SUMMARY

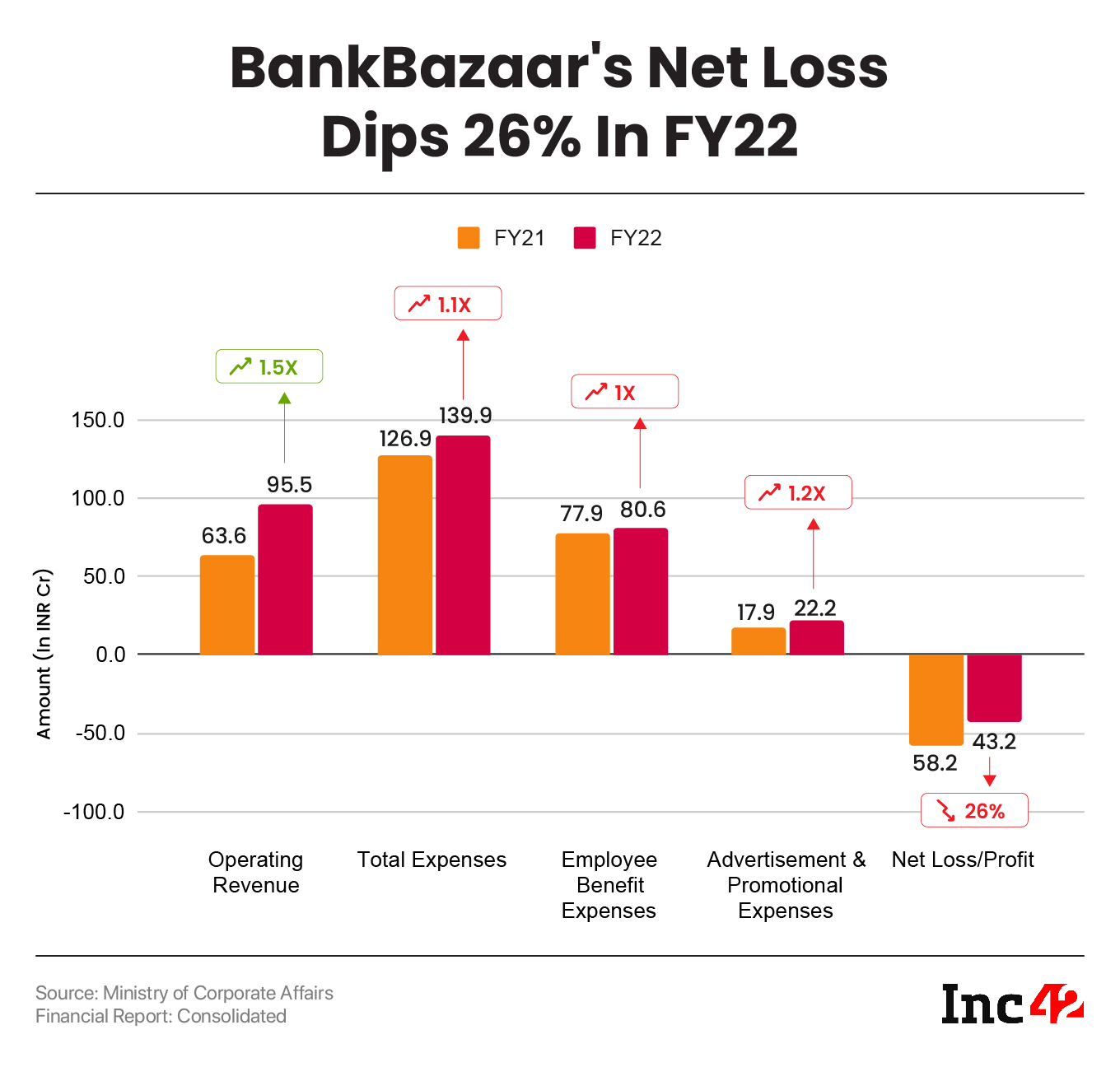

BankBazaar was able to control the rise in expenses relative to the increase in revenue, which helped it narrow its net loss from INR 58.2 Cr in FY21

The startup’s operating revenue jumped 50% to INR 95.5 Cr in FY22 from INR 63.6 Cr in FY21

EBITDA margin improved to -38.3% in FY22 from -69.7% in FY21

Chennai-based fintech startup bankbazaar

The co-branded credit card issuer’s revenue from operations jumped 50% to INR 95.5 Cr in FY22 from INR 63.6 Cr in FY21.

The startup’s revenue from operations mostly comprises commission that it earns from banks. Besides being a credit card issuer, BankBazaar also allows its users to check their CIBIL score for free.

The startup’s total income, including other income, zoomed 41% to INR 96.7 Cr in FY22 from INR 68.7 Cr in the previous fiscal year.

It was able to control the rise in its expenses relative to the increase in revenue. Total expenditure rose only 10% to INR 139.9 Cr from INR 126.9 Cr in FY21.

At INR 80.6 Cr, employee benefit expenses accounted for the biggest portion of total expenditure in FY22. BankBazaar’s employee benefit expenses, which comprise employee salaries, PF contributions, gratuity, among others, stood at INR 77.9 Cr in FY21.

The startup spent INR 22.2 Cr on advertisement and promotional activities during the year under review, a rise of 24% from INR 17.9 Cr in the previous year.

EBITDA margin improved to -38.3% in FY22 from -69.7% in FY21

BankBazaar, founded in 2008 by former Deloitte Touche Tohmatsu executive Adhil Shetty, former Amazon executive Arjun Shetty and former Kraft employee Rati Shetty, provides information about financial products like credit cards, car loans, personal loans, education loans and more on its website.

The startup intends to go public by 2024. It has raised a total funding of $115 Mn across multiple rounds to date. It is backed by the likes of Peak XV Partners, Amazon, and Experian Ventures.

Ad-lite browsing experience

Ad-lite browsing experience