It did not reveal the total number of employees benefiting from the buyback plan

CoinSwitch plans to hire across levels and double headcount by the end of calendar year 2022

It further plans to add other asset classes and financial products on its platform

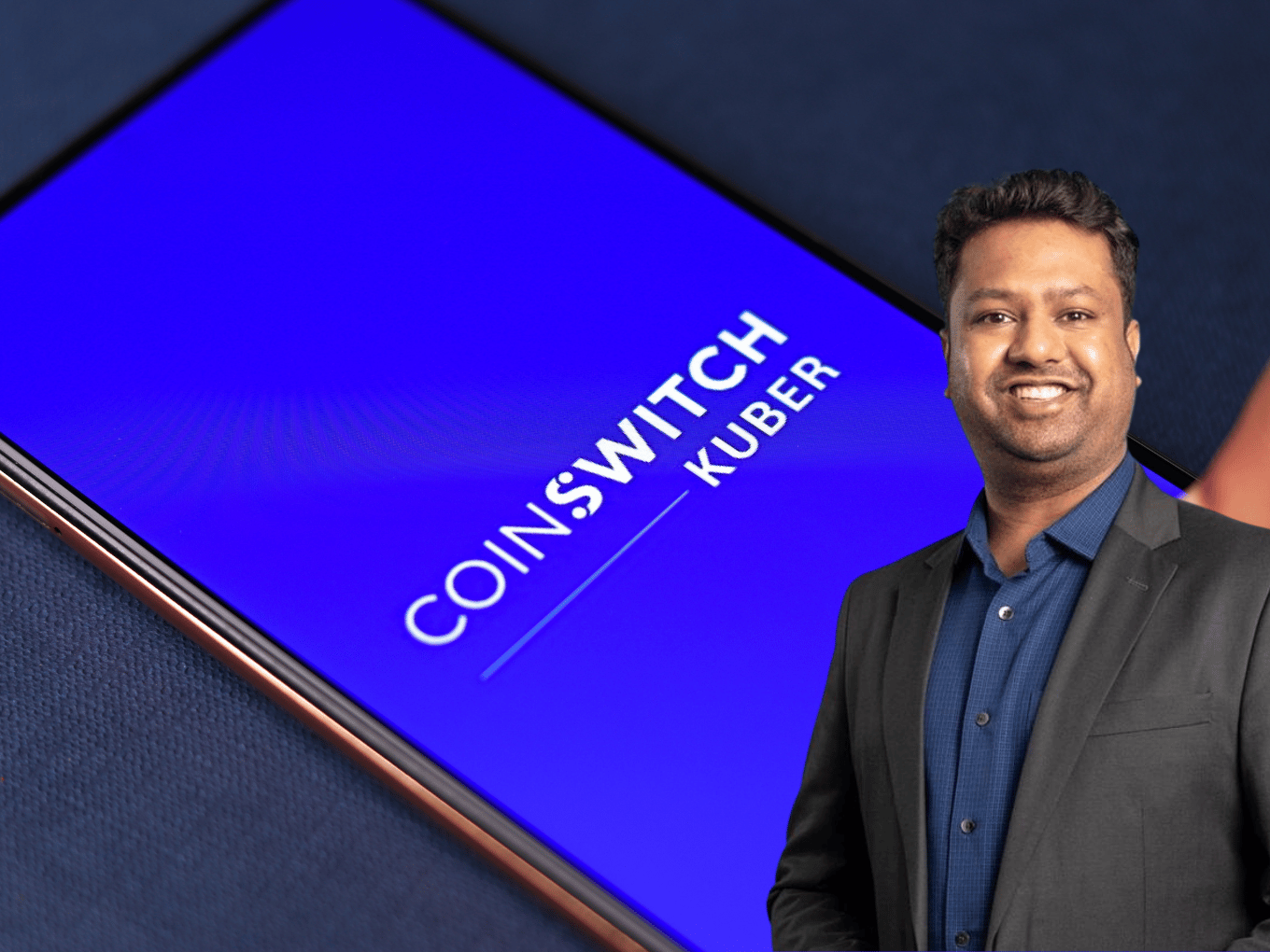

Crypto unicorn CoinSwitch has completed its first-ever employee stock ownership buyback plan (ESOP) worth $2.5 Mn (approx. INR 19 Cr.) within 20 months of its operation in India.

According to Ashish Singhal, cofounder and CEO at CoinSwitch, the equity buyback program is a ‘small effort’ to acknowledge its employees’ contribution to the phenomenal growth of CoinSwitch, which has recently joined the unicorn club in India.

The startup did not reveal the total number of employees benefiting from the buyback plan. However, the number is expected to be small since most of the hiring activities have happened over the last year and ESOPs that was given to most employees are yet to vest, said a CoinSwitch spokesperson to Inc42.

On the other hand, CoinSwitch’s headcount has grown from 20 to 500 in less than two years of its presence in the country with the crypto unicorn crossing the 500 employees mark in March this year.

CoinSwitch announced closing its Series C funding round at $260 Mn at a $1.9 Bn valuation in October 2021. The round was led by Coinbase Ventures and Andreessen Horowitz (a16z).

The startup is also backed by some other reputed investors such as Tiger Global, Sequoia Capital, Ribbit Capital, Paradigm and Coinbase Ventures.

“We are hiring across levels and looking to double our headcount by the end of calendar year 2022,” added Singhal.

Singhal, along with Govind Soni and Vimal Sagar founded CoinSwitch in 2017 as a global aggregator of cryptocurrency exchanges and launched its India exclusive crypto platform, CoinSwitch Kuber in June 2020 with an aim to simplify crypto investments for Indian retail investors.

The startup currently claimed to have 15 Mn registered users on its platform. It said that between January 2021 and January 2022, CoinSwitch’s registered user base grew from a little more than 1 Mn to 15 Mn.

“We meet and exceed our targets in India because of the amazing team and shall continue to launch similar liquidity events as part of our commitment to creating wealth for all,” said Singhal.

The startup now plans to add other asset classes and financial products on its platform to become the wealth-tech destination for every Indian.

However, CoinSwitch is not the only one seeing bright days in India. In fact, with crypto investment taking a pole position in the country, especially among the millennials, its peers such as crypto exchanges CoinDCX and WazirX are also witnessing a surge in trading volumes and user signups since 2020.

Recently, WazirX has unveiled ‘BUIDL With WazirX’, which would allow crypto entrepreneurs to build their own exchange, according to a press statement. With BUIDL, a crypto version of the term ‘build’, WazirX plans to help aspiring crypto entrepreneurs navigate the landscape.

Crypto Market In India

Today, India is one of the largest-growing cryptocurrency markets in the world. A last year’s cryptocurrency report by Chain analysis found that India’s crypto market grew 641% between July 2020 and June 2021. The report said that India also has a much bigger share of activity taking place on Decentralised Finance (DeFi) platforms in comparison to countries such as Vietnam and Pakistan.

As per the report, Joel John, a principal at cryptocurrency investment firm LedgerPrime estimated that there are 4 times as many cryptocurrency investors in India as there are equity investors.

With about 20 Mn Indians actively involved, cumulative investments in cryptocurrencies in India jumped to more than $10 Bn in November 2021 from $1 Bn in 2013, according to crypto intelligence and research platform CREBACO.

After Finance Minister Nirmala Sitharaman addressed a slew of confusions around crypto taxation and proposed a 30% tax on income from digital assets in the latest budget session, crypto investors in a way have been better assured of crypto coming closer to the regulations in India.

The fear around crypto facing a ban in the country has now also taken a backseat.

Ad-lite browsing experience

Ad-lite browsing experience