CCI scheduled a hearing of Future Coupons and Amazon on January 4

The anti-trust body had sent a show-cause notice to Amazon In June

The Mumbai bench of NCLT recently directed Future Group to not hold any meeting of creditors or shareholders on the proposed $3.4 Bn deal with RIL

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

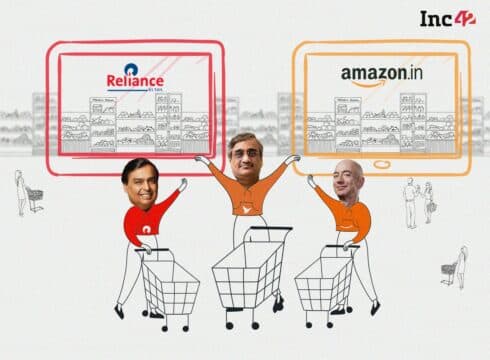

As the Amazon-Future Group feud continues at different forums including the Competition Commission of India (CCI), the Delhi High Court has directed the anti-trust body to decide and a give a ruling on the pleas filed to revoke approval to the ecommerce giant’s investment in Future Coupons.

The High Court has given the directive in a petition filed by the Confederation of All India Traders (CAIT), which had also recently written to CCI seeking the annulment of its approval.

Interestingly, the directive comes just a day after CCI scheduled a hearing of Future Coupons and Amazon on January 4.

Additional Solicitor General N. Venkatraman, representing CCI, said that the watchdog is also contemplating to call Amazon on January 4th, 2022, for a hearing, after which the final decision will be taken.

On Monday, November 15th, CAIT filed a public interest litigation (PIL) in the Delhi High Court against the Future Coupons investment in view of protecting 6,000 traders who had supplied goods to Future Group amounting to about INR 10,000 Cr.

In its plea, CAIT said that Amazon’s investment into the Future Group company was granted based on the US giant’s “misrepresentation about the actual transaction”. In its petition, the traders’ body appealed that traders should not be made a scapegoat or suffer any financial loss due to the fight between corporate giants.

The traders’ body said that the $3.4 Bn deal wherein Reliance Retail proposes to buyout the retail assets of Future Group would instead ensure that the investors and shareholders of the debt-laden Future Retail recover and lead to an increase in bad loans.

It also urged in its petition that the CCI should be directed to take a decision with respect to the show cause notice sent to Amazon in June this year, within 10 days.

Future Retail’s Independent Directors Writes To CCI

The Independent Directors of Future Retail have written twice to the commission seeking annulment of its clearance to Amazon’s investment in Future Coupons made in 2019.

In its latest letter to the Independent Directors disclosed new documents showing that Amazon always wanted to invest in FRL, but couldn’t, due to FDI restrictions on retail entities.

The email added that the restrictions arising out of the 2018 Press Note 2 notification prohibited ecommerce marketplaces from exercising ownership or control over sellers’ inventory on their platform. This led to a change in the investment structure, with Amazon investing in a twin-entity investment structure through Future Coupon’s.

In its previous letter, the directors stated that Amazon “concealed facts, made misrepresentations to the CCI to seek approval for its investment in Future Coupons, a promoter holding company.”

Reiterating the directors’ statements, CAIT also wrote to the CCI, stating that ecommerce major had made false statements. It had added that only a levy of penalty will not suffice and will be illegal.

Regardless of the Amazon-Future Group contract, Future Group in August 2020 announced a deal with Reliance Retail; Amazon took to the SIAC. Consequently, the Reliance – Future deal has been bitterly contested by Amazon through the Singapore Arbitration.

Escalating the matter from the SIAC to Delhi HC, now, a decision by the Supreme Court is pending over a petition filed by the US-based ecommerce major.

On November 8, the Mumbai bench of NCLT directed Future Group to not hold any meeting of creditors or shareholders on the proposed buyout by Mukesh Ambani led Reliance Retail.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.