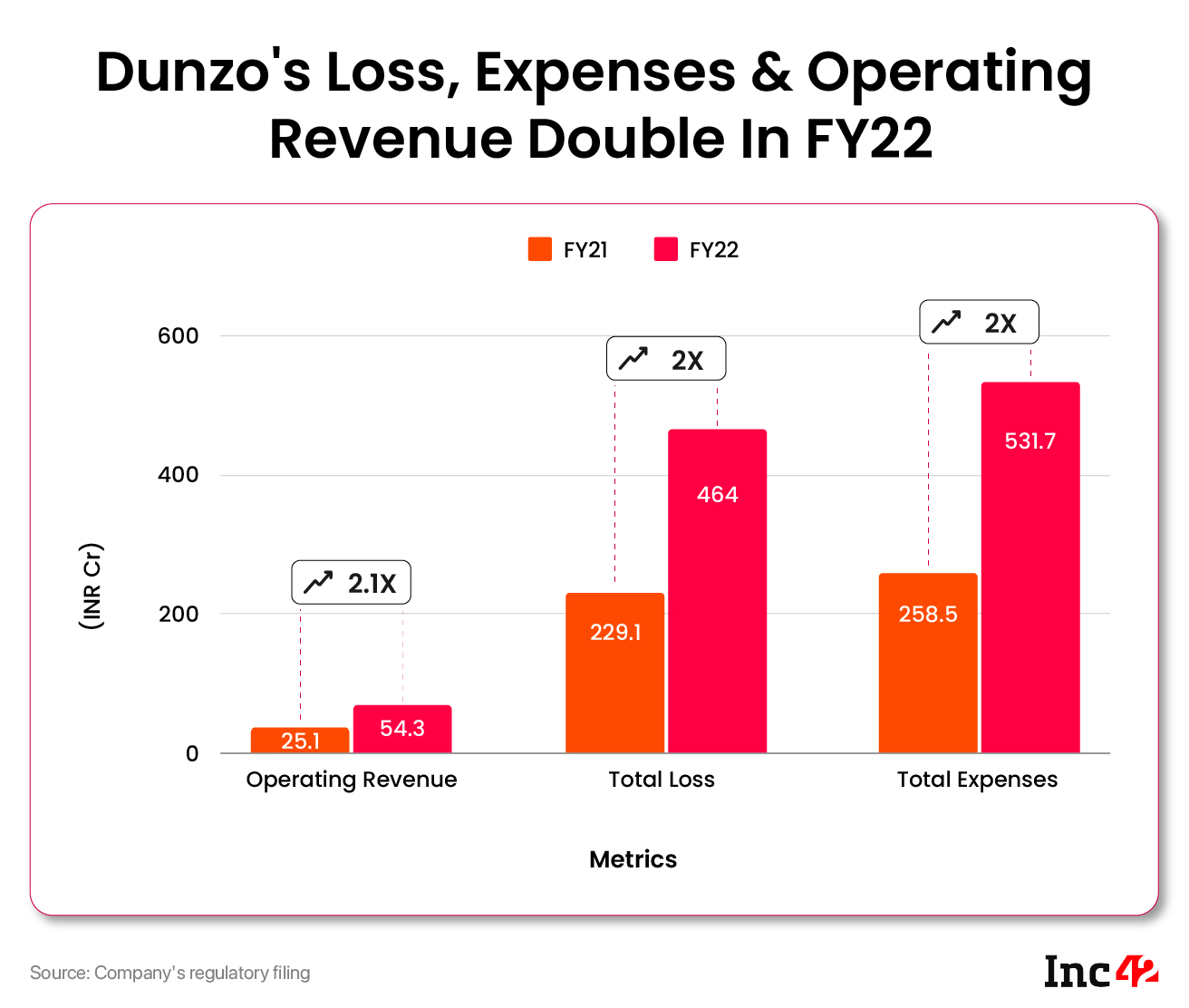

Dunzo’s operating revenue increased 2.1X to INR 54.3 Cr in FY22 from INR 25.1 Cr in FY21

With the expanding business, the Reliance-backed startup’s total expenses also doubled to INR 531.7 Cr in FY22

The Reliance-backed hyperlocal delivery platform’s advertising promotional expenses jumped almost 6X to INR 64.4 Cr INR 11 Cr in FY21

Bengaluru-based hyperlocal delivery platform Dunzo’s consolidated loss rose 2X to INR 464 Cr in the financial year 2021-22 (FY22) from INR 229 Cr in the prior fiscal year due to doubling of expenses.

Dunzo’s bottom line was hit despite income from business doubling during the period. The startup saw its operating revenue increase 2.1X to INR 54.3 Cr in FY22 from INR 25.1 Cr in FY21.

Dunzo, which provides quick delivery of groceries and various other items across almost 10 Indian cities and allows users to send packages, generates its revenue mainly from its online platform services for partner merchants, advertisement services, sale of traded goods, subscriptions, and various other platform services.

Dunzo’s total revenue in FY22 stood at INR 67.7 Cr versus INR 29.4 Cr in the previous year.

