Cryptocurrencies are a clear danger. Anything that derives value based on make believe, without any underlying, is just speculation under a sophisticated name: RBI Governor

Cryptocurrencies are ‘medium’ systematic risk to the economy and the crypto-asset ecosystem is a ‘growing threat’ that warrants drastic approaches, RBI report

The central bank also stressed the need for further examination of the crypto space and its impact on traditional financial institutions

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

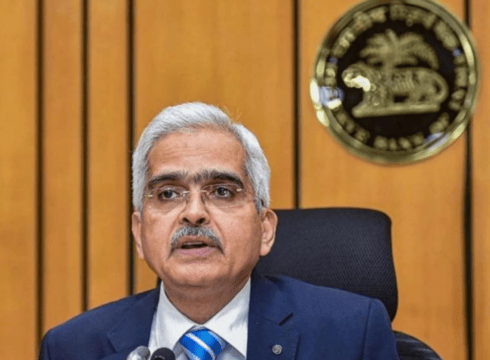

Reserve Bank of India Governor Shaktikanta Das has termed cryptocurrencies a ‘clear danger’, adding that anything that derives value based on make believe is ‘just speculation under a sophisticated name’.

In his foreword to the 25th issue of the Financial Stability Report (FSR), released on Thursday (June 30), Das said that technology has the potential to disrupt financial stability and called for special attention to tackle cyber risks.

“…we must be mindful of the emerging risks on the horizon. Cryptocurrencies are a clear danger. Anything that derives value based on make believe, without any underlying, is just speculation under a sophisticated name. While technology has supported the reach of the financial sector and its benefits must be fully harnessed, its potential to disrupt financial stability has to be guarded against,” the governor said.

The central bank also stressed the need for further examination of the crypto space and its impact on traditional financial institutions.

The report tagged cryptocurrencies as ‘medium’ systematic risk to the economy and described the crypto-asset ecosystem as a ‘growing threat’ that warrants drastic approaches by national authorities.

“Cryptocurrencies are not currencies as they do not have an issuer, they are not an instrument of debt or a financial asset and they do not have any intrinsic value. At the same time, cryptocurrencies pose risks,” the FSR said.

Money Laundering And Other Concerns

The central bank also said that cryptocurrencies can result in ‘dollarisation’ of the economy and impair financial stability. It also added that such digital assets may undermine sovereign control over money supply and weaken exchange rate management.

Reiterating the government’s stance, the central bank also highlighted concerns related to money-laundering. “Cryptocurrencies, typically created on decentralised systems, are designed to bypass the financial system and all its controls, including anti-money laundering /combatting the financial terrorism and know your customer (KYC) regulations”, noted the FSR.

Highlighting other issues, the report said the growth of cryptocurrencies can circumvent restrictions on exchange rates and capital controls, adding that it can limit the effectiveness of domestic monetary policy transmission.

The FSR also said that any issues such as crypto price-crashes could spill over to payment systems and adversely affect real economic activity.

With regards to crypto asset markets, the report highlighted a slew of concerns such as liquidity mismatch, credit and operational risks, lack of regulatory oversight of the sector, among other issues.

The report also called for closely monitoring stablecoins. “The risks from stablecoins that claim to maintain a stable value against existing fiat currencies require close monitoring, in particular – they are akin to money market funds and face similar redemption risks and investor runs because they are backed by assets that can lose value or become illiquid in times of market stress.”

The RBI also observed that many central banks across the globe are not looking at offering interests on central bank digital currencies (CBDCs). The RBI concurred with a host of central banks and said it is uncertain about imposing limits on CBDC transactions to counter disintermediation risk.

Disintermediation refers to cutting out the intermediary. As noted by the US Federal Reserve, offering interest on CBDC could serve as a substitute for banks, with more people opting for it. Such a scenario could potentially disintermediate banks and this shift could then subsequently decrease potential credit availability and increase credit costs.

The report further hinted that India could formulate its own unique risk mitigation strategy while designing its Digital Rupee CBDC.

The report also estimated that the market value of crypto assets grew tenfold between early 2020 and late 2021, peaking at close to $3 Tn. It, however, added that the value has since seen a sharp decline, falling below $1 Tn in June this year.

The central also noted that the degree of ‘cryptoisation’ is limited’ and cautioned against other evolving risks. “The risks from crypto assets to financial stability appear to be currently limited as the overall size is small (0.4% of global financial assets) and their interconnectedness with the traditional financial system is restricted. The associated risks are, however, likely to grow as these assets and the ecosystem supporting their growth are evolving,” said the FSR.

The report comes a day before 1% TDS on crypto transactions comes into effect from July 1.

Amidst a lack of regulatory clarity, some of the leading Indian crypto exchanges such as CoinDCX have restricted basic features such as crypto deposits and withdrawals.

The Indian crypto industry continues to reel under pressure over a slew of reasons such as 30% tax on income from crypto transactions as well global factors such as Luna selloff that has sent prices of cryptocurrencies plummeting.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.