SUMMARY

eMudhra is offering an undisclosed number of shares worth INR 161 Cr as the fresh sale of shares, while its promoters and stakeholders are selling 9.835 Mn shares in total

eMudhra’s offer opens on May 20 and closes on May 24, after a bidding window of three days

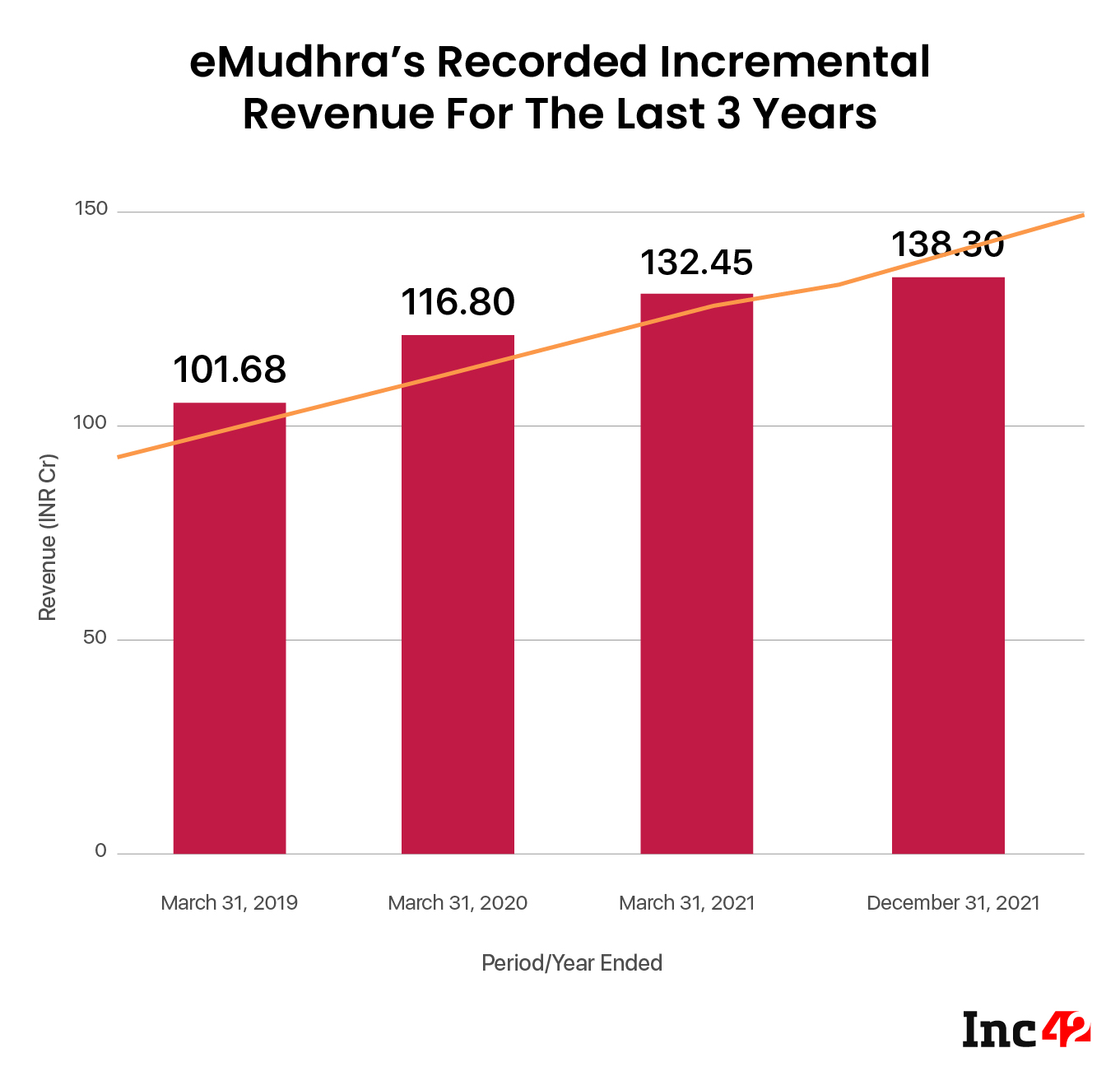

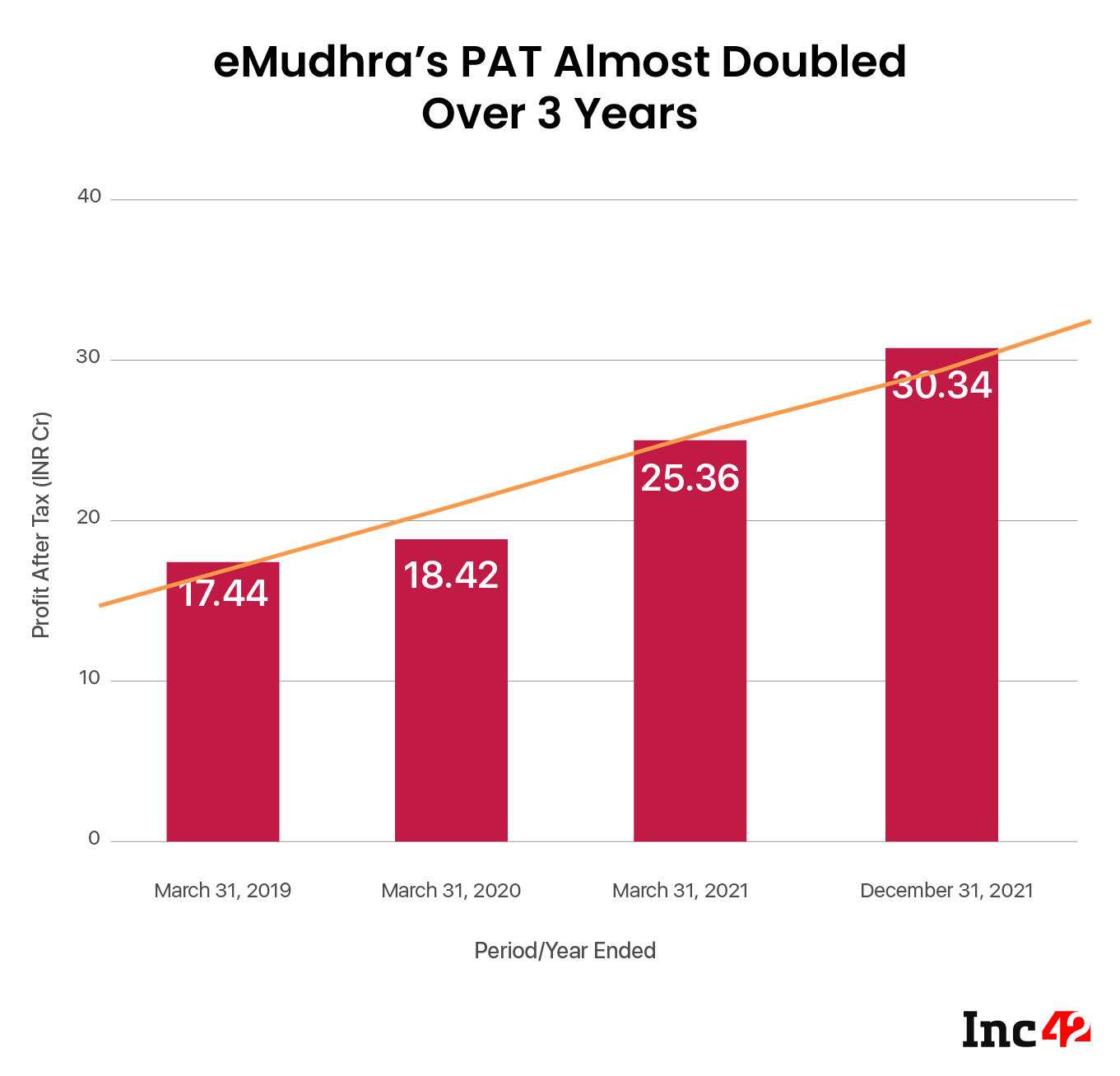

During the nine months ended December 31, 2021, eMudhra recorded revenue of INR 138.30 Cr and a profit of INR 30.34 Cr

Digital signature certificate provider eMudhra has filed its red herring prospectus (RHP) with the Securities and Exchange Board of India (SEBI), offering fresh shares as well as an offer for sale from the existing stakeholders.

eMudhra is offering an undisclosed number of shares worth INR 161 Cr as the fresh sale of shares, while its promoters and stakeholders are selling 9.835 Mn shares in total.

The digital signature certificate provider has set the price band at between INR 243-256. Overall, eMudhra’s IPO is worth between INR 400.43 Cr and INR 413.24 Cr, including the fresh offer, and the shares being sold by the promoters.

eMudhra’s offer opens on May 20, with the anchor investment round opening on May 19. The IPO will close on May 24, after a bidding window of three days.

Founded in 2008 as 3i Infotech Consumer Services Limited, eMudhra pivoted to digital signatures after being acquired in 2010.

The Bengaluru-based online authentication provider claims to have issued more than 50 Mn digital certificates and that all of the banks in India use the eMudhra platform for trust and authentication.

eMudhra works with governments and banks across the world on their paperless transformation journey.

