![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years](https://inc42.com/cdn-cgi/image/quality=75/https://asset.inc42.com/2020/11/Webp.net-compress-image-2020-11-23T173309.374.jpg)

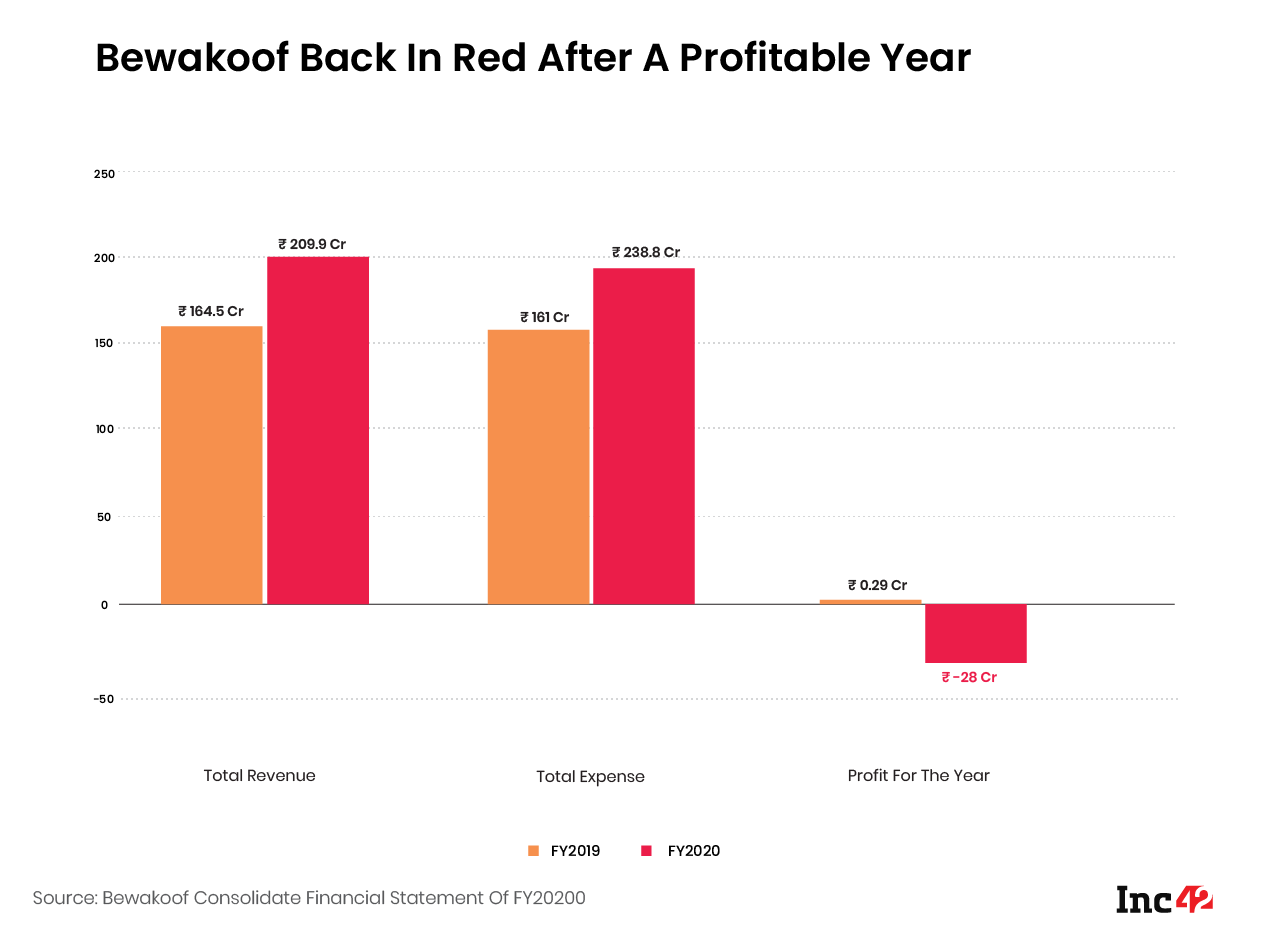

Bewakoof has earned INR 209 Cr with a loss of INR 28 Cr in FY2020

Prior to this, the retailer had registered its biggest loss in FY2015 of INR 2.5 Cr

CEO Prabhkiran Singh explained that the losses are a result of company’s spending on branding and talent

What The Financials

Inc42 unveils and deciphers all the important financial metrics of Indian startups across industries. Find out revenues, unit economics, profit & loss and all the important financial metrics to judge how the startup will perform in the coming years.

