In July, Rao resigned from his position as the chief executive and was initially expected to collaborate with the board for the appointment of a new CEO

Earlier this year, DealShare decided to shut its business-to-business (B2B) operations, sacking more than 100 staff

DealShare’s loss widened 543% to INR 431.1 Cr in the financial year 2021-22 (FY22) from INR 67 Cr in FY21 due to its growing business and the associated cash burn

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

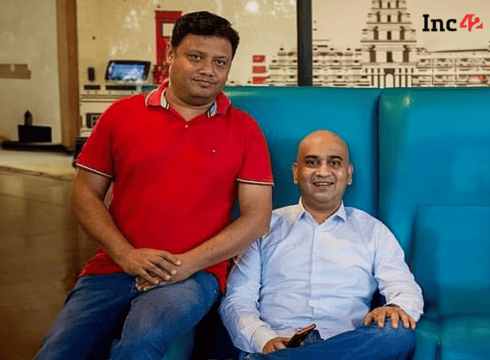

Two of DealShare’s founders, Vineet Rao and Sankar Bora, have reportedly parted ways from the ecommerce company, following multiple rounds of layoffs and a business restructuring this year.

In July, Rao resigned from his position as the chief executive and was initially expected to collaborate with the board for the appointment of a new CEO. However, he has now left DealShare and the company is yet to announce his successor, as per an ET report.

Bora, who served as the chief operating officer, had also left the company. DealShare is currently in the process of relocating its non-tech functions to Gurugram.

As of March 2022, Rao had an 11.7% stake in the company, while Bora held around 3.2%.

Founded in September 2018 by Sourjyendu Medda, Vineet Rao, Sankar Bora and Rajat Shikhar, DealShare enables first-time internet users to shop online.

The startup entered the coveted unicorn club early last year after it bagged $165 Mn in Series E funding round from Dragoneer Investment Group and Unilever Ventures, along with its other existing investors. It later raised $45 Mn from ADIA, further catapulting its valuation to over $1.7 Bn.

Earlier this year, DealShare decided to shut its business-to-business (B2B) operations, sacking more than 100 staff across the vertical.

At that time, DealShare said it was moving its operations to Gurugram and consolidating its business to focus on Jaipur, Delhi NCR, Lucknow and Kolkata markets.

“We also took a conscious decision to focus on B2C business at this point to stay relevant to our consumers in the market. We have taken decisions of realigning our budgets, reorganising teams and locations etc.,” a company spokesperson said in a statement.

Prior to this recent round of layoffs, DealShare had already let go of approximately 100 employees in January, constituting around 6% of its workforce. This move was aimed at reducing the company’s burn rate and working towards achieving profitability.

DealShare’s loss widened 543% to INR 431.1 Cr in the financial year 2021-22 (FY22) from INR 67 Cr in FY21 due to its growing business and the associated cash burn. Its revenue from operations grew more than 8X to INR 1,932.8 Cr in FY22 from INR 236.7 Cr in FY21.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.