Before 3000 BC, we walked ourselves everywhere. Somewhere around 3000 BC, this got partially automated with the first horse getting domesticated. Then who could, rode, rest walked.

For another 1,200 Years, this would be it, till the Egyptians design and attach a carriage in 1800 BC. For Next 1800 Years, this remained popular and then disappeared for a 1000 years to reappear in 1300 AD.But in the next 600 years, a bunch of inventors and engineers created the internal combustion engine and it became automated- Mobile. People could travel more in the same time and didn’t need as much caring. As a result, now horses are not as abundantly employed. They just didn’t make economic sense anymore.

But in the next 600 years, a bunch of inventors and engineers created the internal combustion engine and it became automated- Mobile. People could travel more in the same time and didn’t need as much caring. As a result, now horses are not as abundantly employed. They just didn’t make economic sense anymore. Horses lost their jobs and the Carriage drivers simply became Cab Drivers.

Horses lost their jobs and the Carriage drivers simply became Cab Drivers. There are more cab drivers today than carriage drivers 200 years ago.Now the next wave of automation is catching up.

Now the next wave of automation is catching up.

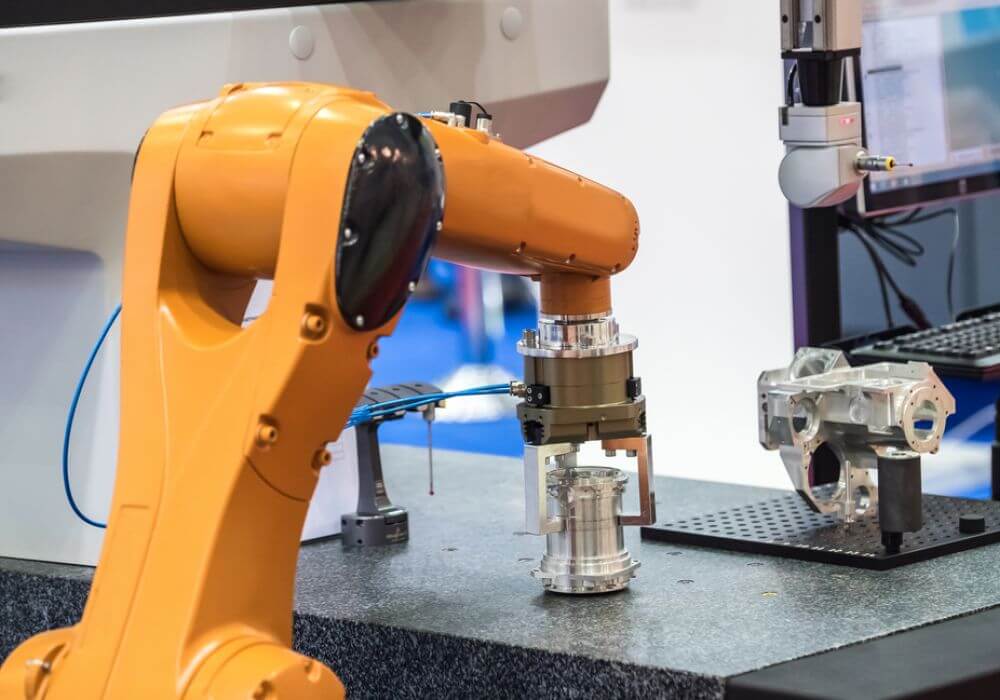

The Next Wave Of Automation

The carriage driver from yesterday who thrived after becoming a cab driver is the new horse in the age of a driverless car.

Engineers are the new age cab drivers building software and hardware that drives the car. They will multiply and thrive for the next 30 years, till the next layer of artificial intelligence kicks in with capability to write code and fix itself and propagate comes in.

This simple illustration is a familiar thread that’s poised to happen across the world and multiple fields, and there is a deep reason why it will happen and it needs to happen.

From the 1800s to 2017, our population grew 6X, but the economic activity became 60X thanks to the industrial revolution. Looking at it from an extended timeline, we may probably be in an economics version of the Moore’s law.

Growth in the last 200 years was not evenly spread. We picked up slowly, gathered some speed and have been picking up more speed since then. This growth has been mostly following a logarithmic scale.

Which means we did more in last 50 years than in 150 years before it. In comparison, what took us 200 years to achieve, theoretically should be achievable in the next 50 years now. But that might not happen by itself. What got us here, will not take us there.

You would have been called an absurdist if you predicted a 60X growth 200 years ago. Today we might just need to do a 60X in next 50 years. Do you see the world economy grow 60X in the next 50 years?

David Attenborough famously quipped “Anyone who believes in indefinite growth, on a physically finite planet, is either mad or an economist”.

There is a good reason for that. Capitalistic economies grow by falling forward more like a snowball rolling off a mountain gathering speed and mass. Like a snowball there is always a looming threat that it might run out of road and will collide and destroy itself. The road for capitalistic economies is growth.We have seen what happens when this growth is threatened in small samples every 12 years or

We have seen what happens when this growth is threatened in small samples every 12 years or so-called economic depression. Since most of the growth is not absolute but valuations, which are just opinions of what a person is willing to pay, it’s very fragile. A house might be valued at INR 1 Cr today, and if the market crashes and the same is now valued at INR 80 Lakhs!

A Simple Calamity Can Depress Valuations And Erode Capital

While growth and valuations are simply a matter of opinions stacked on top of each other. Debts are very real. If you owe someone INR 1 Cr today, and the markets crash, you still owe them INR 1 Cr tomorrow. This creates a problem. We need a way to erode the debt just the way we erode asset valuations.

Mostly throughout history, debt has been eroded by write-offs, or wars. Write off means that the other person agrees he may not realise the money or realising the money is too costly.

Write-offs don’t happen as easily as the loan can be carried off on the books for quite some time, and often leads into lucrative contracts. For instance, have a look at Brazil. In 1990s, Brazil was felling off trees the size of Belgium every year, with all the money going in to pay off national debt. Most of the wood and the contract was given to nations which has also loaned it the money.

Write-offs follows loans, and loans are never given to a country which doesn’t have a collateral or their use in geo-political setup.

Wars are tougher as it means forcefully making the other country or government write off debt, or agree to a debt (to you) to offset your debts.

For instance after WW2, Japan promised to pay over $1.2 Bn as war repatriations and ceded control of territories worth over $24 Bn (figures vary from estimate to estimate). A similar sum was levied on Germany. Combined, this was roughly equivalent to 5% of world GDP in 1947 and today this figure would sound like $3.75 Tn. The majority of it went to the United States. With one stroke, US workers got work manufacturing war machines and soldiering and consuming, all of it paid by Germany and japan. Japan lost 50% of its cities, which were again built by US businesses with a huge line of extended credit.

War has some of the most brutal economics behind it. This is the reason most of the wars happened. To seek natural resources which can be processed and made into valuable products. To erase debt by force. To extract economic gains. Be it oil or favourable trade terms.

Another method of growth is growing consumption, which is a peacetime activity. Like war, consumption brings scarcity, which grows valuations, which makes more people work to reap profits and grow the overall pie.

After 200 years of the industrial age, we are now at a place where the world debt is three times the world GDP. This means unless we speed up the means of production and consumption by over 3 times and cover the gap, economies will start shrinking.

Governments and people will not be able to repay loans. One of two possible things will happen. Either there will be wars to balance the books, or there will be write-offs and economic doom.

We have seen a world threatening war every decade or so and the next one might already be building up. If recent happenstances are anything to go by, Kim Jong Nam’s murder, North Korean missile tests and posturing by US are a very familiar buildup we have seen happen in Iraq as well. The vultures are already circling. They haven’t dived yet because there is very little meat to pick on a country like North Korea. Most of the gains would be around increased justified military spending. No trillions of dollars of repatriations there in oil or contracts to build in one of the coldest countries on earth.

So, to avoid this spectre a healthily growing world economy with massive production and consumption is the need. We need to reach the next 60X and the next and the next. No One knows how.

This Problem Is Very Malthusian

He also had a problem which was very real and kept economists depressed for a really long time. In 1798, Malthus saw that if the economic stability remains, people will grow rich, grow more kids and the earth simply will not be able to sustain. His simple calculation showed that while population grew exponentially, the means of growing food and resources grew arithmetically.

At some point, the world was supposed to run out of food. Science came to the rescue and stopped wolves at the gate. But created another problem. Science combined with economics, capitalism and democracy is a hungry Djinn, which just wants growth and more growth. It’s a snowball down a mountain, which needs more and more running space, else threatens a crash. There is a constant need to grow, else people lose jobs and food security and debts rise and governments fall.

Here, is where economics faces its challenge. Humans cannot work 24 hours a day. They don’t improve daily. There is a biological limit. Reaching 60X growth required immense sacrifice from the human race, simply because Humans are less productive than machines. If we have to achieve more, we need more people to work.

The First Jobs That Were Created Are The First To Be Automated

So economists and marketers have pushed for increased liberalisation on a global level and laws to multiply the number of people and households in the job market. Slaves were set free in 1870’s US, increasing the number of households immediately. Women were allowed to work freely and divorce laws relaxed around 1920’s. Every country that has allowed women to work has done so before it has allowed women to vote.

It’s another matter that the first jobs that women picked up were also the first jobs that were mechanised and are now being automated. Women, as a demography, are under tremendous pressure as the most of the traditional job roles are facing extinction from automation, and the automation proof profiles haven’t opened up as quickly. Say Hello to Siri your personal digital assistant!

For an economist, a united family is one family with one TV and one Washing Machine. One divorce, and poof, you have two houses, two washing machines and two of everything.

People are working harder, buying more things to find happiness and keeping engaged and entertained all the while consuming more.

People have never needed so much of stuff ever before to be happy. But now it’s an economic necessity to convince them that buying more stuff will make them happier. Happiness lies just right there in the next iPhone or the next chocolate bar and the new TV show. We have managed to remove every single human to human interface with a human-technology-human interface. Be it a phone or a social media account or a video call. Marketers managed to convince us that this was same as the real thing, and in some ways better.

This increased consumption puts the government in a tough spot. Governments are tasked with protecting nation’s financial and physical security, but also have to balance out their social responsibilities of keeping citizens happy and healthy. Its not just you who might be in a Rat race, Governments too are in a giant Rat Race, with entire nation’s future at stake.

So for now, most governments favour production which leads to consumption and act as wealth redistribution agents by focusing on taxes. More taxes means better weapons, infrastructure and a higher standard of living for the poorest.

Once the economic growth takes off, the next step focusses on widening the tax base, then bringing efficiency in tax collection and then liberal laws to increase the working population. In the US, working women started increasing from 1920’s and IRS bared its teeth in 1931 by arresting Al Capone. India’s GDP adjusted for inflation matches US GDP from around 1933.

Consumption Versus Growth

Growing GDP by making people work has its set of challenges. They need to be healthy. They need to be educated so that they can be trained. A part of the population needs to be set aside to maintain law and order and cultural activities and entertainment. All of these are costs of doing business.

The only thing humans are really good at is consumption. But to consume, you need to pay and to pay you need to earn.

People also have too many demands around work environment to keep them productive and happy compared to machines. These demands are protected by labour laws, which are protected by governments which, again, are largely people.

Just as Malthus couldn’t have foreseen that we would be able to control our population by birth control or will be able to use machines to till the land and use fertilisers to grow more food, we at present are not able to see a lot of solutions which will take shape to solve the problem of production.

So how to grow production, after all of the above has been done?

When Computers And AI Could Be The Answer

In the immediate sense, it does pose a threat of heavy job losses. Very similar to what happened 200 years ago, when industrialization took over. But similar to industrialisation, the gun of automation may very soon be turned to commodities where businesses anyways didn’t have much margin, with people moving on to different things which are higher up the value chain.

Except there is a little difference. This time, the automation is likely to hit and transform much larger population at a much faster pace than what we have seen before. This means that people might not get time or resources to upgrade themselves.

Simply being literate or having a graduation degree in an obscure subject might not cut it.

The only scenario that might play out where automation doesn’t take away jobs is if governments artificially slow automation by taxation, licensing and protectionist laws. But that only works for geographical boundaries. You can’t stop a local business from automating using international technology.

Whatever the event, there will definitely be casualties in terms of job losses, economic depression and general disillusionment. Every drastic economic event has seen organised religion take hold and right wing politics grow. If you haven’t noticed, the largest democracies of the world like the US, India, Germany, Japan, already have Right wing governments with France, Netherlands, Sweden, Denmark soon expected to become so.

Automation will make things cheaper, and there is no doubt about it. A good development to look for might be the rise of Africa inside the next 50 years. It’s important to notice that 29 of the top 30 countries with the youngest average population in the world are in Africa.

As the search for new consumers reaches critical mass and as liquid money from the west and from China makes way to Africa, as Indian middle class sees a new level of consumption never seen before, the picture might have to get some shades of colour.

Science Could Be The Answer

Our friend science always too keeps on working on these problems, and keeps dropping hints. On a micro scale, the rise of digital education and virtual reality might make learning new skills easier than before.

The recent growth in talks of automated cars, connected homes, artificial intelligence, genetics and private companies entering the space race to moon and Mars may be the preface that is being written for things to come. These technologies combined can allow us to go to the next planet, or set up an automated factory in a place like moon where there is hardly any atmosphere to pollute. May be all of this combine will create a situation where humans don’t need to work to live, with basic rights protected and paid for.

Being a Trekkie and seeing a fingerprint-based Aadhaar system grow, who knows if we will end up eliminating money altogether in 50 years like the world of Star Trek. I don’t know.

All I know is, we are just on the verge of turning a page. What we do in the next 5 to 10 years is going to define a long time to come. 50 and 100 years from now, all the dots would seem connected. But for now these look like very interesting and testing times.