After a profitable sprint in the last three years, online retailer Bewakoof is back in the red in the financial year 2020 that too with the highest margins yet. The Thane-based company recorded a loss of INR 28 Cr in the financial year ending in March 2020, compared to the INR 29 Lakh profit it recorded in the last financial year.

Bewakoof’s cofounder and CEO Prabhkiran Singh explained that the company spent heavily on branding and acquiring talent in FY2020, keeping in mind the company’s long term growth. Though Bewakoof’s sales were almost zero in the first quarter of FY2021 between April and July, it will turn profitable again this year.

The company had noted a profit of INR 2 Cr and INR 30 Lakh in the FY2018 and FY2017, respectively. Prior to this, the retailer had registered its biggest loss in FY2015 of INR 2.5 Cr with a revenue of INR 14.5 Cr. With this precedent spike in losses in the latest financial year, the company has also grown its revenue by 5.5x from INR 38 Cr recorded in FY2017.

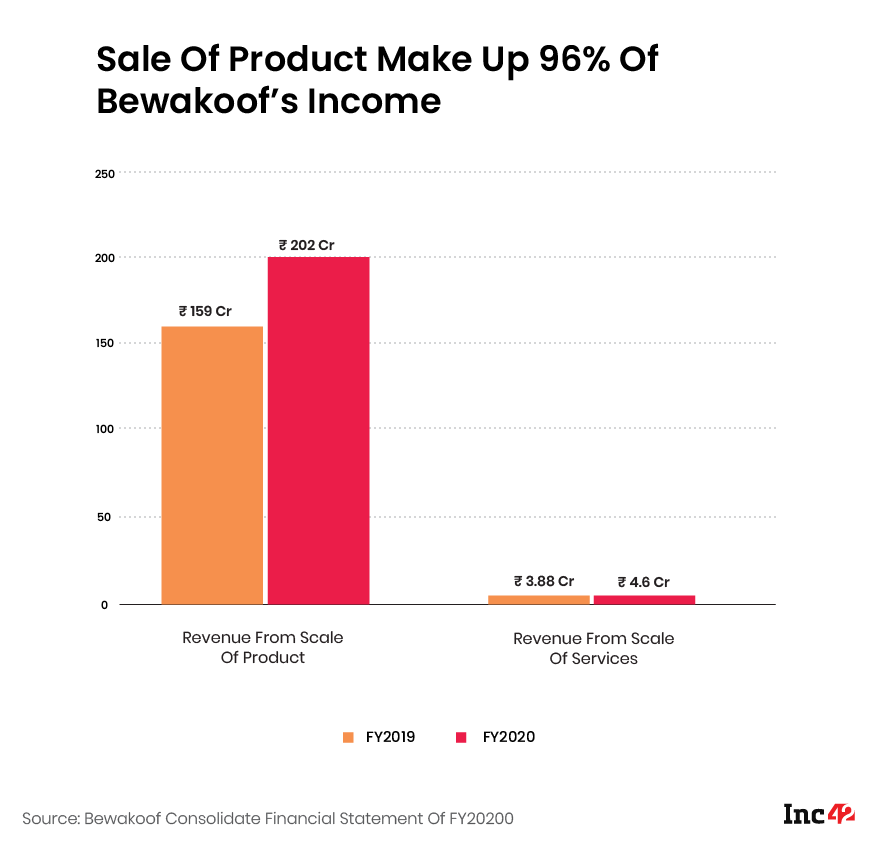

In FY2020, Bewakoof recorded a revenue of INR 210 Cr. Of this, the company has earned nearly INR 202 Cr through the sale of products, INR 4.6 Cr from the sale of services, and INR 2 Cr as other operating revenue and income. The spike in revenue was majorly due to the increase in customers and selections coming on board, Singh said.

