SUMMARY

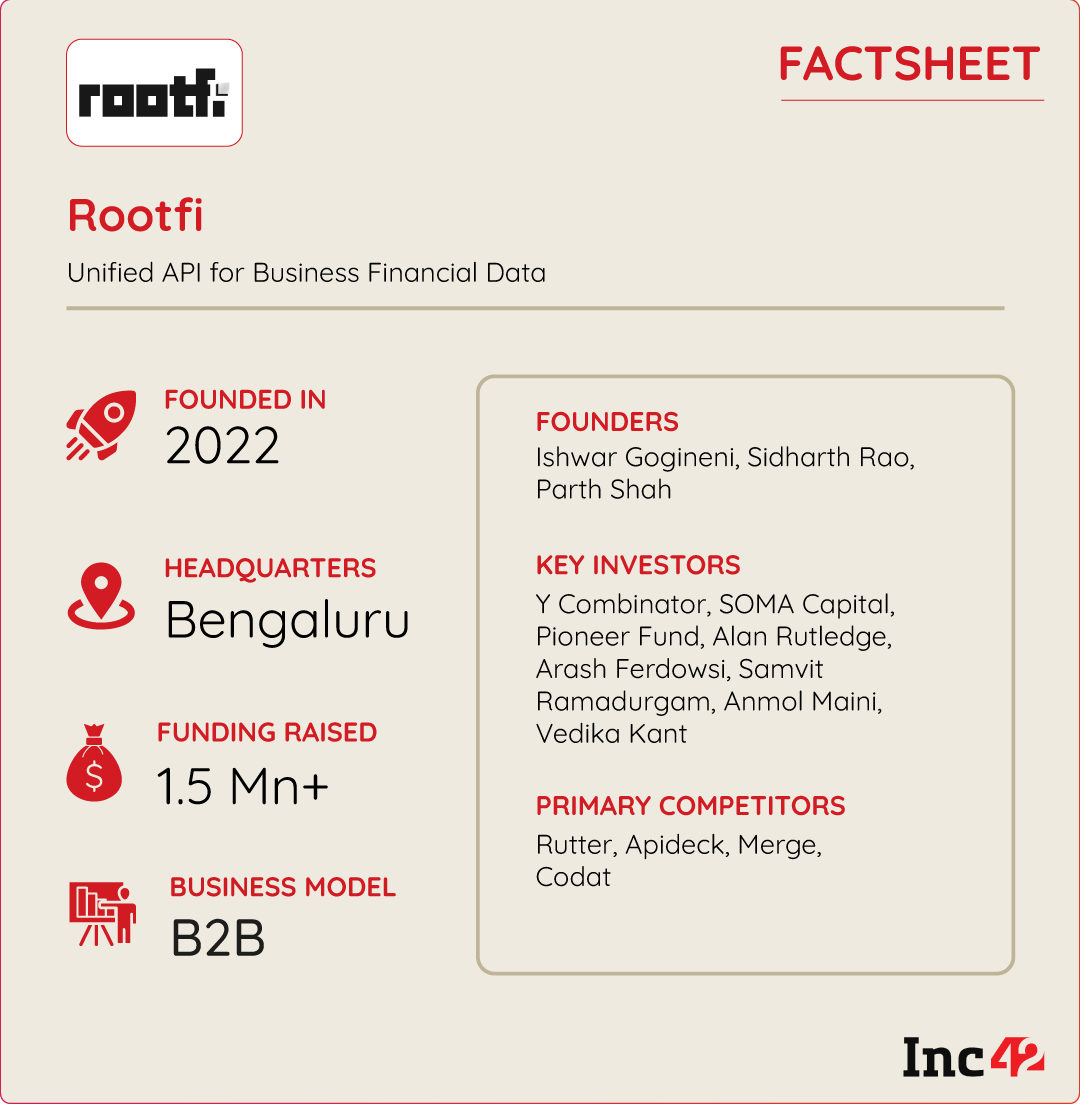

Rootfi automates the accounting process for its clients across 12-plus platforms (such as Tally, Zoho Books, NetSuite, and Sage Intacct)

The startup aims to reach an ARR of $30 Mn by 2026 and claims to be doubling its customer base every month

It recently raised $1.5 Mn in a seed funding round from Y Combinator, Pioneers Fund and SOMA Capital, including angel investors.

During a brief lull in their entrepreneurial journey in 2022, Ishwar Gogineni, Sidharth Rao and Parth Shah were looking for their next big break. At that time, one of their old customers reached out to them with an opportunity. He wanted to build enterprise resource planning (ERP) integrations for a slew of accounting software, such as Tally, NetSuite, and ZohoBooks, among others, for underwriting.

The request was simple: Develop an inclusive solution that could collate data from multiple accounting software in one place and ease the underwriting process.

As the trio poured over the solution over the next few weeks, they realised that the problem ran deeper and it was a herculean task to build such integrations, especially in the accounting domain.

Speaking with Inc42, Gogineni said that building such an integration platform was not only time-consuming but also complex, expensive and difficult to maintain.

