndicate, and angel network. The vibrancy of the Indian startup ecosystem has piqued the interest of even growth and late stage global investors. However, the ongoing funding winter has also hit early stage funding, like all other stages.

Earlier in the day, multiple other investors, including Paytm’s Vijay Shekhar Sharma, highlighted the need to increase the participation of domestic capital in the Indian startup ecosystem. Meanwhile, Peak XV Partner’s Rajan Anandan said there is no funding winter and no dearth of capital for Indian startups.

Presented in partnership with Peak XV Partners, supported by Venture Catalysts, JSA, Samsung, IVCA Associates, Indian Angel Network, JIIF and Marwari Catalysts, MoneyX is aimed at bringing the driving forces of the Indian startup ecosystem under a single roof.

Ad-lite browsing experience

Ad-lite browsing experience