Compared to FY2019, the company’s earnings have increased by 28% from INR 164 Cr. Like the latest financial year, Bewakoof had earned more than 96% of its income by selling its products. The sale of services made for another 2.5% in both FY2019 and FY2020. While other operating revenues and other income have contributed the remaining 2.5%.

“20% of our overall revenue comes from purchases made by Bewakoof Tribe Members, which is a paid loyalty program of Bewakoof. INR 4.6 Cr service revenue includes revenue generated from the Bewakoof Loyalty Program – Bewakoof Tribe and from the Cash Collection Charges, which are levied on the Cash on Delivery Orders,” Singh explained.

With INR 100 Cr In Pocket, Bewakoof Serves More Than 2 Cr Users

With INR 100 Cr In Pocket, Bewakoof Serves More Than 2 Cr Users

Bewakoof started its journey in 2012 by focusing solely on theme-based T-shirts. The company, which was founded by Prabhkiran Singh and Siddharth Munot, later branched out into other categories such as hoodies and sweaters, joggers, pants and trousers, footwear, mobile covers, notebooks, backpacks, and now masks and PPE kits. The company has found its target audience in the young millennials and Gen-Z. According to the company’s website, it has sold more than 2 Cr products and has about 1 Cr app downloads. The retailer sells most of its merchandise through its website and mobile application.

The online retailer has less than INR 100 Cr from investors across two rounds. It had last raised INR 80 Cr from Bahrain’s alternative asset manager Investcorp in exchange for a 14% stake. It was looking to use the funding to further strengthen its platform and capture consumer data to improve their experience on the website by using machine learning. Prior to this, it raised an undisclosed amount in seed round from Snapdeal founders’ Kunal Bahl and Rohit Bansal and founder of Sixth Sense Ventures Nikhil Vora back in 2015.

Where Is Bewakoof Spending?