“To build integrations, we need an API and one of the most popular accounting software, Tally, does not have any. Then, software which have APIs are exorbitantly priced and take months of permissions and compliances. Additionally, integrations are difficult to deploy and maintain at scale. And if you miss a single edge case, it could potentially bring down the whole system,” added Gogineni.

Despite the hiccups, the trio readied a minimum viable product (MVP) within three weeks, which set in motion the wheels of their fintech software-as-a-service startup (SaaS), Rootfi.

The solution was simple and involved building universal APIs for accessing business data from various financial platforms — ranging from accounting to ecommerce.

A universal API is a standardised format for accessing different APIs and data sources. This allows users to read and write into a plethora of sources, such as Tally or ZohoBooks, from a single place without understanding the nuances of each platform.

Simply put, Rootfi automates the accounting process for its clients across 12-plus platforms (such as Tally, Zoho Books, NetSuite, and Sage Intacct), allowing users to read and write data across these platforms in the same way.

The Bengaluru-based startup also maintains each of these integrations, allowing its clients to focus on building other core competencies.

It is also eyeing the ecommerce market and plans to roll out another solution by the next quarter. The new solution will enable ecommerce companies to view and manage their day-to-day business activities from multiple sources all in one place.

Funds No Bar For Rootfi

Since its inception, the startup has been focussed on acquiring customers. It was already hosting 10-plus customers within the very first month of commencing operations. Rootfi was also incubated by Y-Combinator as part of the accelerator’s 2022 summer cohort.

The startup has now raised $1.5 Mn in a seed funding round from Y Combinator and others such as Pioneers Fund and SOMA Capital, including angel investors.

The startup will deploy the capital to improve its integration coverage and expand into newer regions. The startup will also use the capital to double down on its engineering and sales teams and hire more.

The founders are also focussed on retaining customers and claim to be running a lean venture with zero customer acquisition cost (CAC) and very low cash burn.

Gogineni said they emphasise bringing a healthy crop of clients, which has helped them strengthen its top line. Without disclosing current revenue figures, Gogineni said that the startup is eyeing an annual run rate (ARR) of $1.5 Mn by May next year.

It is pertinent to note that Rootfi makes money by charging its clients $5-$10 for each connected business. In the startup’s parlance, a connected business refers to every external integration that is undertaken by a customer via Rootfi’s platform. For instance: A company with 100 clients could integrate up to 100 of these external sources and each would cost them $5 -$10.

The startup claims to have a global presence, with 95% of its customers coming from India, the Middle East, Africa and Southeast Asia. Rootfi is also said to be doubling the number of clients going live on its platform every month, with 30 customers availing its services currently.

As of now, it largely caters to early-stage or growth-stage startups but has also set its eyes on large enterprises.

Lessons From Zoho To Dominate Competition

With a current team size of 10 employees, the Bengaluru-based startup plans to increase its headcount over the coming months. It has also set its eyes on the US and European markets by next year.

Speaking about the company’s long-term plans, Gogineni said that the startup aims to reach a revenue target of $30 Mn by 2026.

In the domain, Rootfi competes with the likes of Rutter, Apideck, Merge and Codat.

Responding to Inc42’s question about how the cofounders aim to edge out the competition, Gogineni said that they plan to take on the aforementioned well-funded players by focussing on long-tail integrations.

“Our competitors will never take up something like Tally or Odoo, which are very popular in the Middle East. It is by focussing on these long-term integrations that we are winning. Secondly, our competitors are focussed on enterprise businesses, which leaves many businesses in the middle without a partner. This is where we come into the picture. In essence, we are using Zoho Books’ playbook on how it competes with Salesforce in the US.”

While Salesforce has been a dominant force in the US enterprisetech market, homegrown Zoho Books has slowly crept into its market, offering better or similar products at lower prices. While Salesforce caters to niche high-value clients, Zoho Books has catapulted itself by offering its services to the other segments of the market and playing on the economies of scale. It is this strategy that Rootfi aims to imbibe to corner companies from different markets and geographies.

Further, the startup claims that it has nothing to worry about when making changes to its data privacy policy. This is because Rootfi cannot view the data that passes through its systems, according to Gogineni.

He, however, added the company, as a safety valve, has acquired ISO, SOC2 and GDPR certifications to address all concerns related to security and data safety for its customers.

Speaking about the startup’s core philosophy, the Rootfi cofounder said that the company is focussed on customer service and increasing the coverage of its products. He added that once these two factors are fully leveraged, then the aspect of reliability comes into the picture over time, which is what Rootfi is aiming at.

What’s Next?

With an aspiration to cover a wide gamut of financial services in future, Rootfi seems to be eyeing the wider fintech SaaS market, which continues to be an attractive proposition for investors despite the ongoing market volatility.

According to the data compiled by Inc42, the segment, which stood at $4.6 Bn in 2022, is well-poised to become a $31 Bn market opportunity by 2030. Not just this, homegrown fintech SaaS startups have cumulatively raised $868 Mn between 2014 and the third quarter of 2022.

This growth has predominantly been the result of the availability of a highly skilled but cheap workforce in the country. Besides, a large chunk of such products are also used across the world.

However, as 2023 enters its second half, it remains to be seen how the ecosystem grows alongside this trend. For now, Indian fintech SaaS startups continue to build products for the world, including India.