I would think continuous engagement with the startups is what is going to help them to remain and do better within India: FM Sitharaman

She said that the government’s doors are open for startups and that they are ready to address the issues

FM’s comments come at a time when a growing number of Indian startups have either departed from the country or are mulling moving their base to Dubai or Singapore

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

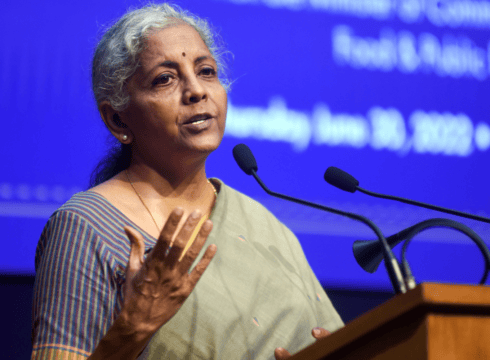

Commenting on the growing startup exodus from the country, Finance Minister (FM) Nirmala Sitharaman said that the government is ready to engage with startups to address issues facing the ecosystem.

“So I would think continuous engagement with the startups is what is going to help them to, one, remain and, second, do better within India. But, if there are temptations for which they would want to go outside, we need to understand how much we can entertain and serve on those courses. Not all of them are possible but equally, we can try,” said Sitharaman.

Noting that many Indian startups were moving their bases to Singapore and the UAE, Sitharaman said that the government’s doors were open for startups and that it was ready to attend to the demands of concerned stakeholders.

“I have engaged…with the startups to know what they want from India. And we kept as much as possible addressing their concerns,” she added.

Off To Dubai, Singapore

The Finance Minister’s statement comes at a time when a growing number of crypto startups have moved their bases to countries such as the UAE (Dubai) or Singapore. More than half a dozen Indian crypto startups have moved to Dubai, Delaware and the British Virgin Islands (BVI) amidst growing crackdown on crypto startups.

While many other startups are also mulling the move, the departure of these players could emerge as a major headache for the government. The exodus of these startups could lead to the brain drain, at least among the upper management, all while wreaking a big blow to the Indian startup ecosystem.

The players have been looking at Dubai and Singapore owing to their lax laws regarding emerging domains such as cryptocurrencies and some of the lowest corporate tax rates.

While the Indian government has been treading carefully with emerging areas, the RBI has issued a flurry of norms that has curbed emerging players in the domain.

While the central bank’s diktats on fintech (banning loading of non-PPI wallets with credit lines), cryptocurrencies and illegal loan apps have brought these startups under some kind of regulatory ambit, it has also increased compliance headaches for these emerging platforms.

The tightening regulatory screws has seen many startups such as Jupiter, EarlySalary and KreditBee wind up its prepaid cards operations. On the other hand, the fintech startup slice has pivoted to real-time term loans to avoid a crash and burn.

This has even spooked the investors that appear to be idly sitting on a lot of dry powder, avoiding investing in startups that could be in the line of RBI’s fire.

While the government has opened its doors for startups, it has not been reflected in its previous interactions with the industry bodies. In July, a futile attempt by the Indian Banks’ Association (IBA) saw the industry body seeking a six-month extension on implementation of new norms related to credit and debit cards.

A similar behind-closed-doors effort by a fintech body, seeking clarity on the purpose behind the PPI norms, also saw no resolution.

With authorities at a crossroads, it remains to be seen what will be the next approach taken by the government to reign in the growing exodus of startups from the country. Till then, it is anyone’s guess as to which way the tide will turn.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.