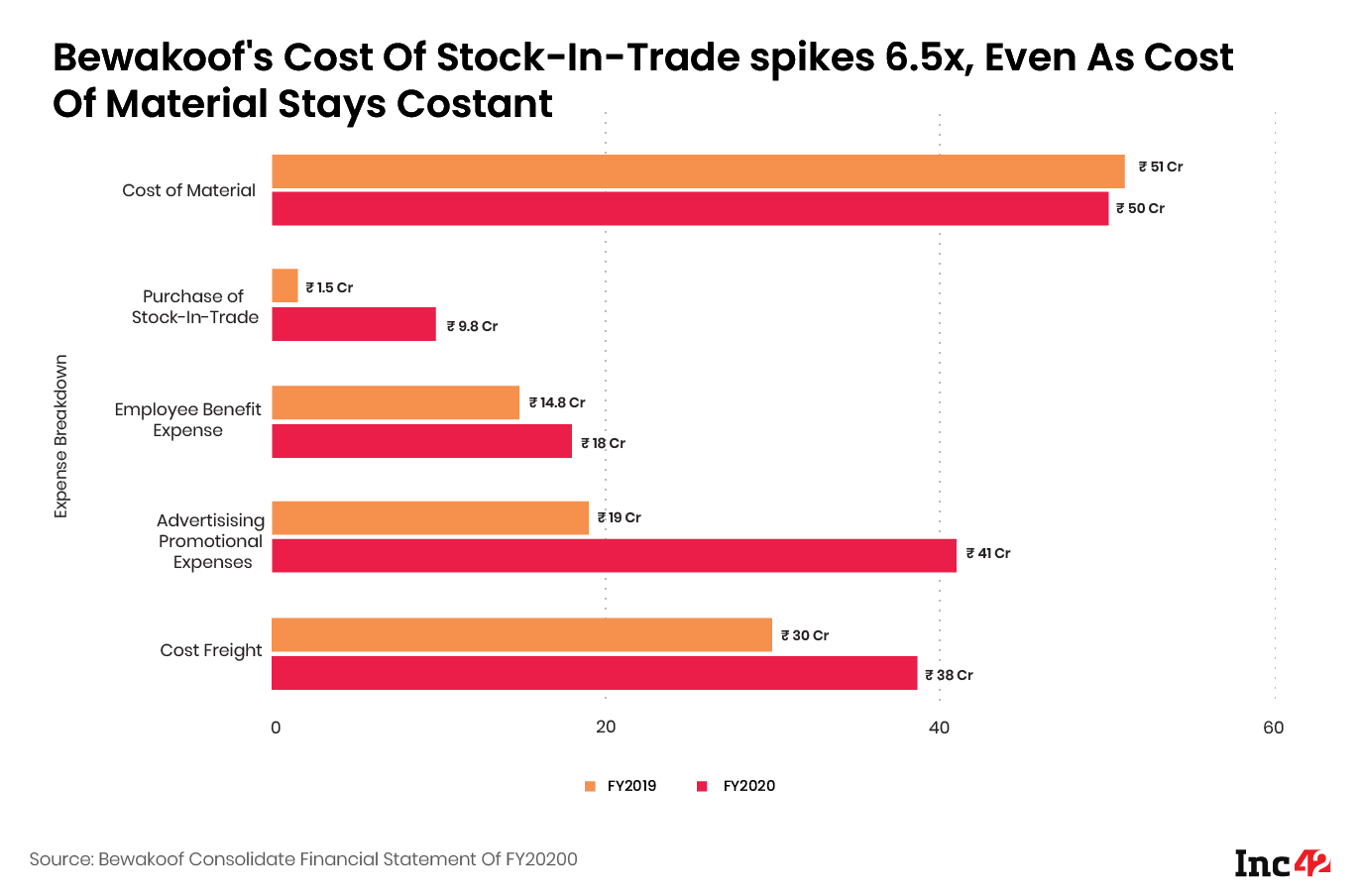

With great sales, comes greater expenses. Over the last financial year, Bewakoof sold more than 75 Lakh products in FY2020, which led to a 5x growth in its purchase of stock-in-trade. While the company had spent only INR 1.5 Cr on such purchases in FY2019, it grew to INR 9.8 Cr in FY2020. However despite the spike, the company’s spending on cost of material reduced by a crore to INR 50 Cr in FY2020.

Another major area of spending for a consumer-facing brand like Bewakoof was its marketing and promotional expenses. The company spent about INR 41 Cr on advertising, almost doubling up its spending from INR 19 Cr in FY2019. This had led to an increase of 15 Lakh customers in FY2020 compared to FY2019.

Besides this, the company’s employee benefit expense has also increased by 21% from INR 14.8 Cr in FY2019 to INR 18 Cr in FY2020. The company attributes this increase to the major hirings the company has made over the last fiscal year.

“Among some of the important senior positions – We have been able to attract Technology Head from Amazon, Manufacturing Head from Page Industries(Jockey), Design Head from Levis, Sourcing from TataTrent(Westside) and Vishal Megamart, HR Head from United Colors of Benetton, CFO from Purplle,” Singh told Inc42.

According to Bewakoof’s financial statements for FY2020, the company paid INR 17.2 Cr as salaries and wages compared to INR 13.5 Cr spent in FY2019. Besides this, the company also spent INR 53.8 Lakh as staff welfare expense, INR 3.70 Lakh as gratuity and INR 53.4 Lakh as a total contribution to provident and other funds in FY2020.

The online retailer also spent INR 55 Cr as a miscellaneous expense, which includes job work charges, contract labour expenses, carriage inward, royalty, commission expense, and a net loss of sale or discard of property, plant and equipment.

With INR 100 Cr In Pocket, Bewakoof Serves More Than 2 Cr Users

With INR 100 Cr In Pocket, Bewakoof Serves More Than 2 Cr Users

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![[What The Financials] Bewakoof Back In Losses After A Profitable Run Of Three Years-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience