In 2020, the share of installs of Chinese apps dropped to 29% in 2020, from 38% in 2019

Among the banned Chinese apps, gaming, food and finance apps witnessed highest uninstalls

85% of app installs came from Tier 2 and Tier 3 cities, revealed AppsFlyer

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

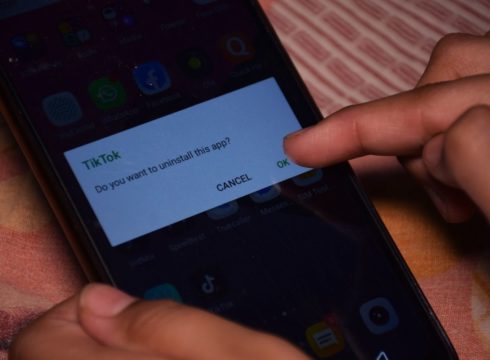

After the Indian government banned over 220 Chinese apps in the country, under Section 69A of the Information Technology Act last year, the tussle between India and China over the border tension seems to have taken a hit, particularly in terms of app uninstalls.

According to California-based mobile marketing analytics company AppsFlyer, the share of installs of Chinese apps dropped to 29% in 2020, from 38% in 2019. Indian apps, on the other hand, seem to have seized the opportunity by developing alternative apps, as their app install volume grew by 39% in 2020.

Further, the report revealed that China’s loss was also captured by apps from the US, Russia, Israel and Germany. Soon after the Chinese app ban, many products from these countries also expanded into India, thereby making in-roads into the India’s app market.

Despite the ban of these apps, several had reappeared through proxies, therefore, there was a need for continued monitoring and barring of multiple apps. Though the proxy sites were eliminated, the use of VPN to bypass banned Chinese apps remains a challenge.

The Indian government on a Chinese app ban spree started by banning about 59 apps, including TikTok, WeChat, followed by the second wave of 47 apps in July, which were proxies of the banned apps. On September 2, 2020, in the third wave of Chinese app ban, the Indian government had banned about 118 apps, which included the popular gaming platform PUBG as well as Bidu.

In the fourth wave, the government had banned 43 Chinese mobile apps, including the likes of Alibaba Workbench, CamCard and a host of dating apps among others.

Tier 2, Tier 3 Cities Account For Most Downloads

The AppsFlyer report revealed that the day one uninstall rates stood at 27% (marginally up from 26% last year, where gaming, food and finance app witnessed highest uninstalls which stood at 32%, 32% and 30%, respectively. Between January 1 and November 30, 2020, India recorded over 7.3 Bn installs, covering 4.5K apps across verticals.

Sanjay Trisal, country manager at AppsFlyer India told ToI that the app markets are increasingly expanding to cover Tier 2 and Tier 3 regions, as the demand from semi-urban areas is firing up India’s app consumption. It is said that around 85% of app installs came from Tier 2 and Tier 3 cities, where gaming, fintech and media and entertainment categories saw maximum downloads. Interestingly, the Indian app users continued to prefer apps that take up less space, consume less data and run smoothly in areas that have poor connectivity.

Further, Trisal said that most players in India are still in the nascent stages, where the focus is on acquiring new users over retention. “Without a retention strategy, companies are essentially spending resources with no benefit,” he added.

The study further revealed that for an average app, the overall retention rate across verticals fell this year by 12% as marketing budget was slashed due to the pandemic — the retention rate of apps was at 22.3% on day one, followed by a massive drop to 1.7% by day 30.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.