SUMMARY

SaaS, Media, Fintech, Healthcare, Consumer Goods were the most heavily funded sectors

More than usual deals happening in the Hardware/IOT segment

Drop in the number of early stage companies operating in the vertical ecommerce space

While 2017 was a year of correction for Indian startups showing a decline in the number of startups established in 2017 compared to that of 2016, 2018 rehashed the growth tune both in terms of the number of startups founded as well as the total funding to the startups. However, the funding, this year, remained limited to less number of startups compared to the previous year.

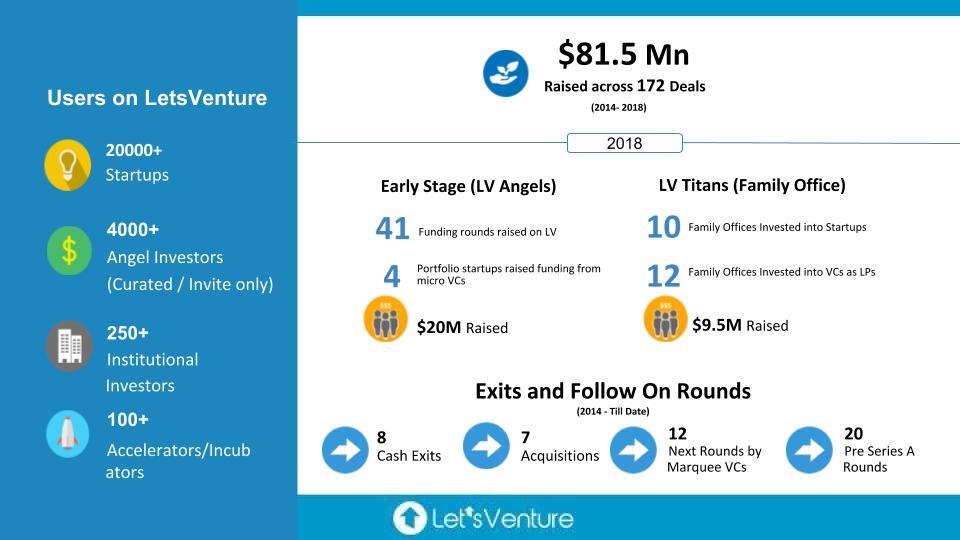

As we look back to 2018, we have created the analysis on the early stage space, with respect to the trends seen on the startup side, and investor side. The data analysis is based on the LetsVenture platform data and does not represent the overall ecosystem data. However with over 5000 startups that registered on LetsVenture in 2018, and the investor base growing by 1000, we believe it is a fair representation of the overall behaviour of trends seen in the Indian ecosystem.

The summary of what was achieved in 2018.

2018 Early Stage Startup Trends

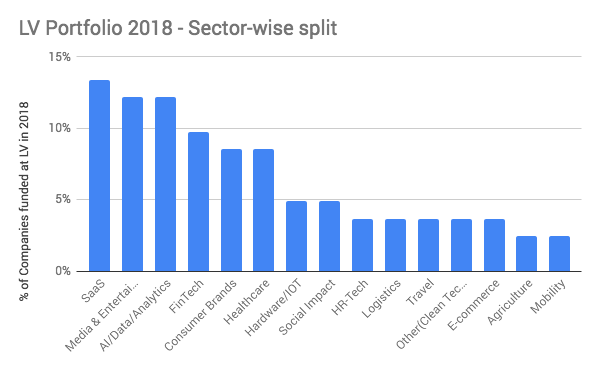

Sector split(% of companies):

- SaaS, Media, Fintech, Healthcare, Consumer Goods were the most heavily funded sectors comprising more than 50% of the funded companies. This is inline with the funded sectors in the market which has seen similar levels of funding in these sectors.

- Increased Digital Adoption: Was witnessed in payments, content & video by the Indian masses, matured products solving for Indian SMEs and enterprises and the need felt by enterprises to adopt digital tech to stay ahead of the curve.

- Hardware / IoT Starting To See Traction: We saw more than usual deals happening in the Hardware/IoT segment which traditionally has not been one of the hot favorites among the venture investors. This indicates the maturity on the investor side and the availability of patient capital required to drive innovation.

- New Themes Emerging: Hedge funds using AI, Intelligent apparel, Airport logistics optimisation, disruptive lending models for healthcare & education, voice-based assistants for the masses, standardised healthcare experience for patients, travel social networks, nanotech-based pollution filters were some of the new themes that emerged in 2018.