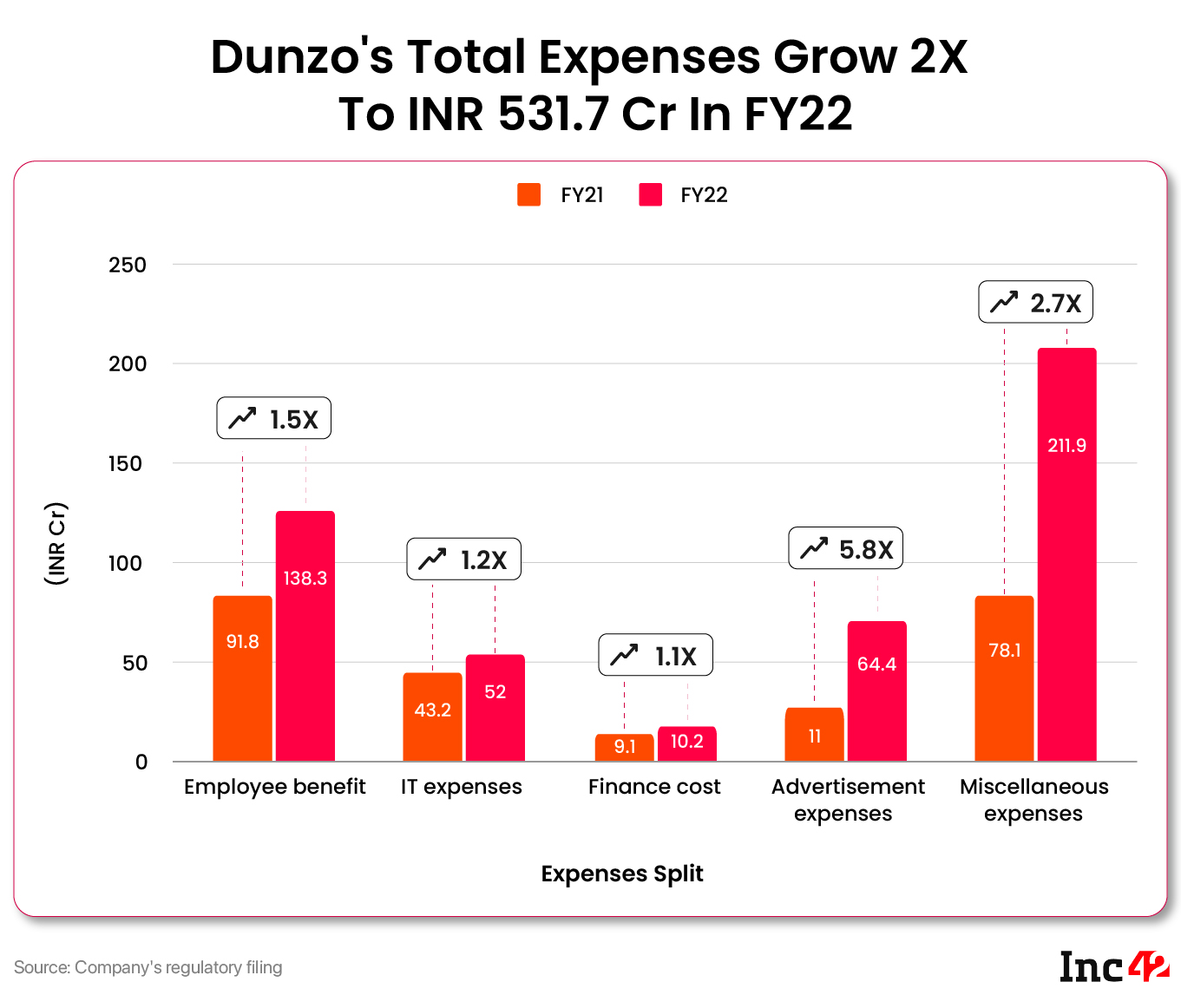

With the expanding business, the Reliance-backed startup’s total expenses also doubled to INR 531.7 Cr in FY22 from INR 258.5 Cr in FY21.

Employee benefit expenses, which rose to INR 138.3 Cr in FY22 from INR 91.8 Cr in FY21, alone accounted for 26% of the total expenditure.

On the other hand, Dunzo also spent INR 1.9 Cr in FY22 for purchases of goods meant for resale purposes, thanks to its growing B2B business.

Meanwhile, Dunzo’s advertising promotional expenses jumped almost 6X to INR 64.4 Cr in FY22 from INR 11 Cr in FY21.

It is pertinent to note that in September last year, the startup had signed late Kannada actor Puneeth Rajkumar for one of its commercials. Comedian Sunil Grover also teamed up with Dunzo in promoting its quick commerce model, 19 minutes delivery, last year.

Meanwhile, Dunzo’s IT expenses rose 20% to INR 52 Cr in FY22, which was alone equivalent to the startup’s operating revenue during the year.

Dunzo spent a major portion on miscellaneous expenses, which increased to INR 211.9 Cr in the year from INR 78.1 Cr in FY21. However, the startup did not provide a complete breakup of its miscellaneous expenses.

Dunzo ended FY22 with negative operating cash flow of INR 603 Cr as against INR 209 Cr in FY21.

Dunzo had bagged $240 Mn in a fresh funding round led by Reliance Retail Ventures Limited with participation from its existing investors Lightrock, Lightbox, Alteria Capita, and 3L Capital in January this year amid the growth in its business. The plan was to bolster its position in the growing quick-commerce market where it competes with the likes of Swiggy Instamart, Zepto, and Zomato-owned Blinkit.

Besides, it also wanted to expand its B2B business vertical, Dunzo for Business (D4B), which is currently present in nine Indian cities.

Despite the ongoing funding crunch in the Indian startup ecosystem, Dunzo is reportedly mulling raising another $200 Mn-$300 Mn in fresh funding. However, the startup has also turned its focus to cost-effective group deliveries from quick-commerce deliveries.

The startup has also been facing allegations from delivery partners pertaining to an increasing number of orders being assigned to them during their log-in period, changes in incentive structure, among others.

There have also been numerous instances of strikes by Dunzo’s delivery partners in different parts of Bengaluru this year.

Meanwhile, the Reliance-backed startup’s presence on the government’s Open Network for Digital Commerce (ONDC) has also led to some apprehensions among sellers on the platform.

Ad-lite browsing experience

Ad-lite browsing experience