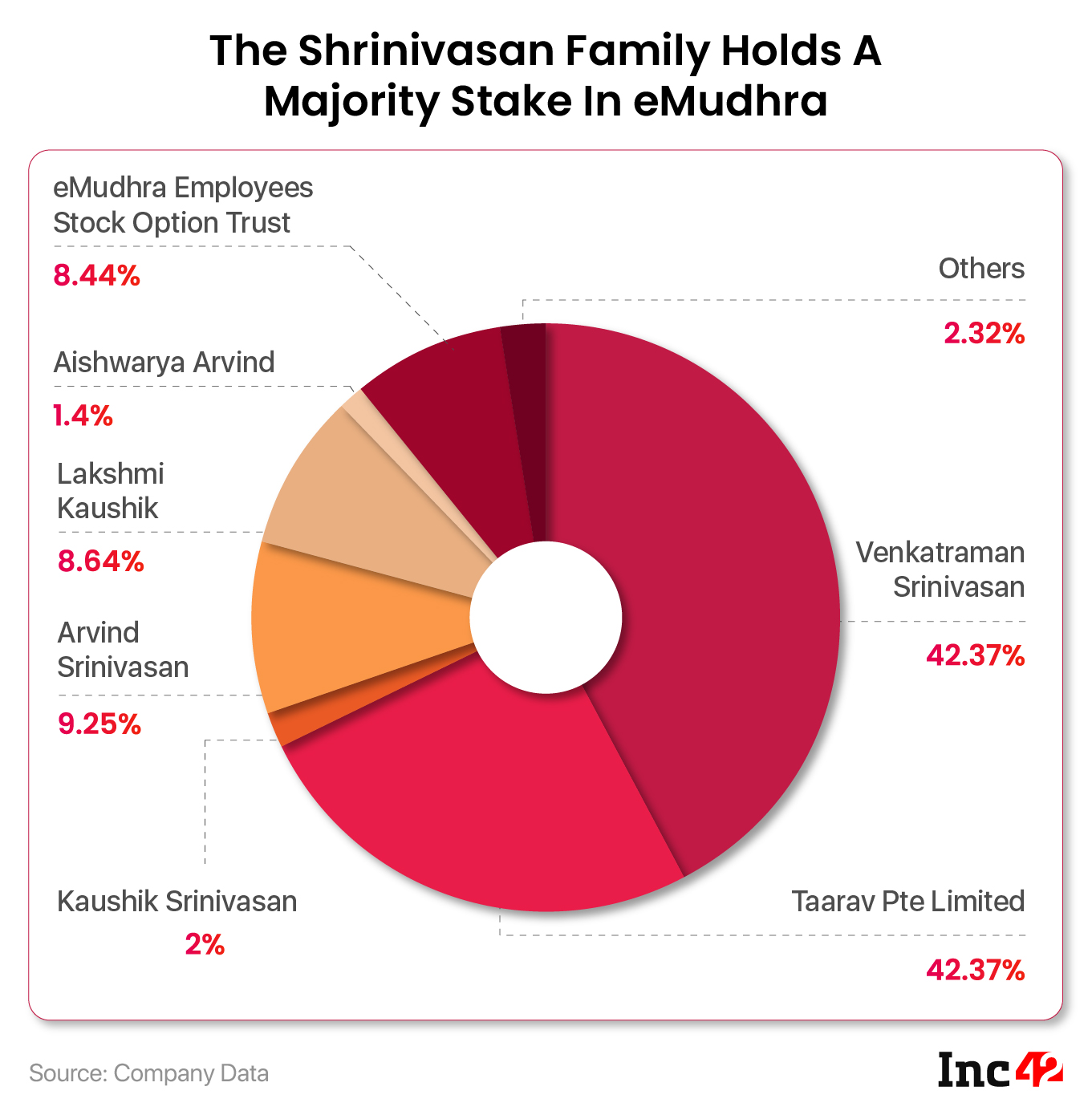

For the offer for sale, up to 3.3 Mn shares owned by Venkatraman Srinivasan, who is also the executive chairman, and up to 4.5 Mn shares owned by Taarav Pte Limited are being sold, along with other stakeholders also diluting their stakes.

The promoter group alone holds more than 60% of the shares in eMudhra.

The digital signature certificate provider has reserved half of the selling stake for qualified institutional buyers (QIB). Retail individual investors will be able to bid for 35% of the shares up for sale, while 15% of the shares have been reserved for non-institutional buyers.

eMudhra has aimed to repay INR 35 Cr in loans, INR 40.12 Cr in working capital requirements, INR 46.36 Cr in the purchase of equipment and funding other related costs for data centres proposed to be set up in India and overseas locations and INR 15 Cr each for the funding of expenditure relating to product development and the investment in eMudhra INC.

The company will also spend the remaining amount of money on general corporate expenditures, as mentioned in the RHP.

During the nine months ended December 31, 2021, eMudhra recorded a revenue of INR 138.30 Cr, registering a nominal 4.4% rise from the previous year.

eMudhra is also profitable, and it has been so for a while. According to its RHP, it registered a profit after tax (PAT) of INR 30.34 Cr, up by almost 20% from the previous year. eMudhra has managed to maintain the profitable streak since March 2019, a perusal of the RHP shows.

eMudhra also boasts of a market share of 37.9% in the digital signature certificates market space in FY21, having grown from 36.5% the year before. It counts the likes of Infosys, Tata Consultancy Services and Bharti AXA Life Insurance Company among its customers.