- There has been a drop in the number of early stage companies operating in the vertical ecommerce space. Given the number of large players in the sector, there is room left only for a few disruptive ideas and not everyone.

- Startups have started to emerge exploiting the untapped potential for consumer brands especially in food & beverages, hygiene, and healthcare.

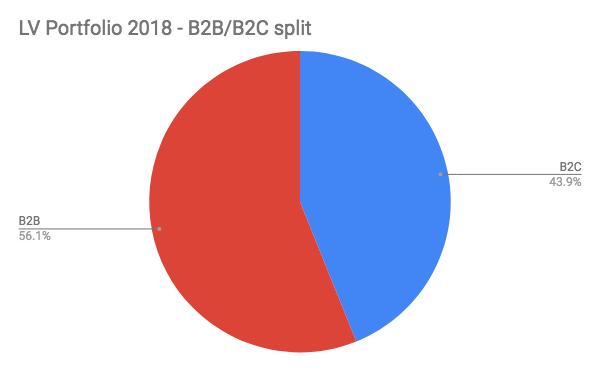

B2B/B2C split:

B2B has been on a rise for the last three years and this year it has become the dominating segment in the early stage market. There has been an increase from 45% last year to 56% in 2017.

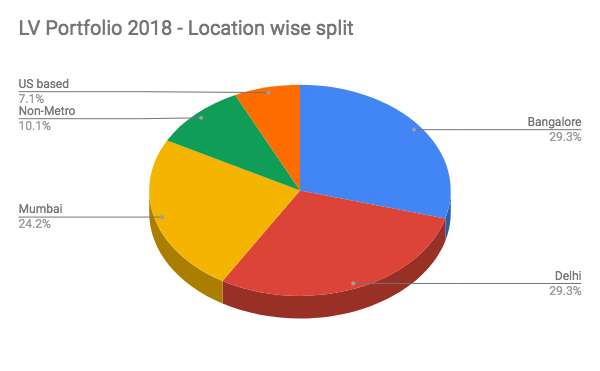

Location wise split:

- Delhi and Bengaluru (29% each) stayed at par in terms of early-stage funding on the platform. We see a similar trend in the market, except Delhi was slightly lesser in the market.

- Non-metro cities which contributed 10% of the deals saw a good increase in comparison to the last year. We saw a couple of most innovative models coming out from non-metros.

2018 Early Stage Investor Trends

There has been a 55% increase in investor registration requests in 2018, but the rejection rate has almost doubled from 23% in 2017 to 45% this year. Though awareness of the asset class is increasing, we also see investors struggling to manage diversification of the portfolio.

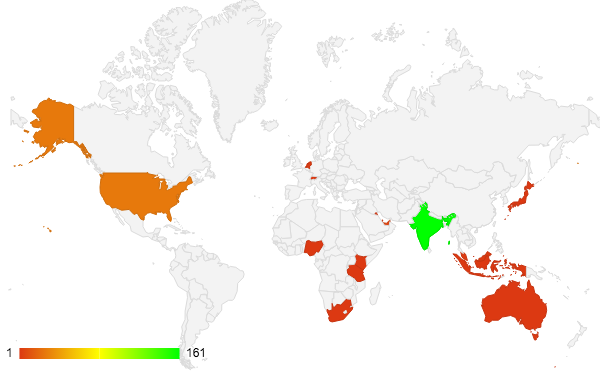

We received a total of 430+ commits this year from investors. The heatmap of these commits is depicted below:

Investor Registrations

- 2018 witnessed more investors registering to the platform as compared to 2017. Awareness in the Indian HNIs through Media and other channels played a key role in attracting more investors to startups as an asset class.

- With a more stringent curation process to onboard investors, the number of rejects on investor registration saw a significant increase.

Commitments on LetsVenture from Angels

- The contribution of India-based investors in deals continued to have a major share. This is followed by investors in the US, and Singapore.

- Every round sees 30% commitments from global investors.

- Every round sees 18% commitments from investors in Tier 2 cities.

- Average cheque size on LV was seen as INR 10 lakhs.

- About 4-5% of the investors committed within the first quarter of joining the platform.

- We saw an increase in engagement from micro-funds and their willingness to syndicate with angels. In 2018, more than 50% of the early stage in India was done by Institutional investors (VCs, Microfunds)

Family Offices Becomes an Active Participant into Startups as an Asset Class

2018 marked the first year of LV Titans — our private platform designed specifically for Family Offices to access the Startup & Venture Capital asset class. We met with and onboarded 130 Business Families across sectors, most of whom have established large traditional businesses.

