The acquisition is part of LoanTap's plans to expand presence in the healthcare finance space and also, provide affordable financing options for healthcare needs

The acquisition will also enable LoanTap to leverage Unofin's network of hospitals, clinics, and medical equipment suppliers by offering customised financing solutions

The development comes almost two months after LoanTap secured $2.6 Mn debt funding from Lighthouse Canton

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Lendingtech startup LoanTap has acquired healthcare-focused fintech startup Unofin for an undisclosed amount.

The acquisition is part of LoanTap’s plans to expand presence in the healthcare finance space and also, provide affordable financing options for healthcare needs. The deal will also enable LoanTap to leverage Unofin’s network of hospitals, clinics, and medical equipment suppliers by offering customised financing solutions to these entities.

As part of the acquisition deal, LoanTap further plans to introduce an array of products such as equipment financing, working capital loans, and term loans to healthcare professionals and institutions.

The development comes almost two months after LoanTap secured $2.6 Mn debt funding from Lighthouse Canton.

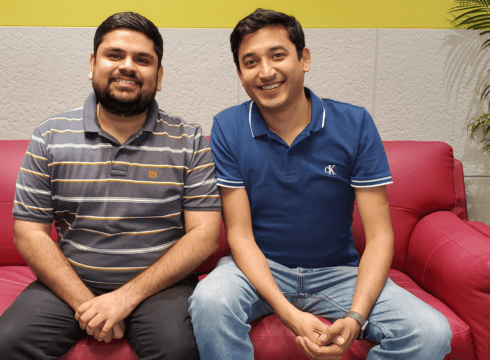

Founded in 2016 by Satyam Kumar and Vikas Kumar, LoanTap offers customised loans to individual customers. It also operates an in-house RBI registered NBFC.

“This acquisition is a strategic move for us to expand our product offerings and tap into the immense potential of the healthcare sector. We believe that healthcare financing is a niche segment with tremendous growth potential. Unofin’s deep understanding of the industry will help us create innovative solutions that cater to the unique needs of healthcare professionals and institutions,” said Satyam Kumar, CEO and cofounder of LoanTap.

LoanTap has raised more than $29 Mn in funding to date from a bunch of investors including Tuscan Ventures, Kae Capital, 3one4 Capital, Blacksoil Advisory, Shunwei Capital, India Quotient, AVANA Capital.

Unofin, which was founded in 2018 by Tushar Aggarwal and Soumya Arora, offers healthcare-focused loans to consumers residing in Delhi NCR, Jaipur and Chandigarh.

“We have a physical distribution network of over 1600 healthcare service providers in 7 cities combined, but now with LoanTap’s digital capabilities, we will be able to reach a much larger customer base and provide them with seamless access to credit. Together, we will be able to offer customized financial solutions to healthcare professionals and institutions that will help them to grow and expand their operations,” said, Tushar Aggarwal, cofounder and CEO of Unofin.

Unofin claims to have partnered with more than 1600 hospitals in seven Indian cities. It further asserts that it has disbursed loans up to INR 120 Cr and served over 12K customers so far.

Indian fintech startups have lapped up over $24 Bn investments between 2014 and 2022. The country’s fintech sector is currently home to 22 unicorns and 33 soonicorns. The segment is expected to grow at a CAGR of 18% to become $2.1 Tn by 2030, according to the Inc42 report.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.