As the first wave of successful startups emerged in the last three years, Family Offices have taken notice of the new-age economy but lacked a trusted partner who can help them navigate it efficiently. LV Titans came as a welcome initiative, and our first year helped us understand the Family Office needs, and create personalised offerings.

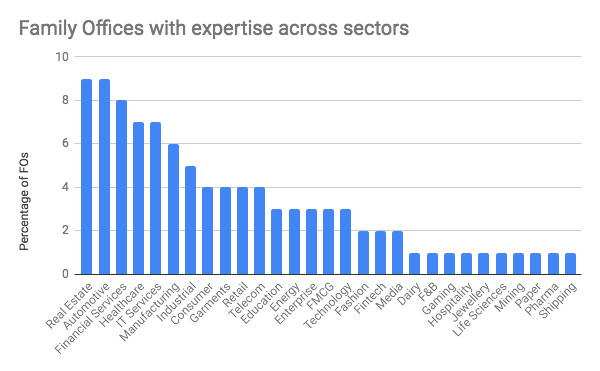

Apart from early stage startup investments on the LetsVenture platform, we brought to our Family Offices exclusive co-investment allocations in growth stage rounds (Series B & C) which were led by marquee VCs. What was distinct was that apart from being patient capital, the Family Offices offered an unparalleled understanding of sectors where they have built businesses. This offers entrepreneurs support on business, the customer connects as well as support to navigate the govt and regulatory challenges. Below is a summary of the various industries in which our Family Offices have expertise / large operating businesses in:

Family Office Investment Trends

While the direct startup investment is beginning to see acceptance among Family Offices, many of them look Limited Partner investment into VC Funds as their initial step in the asset class. As Limited Partners, they are able to understand this asset class while parallelly learning the differences from typical public markets and private equity investments.

LetsVenture has enabled Family Offices to access exclusive allocations in premier VC Funds in India and Silicon Valley. LV allocations are with coupled with co-investment rights provide a continuous engagement with the Family Offices.

- Num of Family Offices Onboarded o LV: 130

- Num of Family Offices who have invested into startups via LV: 19

- Num of Family Offices who have invested into VC Funds via LV: 12

- 80% of the capital invested in the VC Funds came from Family Offices who had never invested in VC Funds before the LV Titans engagement.

Trends in 2019 in the Indian Ecosystem

Based on the early stage funding patterns from 2018, we believe these would be some key trends to watch out for in 2019.

Sector Trends

- Healthcare will continue to be a growing sector, with a shift towards the deep vertical/specialised focus.

- In Fintech, while lending seems passe, 2019 will see the emergence of insurance offerings and Wealth Management solutions targeted towards India. Wealth management will see both offline and online players compete for the same customer segment.

- There will be an emergence of new asset models. 2019 will see Land as an asset model (cars and real-estate will continue to be hot, as the market will move towards consolidation in these spaces)

- Drones will see revived a rejuvenation of interest with the new Government regulations coming finally in place.

- We will continue to see the market adapt health-related products targeted with healthy eating options, fitness for mind and body. The market consolidation will not yet happen in 2019.

- Consumer brands will continue to see increased capital inflow in Product plays. It remains to be seen if Brand only plays can find any footing in India

- Cloud will continue getting increased adoption by Enterprises and SMEs – much more room for SaaS startups to gain traction in India. Models where product building happens in India and target global markets will remain a hot favorite among investors

Other Market Trends

- Content consumption will move towards video and audio content, with an emphasis on 3-5m reading time for written content.

- New models of distribution targeted at tier2 & tier 3 cities will emerge in 2019.

- Mobile first models to stay relevant in this context.

- AI/ML will become must-have standards in implementation, and will no longer be differentiators in product offerings.

- Voice as a layer will become a game changer

- Micro-funds and institutional investors participating in the early stage will continue to rise. In 2018, this percentage crossed 50% of the overall funding. We believe this will continue to see a 10-15% increase in 2019.

- Venture Debt is seeing the surge, and we believe in 2019, this will become more prevalent as an alternate model for funding.

- Family Offices as an alternate channel for liquidity now directly investing into growth stage startups is here to stay. We think the allocation towards direct co-investment will see an increase in their allocation percentage set aside for this asset class.